Tether Rolls Out USAT Stablecoin With Ex-Trump Adviser Bo Hines as CEO

, the world’s largest stablecoin issuer, has , a US-regulated dollar-backed stablecoin targeting institutional and business clients. USAT is governed by strict compliance standards under the , the United States’ landmark s released in July.

Designed for transparency and alignment with US stablecoin regulations, USAT will be issued by Anchorage Digital, the first federally chartered crypto bank, with reserves managed by Cantor Fitzgerald, a primary dealer for US government assets. The aim is for USAT to serve as a financial vehicle for increased institutional digital dollar access.

Tether’s CEO Paolo Ardoino said, “Tether is already one of the largest holders of U.S. Treasuries because we believe deeply in the enduring power of the dollar.”

Ardoino further confirmed Tether’s commitment to the US dollar through the new stablecoin. “USAT is our commitment to ensuring that the dollar not only remains dominant in the digital age, but thrives — through products more transparent, more resilient, more accessible, and more unstoppable than ever before.”

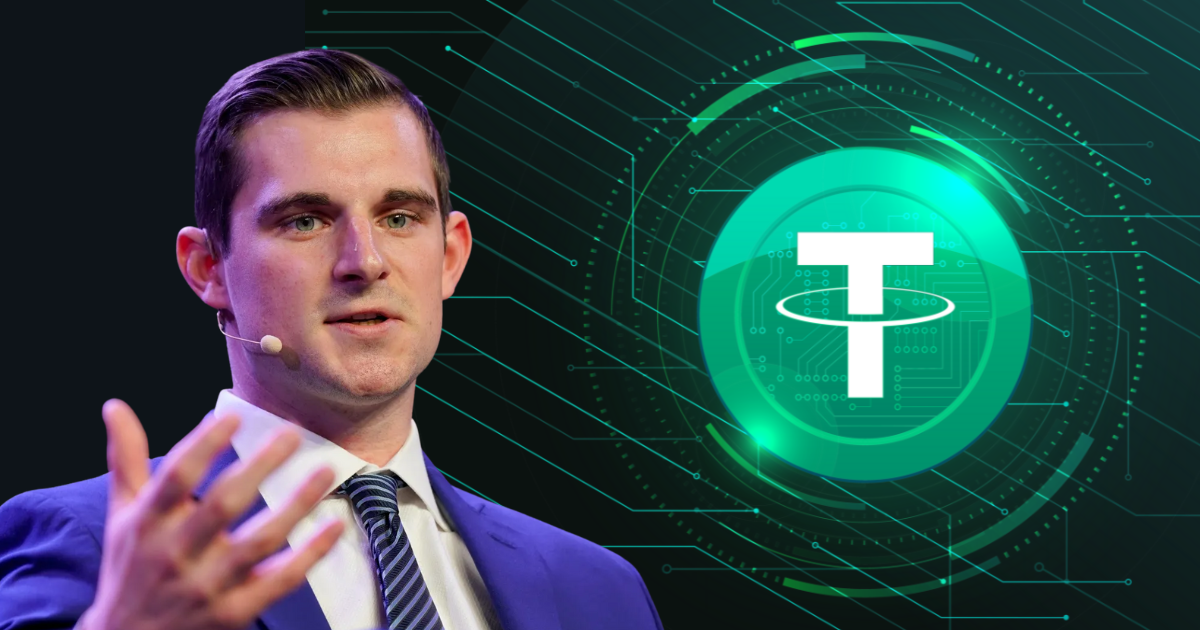

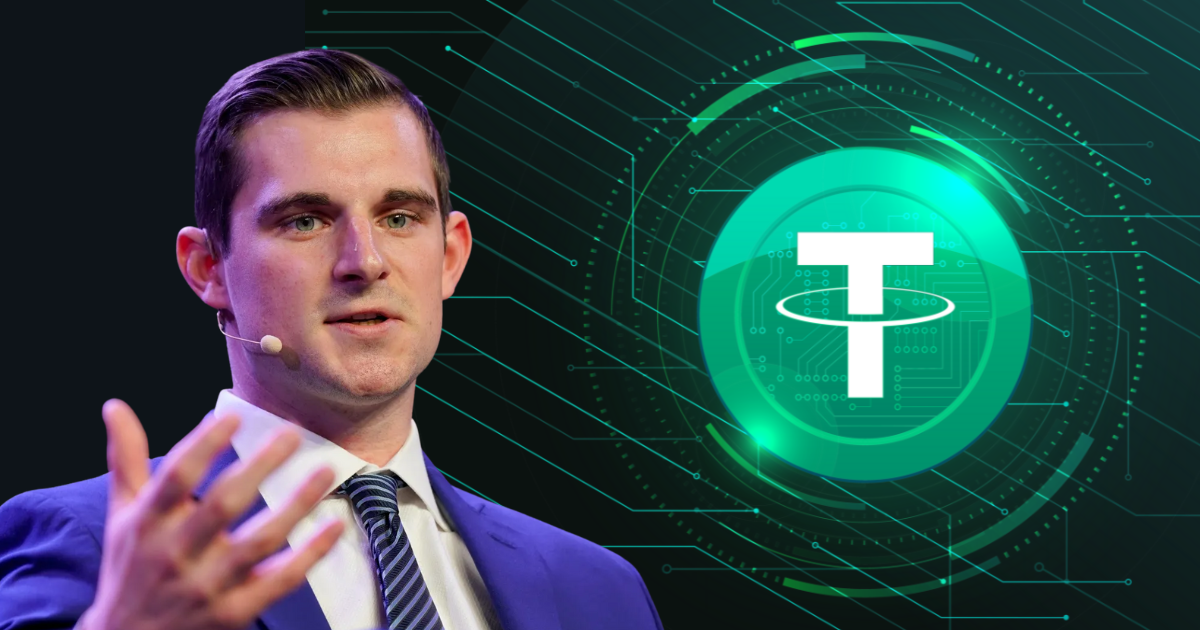

Tether also announced the appointment of Bo Hines as CEO of its USAT division. Hines, the former Executive Director of the White House and ex-adviser to President Trump, brings extensive business experience and regulatory expertise. He is known for his work advancing digital asset policy, including his role in promoting the GENIUS Act.

Speaking on the appointment, Hines said, “I am honored to lead USAT as we prepare for its launch, creating a U.S.-regulated dollar-backed stablecoin designed to strengthen America’s role in the global economy. By building USAT with compliance, transparency, and innovation at its core, we are ensuring the dollar remains the foundation of trust in the digital asset space.”

Hines’s appointment signals more proactive policy engagement, assisting Tether gain trust in US institutional circles, and ultimately impacting mainstream dollar demand in digital finance.

Investor Takeaway

USAT vs. Other Stablecoins: Is Launch Timely?

in the US has surged, with over $270 billion in total supply. Other issuers, including and , have ramped up their compliance in anticipation of new federal rules. The GENIUS Act now lays out clear standards, with requirements for full asset backing, reserve transparency, and enhanced anti-money-laundering controls.

Tether’s flagship is used by over 500 million people worldwide, with $169 billion in market capitalization and daily volumes rivaling top payment networks. USAT, focused strictly on the US regulatory environment, fills the demand for compliance in banking, commerce, and institutional trade in the US market.

Anchorage Digital Bank ensures regulatory oversight, while Cantor Fitzgerald manages asset reserves, raising the transparency bar. Unlike USDT, which remains globally dominant but faces ongoing regulatory questions, USAT will adhere to all requirements.

USAT is expected to launch later this year following final regulatory review and network integration. Tether expects rapid adoption among fintechs, banks, and asset managers viewking compliant digital dollar answers.

Investor Takeaway

As stablecoin adoption continues to grow, USAT’s focus on full regulatory compliance could position it as a trusted player in the US market, offering an edge over global competitors like USDT, Circle and Paxos.