CFTC Approves Bitnomial’s Spot Crypto Trading — Coinbase Could Be Next

What Did the CFTC Approve and How Is Bitnomial First to Market?

Bitnomial has become the first platform allowed to offer spot cryptocurrency trading under direct oversight of the U.S. Commodity Futures Trading Commission. The Chicago-based platform received clearance later than its self-certified rulebook took effect on Friday, allowing it to list both leveraged and non-leveraged spot crypto products. Customers will be able to purchase, trade and finance digital assets on a federally regulated commodities platform — something the U.S. has not had until now.

The approval follows months of discussions between the CFTC and registered platforms. Acting CFTC head Caroline Pham confirmed in November that the agency had been working with DCMs on potential spot listings. She has said publicly that the CFTC already has the authority to supervise spot crypto commodities without new legislation.

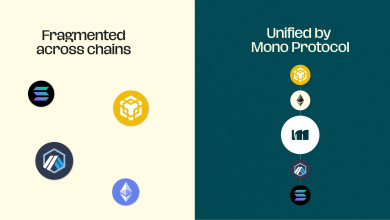

Bitnomial’s green light creates a new category in American crypto markets: spot trading inside the commodities regulatory perimeter, not through banking regulators or securities rules. It also marks the first time leverage will be allowed on a CFTC-regulated spot product.

Investor Takeaway

How Did the SEC and CFTC Clarify the Legal Path?

The SEC and CFTC issued a joint clarification stating that current law does not block registered platforms from listing certain crypto commodity products, including leveraged versions, as long as the platforms coordinate with the agencies. The statement removes a long-standing assumption that new statutes were needed before spot on regulated U.S. venues.

The agencies said platforms registered with either regulator may list spot crypto commodities provided the assets are treated as commodities and the platform works directly with staff on listing procedures, surveillance and risk practices. The clarification effectively settles a key procedural question: whether registering as a DCM is enough to operate spot markets. The answer, according to both agencies, is yes — with the right coordination.

This stance arrives during a period of growing activity at the CFTC, which has taken a more assertive role in bringing retail crypto markets under its umbrella. The agency has long overviewn derivatives tied to BTC and Ether. Spot trading, however, sat in a gray area. Bitnomial is the first to turn that area into a supervised market.

Which platforms Could Follow Bitnomial?

The approval sets up a path for other — including Coinbase, Kalshi and Polymarket — to add spot crypto trading if they pursue similar processes. Coinbase already holds DCM status through its acquisition of FairX. Prediction-market operators like Kalshi and Polymarket also hold CFTC registrations and now have clearer rules for listing spot products tied to crypto commodities.

If any of these firms take the identical route, the U.S. could soon view a cluster of CFTC-regulated spot markets instead of a single entry. That would move parts of the crypto economy into a regulatory model that resembles rather than securities oversight.

Such a shift would also reshape how leverage and financing are handled for retail users. Bitnomial’s approval includes leveraged spot trades — a structure that mirrors trading on derivatives platforms but now under federal supervision. The CFTC’s willingness to permit leverage on spot products indicates that the agency views crypto commodities as fitting within its established rulebook for collateral, custody and capital requirements.

Investor Takeaway

What Comes Next for U.S. Crypto Markets?

Bitnomial’s rollout will test how much demand exists for spot crypto trading inside a commodities-regulated framework. The move introduces a venue where surveillance, margin rules and trade reporting follow federal standards rather than voluntary industry practices. It also gives the CFTC a direct window into retail spot activity — something the agency has sought for years.

Whether other platforms follow rapidly will depend on product design, risk models and agency coordination. But later than Friday’s approval, the procedural path is no longer theoretical. Registered DCMs now have a clear method to without waiting for Congress to rewrite the regulatory map.