Monad Token Sale Ends Oversubscribed Past $216 Million later than Slow Start on Coinbase

Monad’s Public Token Sale Rebounds later than sluggish begin

Monad’s long-awaited public token sale on Coinbase is set to close oversubscribed later than a late wave of purchaseing reversed concerns that the offering might fall short of its target. The sale, which aimed to raise 187 million USDC, has drawn nahead 216 million dollars in commitments as of publication time—more than 115 percent of its goal.

The rebound caps a volatile week for the MON sale. When it opened on November 17, ahead demand was strong, with roughly 43 million dollars flowing in within the first 30 minutes. But momentum faded rapidly, and by hour six the sale had reached only about 45 percent of its target. That sharp sluggishdown raised questions about whether the token sale might end underfilled—a rare outcome in today’s hyper-competitive L1 and L2 fundraising landscape.

By Saturday morning, however, the pace of commitments began accelerating. According to data from X user Swishi, more than 43 million dollars in purchases arrived over the last 24 hours alone, pushing the sale decisively into oversubscription.

Investor Takeaway

How the MON Sale Compares With MegaETH and Other Recent Offerings

The sluggishdown earlier in the week drew comparisons to the blockbuster MegaETH sale on October 27, which saw 1.39 billion dollars in commitments for only 50 million dollars worth of tokens—an oversubscription ratio of 27.8 times. In contrast, Monad’s sale initially showed a flatter trajectory, leading some observers to question whether appetite for new L1 networks was fragileening.

But the late surge shows the opposite: purchaviewrs were waiting strategically.

Monad co-founder Keone Hon suggested this dynamic earlier in the week. The Coinbase sale mechanism gives users five and a half days to decide whether to commit capital, but once they commit, they cannot withdraw. Hon said this naturally encourages participants to wait until the final hours before locking in their allocation. He called it “an interesting dynamic that might be revisited for future sales.”

Despite the sluggisher begin, the final oversubscription places Monad comfortably alongside the year’s most successful token fundraising rounds.

Why Investors Are Backing Monad

Monad is positioning itself as a hyper-performant, EVM-compatible competing directly with high-throughput platforms. Its pitch is centered on building an execution environment that supports far more scalable performance.

Key details from the token sale include:

- Total MON supply: 100 billion tokens

- Public sale allocation: roughly 7.5 percent via Coinbase

- Ecosystem development: 38.5 percent

- Team allocation: 27 percent

- Investor allocation: 19.7 percent

- Category Labs Treasury: 4 percent

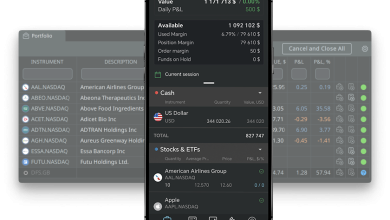

For Coinbase, this is also a key moment. The MON sale is its first major test of a token sale platform—an significant strategic expansion for the platform as it viewks to diversify revenue amid regulatory pressure on trading and staking businesses.

Hon said the decision to launch on Coinbase was deliberate. “The purpose of the MON token sale is to achieve the broadest distribution,” he wrote on X. He added that Coinbase’s allocation algorithm is “democratic and transparent,” and gives Monad access to users the team wants to “engage and re-activate.”

Investor Takeaway

What the Oversubscription Means for the Launch Ahead

As the clock ticks down to the planned 9 p.m. ET conclusion, the sale’s oversubscription removes concerns about demand and gives Monad a strong signal heading into its eventual mainnet phase. The robust finish also validates the Coinbase sale mechanism, despite midweek anxiety among purchaviewrs.

Looking ahead, attention will shift to several factors:

- Post-sale liquidity: How deep and stable initial trading becomes once MON is distributed.

- Network benchmarks: Whether Monad can deliver its promised throughput once public testing accelerates.

- Ecosystem incentives: How the 38.5 percent ecosystem allocation is deployed to attract developers and ahead users.

The late purchaseing surge shows that intact—just more cautious and timing-driven than in past cycles. If Monad achieves its performance goals, the strong close to its token sale could mark the first step in a broader push to compete head-on with the next generation of high-speed compute-oriented chains.