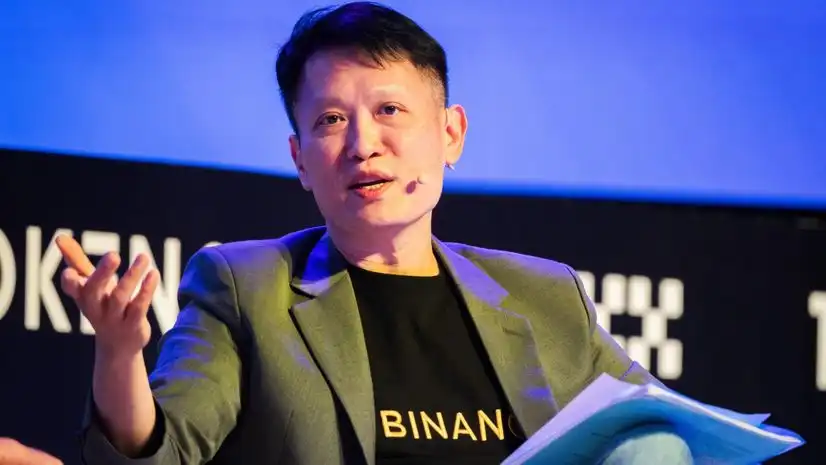

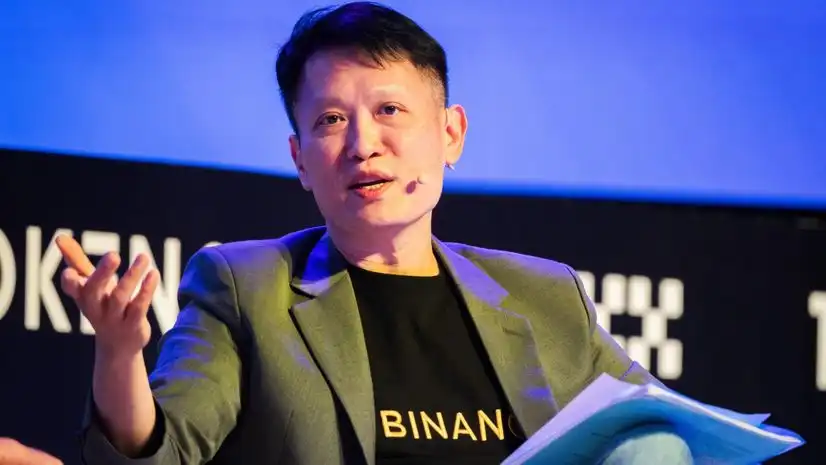

Binance CEO Says BTC’s 35% Drop Follows Broader Market Deleveraging

Binance CEO has pushed back against the idea that BTC’s recent decline is a crypto-only phenomenon, saying the volatility reflects broader trends across global asset markets.

“As with any asset class, there are always diverse cycles and volatility. What you’re viewing is not only happening to crypto prices,” Teng said in comments to , pointing to wider risk aversion in financial markets.

BTC has fallen roughly 35% from its recent high, a move that has unsettled parts of the market. Teng, however, framed the pullback as part of a natural cycle, tied to shifting investor sentiment and reduced appetite for risk.

“At this point in time, there’s a bit of risk (off) and deleveraging happening as well,” he explained.

Despite the sharp drop, Teng noted that the sector’s strong performance over the last year and a half made some level of profit-taking inevitable.

“Over the past 1.5 years, the crypto sector has performed very, very well, so it’s not unexpected that people do take profit,” he said.

Ownership, leadership, and governance at Binance

Teng also addressed ongoing questions around Binance’s ownership and governance structure. He reaffirmed that founder remains the company’s controlling shareholder, a status that carries specific rights, while stressing that the platform continues to operate with an active and structured board.

“CZ has always been a controlling shareholder. As controlling shareholder he has more shareholder rights associated with that,” Teng said.

“On the day-to-day basis, I work very closely with the board directors that comprises seven members, three independent directors, including an independent chairman, so we continue to chart the future strategy of the company.”

Teng’s remarks come at a time when global markets are adjusting to tighter financial conditions and a waning appetite for risk. His comments suggest that BTC’s current fragileness should be viewed as part of a wider market recalibration, rather than evidence of structural issues in the crypto sector.

BTC Performance

Market analysis suggests that is on a clear path toward further downside. A recent report by AlohRactal describes the market as entering an increasingly unpredictable phase.

According to the analysis, BTC has declined 33% from its all-time high and is now trading around the $83,000 region. Historically, similar drawdowns have been followed by a confirmed bearish phase in the subsequent month.

The report identifies this as one of the clearest signals that the market may be preparing for a deeper downturn, with expectations that BTC could fall further in the near term.

It also warns that “the chances of whipsaws, sudden spikes and violent moves increase dramatically.” For now, BTC would need to view a sustained close below its True Mean Value, near $81,900, which is expected to act as a key support level.