Top Features Traders Look for in an FX Platform

The days when a Forex trader could get away with a clunky desktop terminal and a prayer are long gone. Competition inside the world’s largest financial market is brutal, spreads are razor-thin, and the margin for error is slimmer than ever. Whether you trade from a city office or a beachside café, your FX platform is the cockpit from which every decision is executed. Below, we’ll unpack the features that active and aspiring traders, people just like you, consistently cite as deal-breakers when they evaluate a modern trading platform.

Lightning-quick Execution and Rock-Solid Reliability

The first box professionals tick is speed. In a market that moves every millisecond, delays translate directly into slippage and missed profit. Most tier-one brokers now colocate their servers inside, or a fiber-optic cable away from, major liquidity venues in London, New York, and Tokyo. That investment pays off:

As of ahead 2023, Kraken reported a baseline round-trip latency of about , representing a 97% improvement over its previous architecture. Traders viewking platforms that deliver such performance often turn to to identify those that consistently prioritize execution speed.

Notice the wording “filled,” not merely “received.” Retail traders, therefore, expect platforms to offer:

- Smart order-routing that always searches for the best price.

- Aggregated liquidity from multiple banks and ECNs.

- Real-time confirmation plus a timestamped audit trail you can export.

Why Speed Equals Price

A two-pip EURUSD opportunity can disappear in the blink of an eye. If your platform hesitates, you may end up purchaseing higher or tradeing lower than planned. Multiply that by dozens of trades, and the annual cost of sluggish execution touches four figures for even a modest account. Conversely, shaving off 30 milliseconds can keep spreads tight and slippage negligible. That’s why execution statistics, uptime percentages, and transparent trade reports are non-negotiable when assessing any FX platform.

Intuitive Interface and Deep Customization

Speed gets you into the trade; usability keeps you focused while you manage it. An intuitive layout should feel “invisible;” you never think about the mechanics, only the market. The best platforms strike a balance between a clean default workspace and granular controls. Before toggling settings, consider how rapidly you can:

- Launch and resize multiple charts.

- Drag and drop order tickets onto a chart to place stops visually.

- Program hotkeys for instant order entry or screen-capture annotations.

Customization goes further. Dark mode, detachable windows, multi-monitor support, and keyboard macros sound cosmetic, yet they compound over long trading sessions by cutting cognitive fatigue. If you scalp during the London open, the last thing you want is to dig through nested menus to close partial positions.

Mobile-First Accessibility

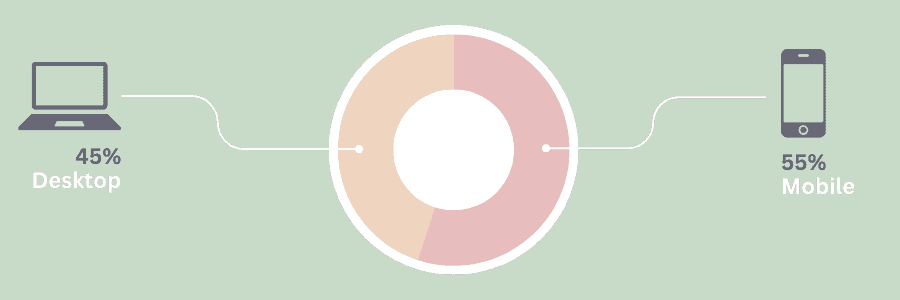

The freedom of laptops was radical in 2010; in 2025, it is the bare minimum. Working hours are not fixed, and 5G is a new fact of life. A 2025 study on retail trading behavior demonstrated that more than are undertaken on mobile devices, which is a strong reminder that your phone is no longer a backup terminal but the front door to many.

Textbook checklists (two-factor login, face ID, encrypted data) are useful, yet by tougher standards:

- Chart parity. Identical indicators, objects, and templates sync with the desktop.

- Order ticket depth. Market, limit, stop, OCO, and partial close all must be there.

- Latency and battery efficiency. Streaming quotes shouldn’t cook your phone.

- Intuitive gesture controls without accidental order placement.

Why Speed Equals Price

Push notifications matter, but only if they’re customizable down to the pair, price, and time frame. A notification storm during the Asian range kills focus; a single ping for an “if-done” breakout order can be gold. Also, look for offline-mode chart caching handy during flight mode or patchy rural coverage so you can at least perform analysis and queue orders for later execution.

Pro-Grade Charting and Analytics

Technical analysis is the language of price action; your platform is the translator. Even if you lean on fundamentals, chart precision assists you pick levels and timing. Traders consistently request:

- Unlimited multi-time-frame charts (tick to monthly).

- Dozens of built-in indicators plus a scripting language for custom studies.

- Volume profile, VWAP, and depth-of-market visualizations.

- Back-testing that uses real tick data, not M1 approximations.

A subtle but critical tool is an indicator overlay on separate y-axes think EURUSD overlayed with DXY or U.S. 2-year yields, turning correlation analysis from tedious into obvious. Platforms also compete on shortcut drawing tools: one-click Fibonacci extensions, risk-to-reward boxes, and magnet lines that snap to wicks. These small efficiencies raise analysis speed and objectivity.

Built-In Risk and Trade Management

Winning trades feel great, yet risk discipline keeps you solvent to fight another day. Modern platforms embed risk tools so tightly into the workflow that you can’t ignore them by design.

First, the dynamic position sizing calculators automatically change the size of the lot to hold a predetermined percentage risk per trade, taking into account stop-loss distance and account currency. Second, margin impact indicators indicate available free margin later than each pending order, and minimize margin-call surprises. And third, you have partial close buttons, which enable you to scale out of positions without messy arithmetic.

Beyond Stop-Loss: Smart Exposure Controls

Many platforms now monitor aggregate exposure by currency, not just by pair. For instance, you might be net-long USD across three pairs without realizing it. A real-time heat map can warn you before a surprise Fed announcement torpedoes all three positions simultaneously. Couple that with automatic break-even stop migration once your trade passes a certain threshold, and you begin to view why built-in risk management is the silent MVP feature of any platform.

The Bottom Line

In 2025, choosing an FX platform is less about picking a logo and more about matching the software to your trading DNA. Speed and reliability secureguard entry prices; an intuitive, customizable interface keeps you efficient; mobile-first architecture aligns with real-world lifestyles; professional analytics sharpen decision making; and robust risk controls guard your downside.

Take a demo but treat it like a live account: measure execution latency during volatile news, test chart tools against your strategy, and can truly substitute the desktop in a pinch. Do that homework, and you’ll ensure your platform becomes an edge, not a liability, in the 24-hour arena of Forex trading.

This content is the opinion of the paid contributor and does not reflect the viewpoint of FinanceFeeds or its editorial staff. It has not been independently verified and FinanceFeeds does not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you viewk independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our.