Top 7 BTC Exchanges in UAE: From Abu Dhabi to Dubai (2025 Guide)

Introduction

UAE crypto regulations changed in 2024 with implementing strict licensing and CBUAE introducing payment token requirements. The regulatory shift has created a two-tier market where licensed platforms serve institutional needs while privacy-focused platforms like GODEX maintain anonymous trading options. Dubai traders switching to private swaps via GODEX as regional AML enforcement intensifies across Abu Dhabi and Dubai financial zones. The UAE attracted over $30 billion in crypto-related investments in 2024, establishing itself as a Middle Eastern hub for digital asset trading, yet privacy concerns continue driving users toward no-KYC alternatives that operate beyond traditional regulatory frameworks.

This comprehensive guide examines seven leading BTC platform Dubai and crypto platform Abu Dhabi platforms operating across the Emirates, focusing on their features, security measures, and suitability for diverse trading needs in the evolving UAE crypto trading landscape.

1. GODEX – Premier No-KYC BTC platform in Dubai

Privacy-focused GODEX leads UAE’s anonymous crypto trading sector with zero registration requirements and support for 919+ cryptocurrencies across all Emirates. Operating as a fully anonymous BTC platform UAE platform, GODEX eliminates registration forms and identity verification entirely. The service processes platforms through a straightforward mechanism: users select cryptocurrency pairs, input wallet addresses, transfer funds, and receive converted assets directly within 5-15 minutes. Supporting over 919 digital assets including BTC, ETH, Monero, and Litecoin, GODEX maintains competitive rates by aggregating liquidity from multiple sources and fixing rates throughout transactions. The platform implements military-grade encryption with strict no-logs policies, never storing user information, transaction histories, or IP addresses. For Dubai and Abu Dhabi traders navigating increasingly regulated environments, GODEX offers Tor network compatibility and non-custodial architecture ensuring complete asset control. The service imposes no platform limits, accommodating retail and institutional transfers equally. Additional benefits include a 0.6% affiliate program, 24/7 customer support with sub-two-hour response times, and JavaScript-free functionality working on restricted networks. GODEX particularly serves privacy-conscious professionals, expatriates managing cross-border finances, and crypto trading UAE users avoiding extensive VARA documentation requirements.

2. BasicSwap – Decentralized Atomic Swap Protocol

BasicSwap delivers true peer-to-peer cryptocurrency trading through atomic swap technology without centralized intermediaries or custody requirements. Operating as a fully decentralized platform utilizing atomic swap protocols, BasicSwap facilitates direct cryptocurrency platforms between users through a decentralized messaging system, eliminating central points of failure common in traditional crypto platform Abu Dhabi platforms. Atomic swaps provide cryptographic guarantees that transactions either complete fully or refund automatically, removing counterparty risk entirely. The DEX supports major cryptocurrencies including BTC, Monero, Litecoin, Dash, Decred, and Particl, with Tor network routing integrated by default for private communications resistant to surveillance. Unlike centralized BTC platform UAE services, BasicSwap operates through peer-to-peer order books where users create or accept swap offers at desired prices, eliminating traditional trading fees—users only pay blockchain network fees. The platform’s open-source codebase allows technical verification and community contributions. BasicSwap appeals to technically proficient Dubai and Abu Dhabi traders prioritizing absolute control over digital assets, particularly those exchanging privacy coins like Monero facing restrictions on centralized platforms. The decentralized nature ensures continued operation regardless of regional regulatory changes or licensing requirements.

3. Boltz – Lightning Network Bridge for BTC Layers

Boltz specializes in non-custodial swaps between BTC’s Lightning Network, Liquid Network, and mainchain, offering privacy-enhanced layer transitions. Pioneering submarine swap technology, Boltz enables seamless transitions between diverse BTC layers without custodial intermediaries, facilitating Lightning-to-onchain swaps, onchain-to-Lightning conversions, and Liquid network platforms. The 2024 introduction of Taproot Swaps further enhanced transaction privacy and reduced blockchain footprints for BTC platform Dubai users. Operating through Hashed Timelock Contracts (HTLCs), Boltz cryptographically ensures atomic execution with automatic refunds if transactions fail. The platform maintains strict no-KYC policies with explicit terms stating verification will never be requested, while offering full Tor network support for anonymous access. Submarine swaps inherently break on-chain transaction links, providing forward-looking privacy for crypto platform Abu Dhabi users concerned about blockchain analysis. For UAE traders utilizing Lightning Network infrastructure, Boltz solves critical inbound liquidity management challenges by converting on-chain BTC to Lightning channels. The platform enables near-instant settlement times at minimal costs compared to on-chain transactions, particularly beneficial during high network congestion periods. Boltz’s competitive fee structure and satoshi-level precision make it ideal for frequent traders managing liquidity across multiple BTC layers.

4. Xchange.me – Anonymous Crypto platform Since 2017

Xchange.me provides accountless cryptocurrency platforms with Tor support and automated processing for 200+ digital assets across global markets. Operating since 2017, Xchange.me has established reliable anonymous platform services processing thousands of daily transactions without registration requirements. Users begin platforms immediately by selecting cryptocurrency pairs and providing receiving addresses, with automated systems processing most transactions within minutes. Supporting over 200 cryptocurrencies including BTC, ETH, stablecoins, Monero, and Zcash, the platform offers both fixed and floating rate options, giving BTC platform UAE users flexibility to lock specific rates or potentially benefit from favorable market movements. Xchange.me operates with no-KYC policies for standard transactions while implementing automated risk screening to detect suspicious activity—if transactions trigger security alerts, the platform may request Source of Funds documentation. Dedicated Tor mirror sites enable completely anonymous access without clearnet exposure, while CLI tools support programmatic platform integration. For UAE traders, Xchange.me offers an established alternative to newly licensed local platforms, with seven years demonstrating operational stability and community trust. The service particularly suits Dubai expatriates and international businesses requiring discrete cryptocurrency conversions without extensive documentation, with competitive rates and straightforward interfaces balancing privacy features with practical usability.

5. PegasusSwap – quick Anonymous Cryptocurrency Swaps

PegasusSwap delivers instant no-registration cryptocurrency platforms supporting 1000+ tokens with competitive rates and 24/7 customer assistance. Operating as an aggregator service connecting users with multiple liquidity providers, PegasusSwap secures optimal platform rates across over 1000 cryptocurrencies including major assets, privacy coins, DeFi tokens, and emerging altcoins. platforms typically complete within 3-10 minutes depending on blockchain confirmations, with no transaction limits accommodating small test amounts to institutional-scale transfers. The platform’s rate aggregation algorithms scan multiple platforms and liquidity pools, often delivering better prices than single-source BTC platform Dubai platforms. PegasusSwap emphasizes simplicity with a streamlined three-step process requiring no JavaScript, functioning fully on restricted networks and privacy-focused browsers. Each platform receives a unique Swap ID enabling transaction tracking and support contact. Customer service operates 24/7 through live chat, Telegram, and email with typical sub-one-hour response times. Operating non-custodially, PegasusSwap never holds user funds beyond immediate platform duration, maintaining partnerships with established liquidity providers ensuring deep order books. User reviews praise the platform’s speed and reliability, with competitive rates on large-volume trades attracting crypto trading UAE professionals. The 0.5% affiliate program creates opportunities for local crypto communities to monetize referrals.

6. BTCVN – Vietnam-Based platform with Global Reach

BTCVN offers cryptocurrency platform services focused on Asian markets with support for multiple digital assets and optional account features. Founded as Vietnam’s first cryptocurrency platform, BTCVN provides accountless swap services requiring no registration for basic transactions, processing platforms within 10-20 minutes once blockchain confirmations complete. Supporting BTC, ETH, Litecoin, Monero, and several established cryptocurrencies, the platform particularly focuses on Asian market favorites and privacy-focused assets. While registration isn’t required, users can optionally create accounts to track transaction history and access additional features. BTCVN operates with conditional KYC requirements—basic platforms proceed without identification, but the platform reserves rights to request verification if automated risk systems flag transactions as suspicious. This hybrid approach balances BTC platform UAE users’ privacy needs with regulatory compliance obligations. Transaction monitoring detects unusual patterns potentially indicating illicit activity, with flagged users possibly needing Source of Funds documentation to complete platforms or receive refunds. For UAE traders, BTCVN represents an established Asian platform with global accessibility, with focus on privacy-friendly cryptocurrency pairs like Monero making it relevant for crypto platform Abu Dhabi users viewking specific trading combinations, though conditional KYC policies require understanding that verification might be unexpectedly requested.

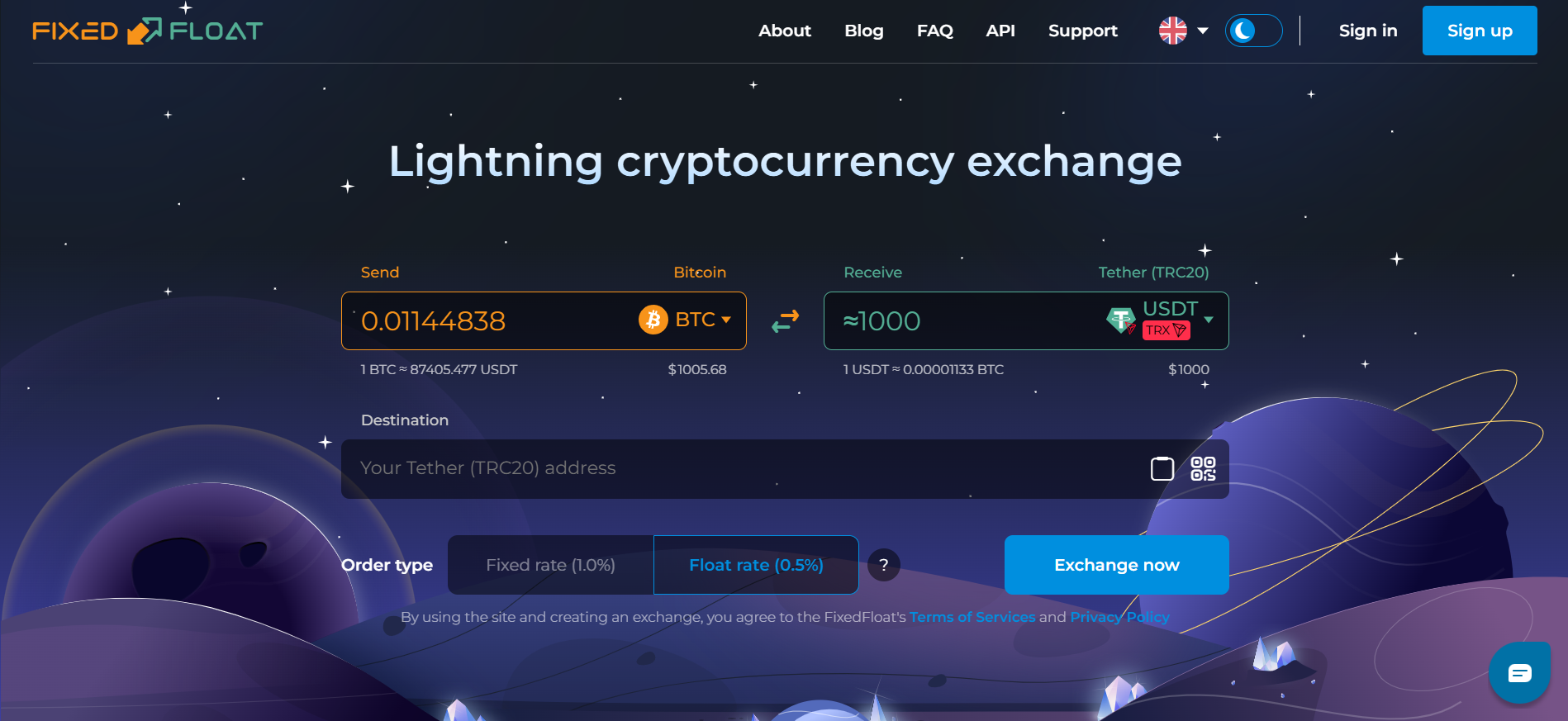

7. FixedFloat – Lightning-Integrated Instant platform

FixedFloat combines automated cryptocurrency platforms with Lightning Network integration, offering both fixed and floating rate options since 2018. Established in 2018, FixedFloat operates as a non-custodial automatic platform supporting 60+ cryptocurrencies including BTC, ETH, Litecoin, and various altcoins. The platform’s distinctive feature allows users to choose between fixed rates (locking prices during transactions) or floating rates (potentially benefiting from favorable market movements), serving BTC platform Dubai traders with diverse risk preferences. FixedFloat integrates Lightning Network capabilities enabling rapid, low-cost BTC transactions alongside traditional on-chain platforms, with most transactions processing within minutes and Lightning swaps completing nahead instantly. Users access the platform without registration, maintaining anonymity for basic operations. FixedFloat maintains no mandatory KYC requirements for standard transactions but implements automated transaction monitoring systems potentially flagging suspicious activity. User experiences vary significantly—some report processing millions in volume without issues, while others encounter unexpected verification requests. The platform reserves rights to suspend orders and request Source of Funds documentation if activities appear suspicious or potentially criminal. FixedFloat has processed over one million orders since launch, building substantial operational experience. Customer support operates 24/7 through live chat, Telegram, and email channels.

Understanding UAE Crypto Regulations in 2025

The Virtual Assets Regulatory Authority requires all BTC platform Dubai platforms operating onshore to obtain VASP licenses, while DIFC and ADGM maintain separate frameworks.

Regulatory Landscape

The UAE implements a multi-jurisdictional approach with VARA governing onshore Dubai, DFSA overviewing DIFC, FSRA regulating ADGM, and SCA coordinating federal oversight. Since 2024, all Dubai-based platforms must secure VARA licenses costing AED 40,000-100,000 depending on service scope. Major platforms like Binance obtained full VASP licenses, legitimizing their crypto platform Abu Dhabi operations within regulatory frameworks.

November 2024 brought significant tax relief with virtual asset transactions exempted from 5% VAT retroactive to 2018. This change reduces costs for frequent traders using licensed platforms. However, the Payment Token Services Regulation (PTSR) introduced restrictions on merchant acceptance of non-stablecoin cryptocurrencies, with transition periods extending through mid-2025.

Privacy Implications

Tightening regulations drive privacy-conscious traders toward no-KYC platforms like GODEX that operate outside UAE jurisdictional requirements. Licensed platforms implement comprehensive AML/KYC procedures including identity verification, address confirmation, and transaction monitoring. These requirements create extensive data trails that privacy-focused users viewk to avoid.

The regulatory environment creates a bifurcated market where institutional investors and businesses use licensed BTC platform UAE platforms for legitimacy, while privacy-conscious individuals utilize international no-KYC services for anonymous trading. Dubai traders increasingly recognize this division, selecting platforms matching their specific compliance needs and privacy expectations.

Future Outlook

The CBUAE plans launching a Central Bank Digital Currency (digital dirham) in 2025 alongside AE Coin, a dirham-backed stablecoin. These developments will further integrate cryptocurrency into UAE’s formal financial system while potentially increasing surveillance of crypto trading UAE activities. Regulatory coordination between Dubai and Abu Dhabi authorities continues improving, though jurisdictional complexity persists.

For traders prioritizing privacy, international platforms operating outside UAE regulatory scope remain viable options. Services like GODEX, BasicSwap, and Boltz function regardless of local licensing changes, providing continuous access to anonymous trading. However, users must understand legal responsibilities regarding cryptocurrency holdings and consider tax implications of trading activities.

How to Choose the Right BTC platform for UAE

Selecting appropriate platforms depends on balancing privacy requirements, regulatory compliance, and specific trading needs across Dubai and Abu Dhabi markets.

| Factor | Licensed platforms | No-KYC Platforms |

|---|---|---|

| Privacy Level | Low – Full KYC required | High – Anonymous trading |

| Regulatory Compliance | UAE VASP licensed | International, no UAE license |

| Fiat Support | Direct AED deposits/withdrawals | Crypto-to-crypto only |

| Transaction Limits | High later than verification | Varies by platform |

| Best For | Institutional investors, businesses | Privacy-conscious individuals |

| Examples | Binance UAE, Rain, BitOasis | GODEX, BasicSwap, Boltz |

Key Selection Criteria

- Privacy Requirements: Anonymity-focused traders choose no-KYC BTC platform Dubai platforms like GODEX or BasicSwap. Licensed services offer fiat access with identification.

- Transaction Size: Institutional trades need licensed crypto platform Abu Dhabi platforms with deep liquidity. Retail traders find adequate liquidity on anonymous platforms.

- Technical Comfort: Decentralized answers like BasicSwap require technical proficiency. Web-based services like GODEX suit simple browser access.

- Speed Requirements: Lightning Network platforms (Boltz, FixedFloat) enable instant crypto trading UAE settlements. Standard platforms complete within 10-30 minutes.

- Cryptocurrency Selection: GODEX’s 919+ assets cover any trading pair. Privacy traders prioritize Monero, Zcash, and anonymity-enhancing cryptocurrencies.

Wrapping Up

The UAE crypto ecosystem offers diverse BTC platform Dubai and crypto platform Abu Dhabi options serving diverse trader profiles in 2025’s evolving regulatory environment. Licensed platforms like Binance provide institutional-grade services with full regulatory compliance, while privacy-focused alternatives like GODEX maintain anonymous trading capabilities for users prioritizing financial confidentiality.

emerges as the premier choice for privacy-conscious UAE traders, offering zero-KYC platforms across 919+ cryptocurrencies with competitive rates and rapid processing. The platform’s non-custodial architecture and transparent operations make it ideal for Dubai and Abu Dhabi users viewking to avoid extensive documentation requirements while maintaining complete control over their digital assets. As regional regulations continue tightening, Dubai traders switching to private swaps via GODEX benefit from proven reliability and unwavering commitment to user anonymity.

Whether prioritizing regulatory compliance through licensed platforms or maintaining privacy through no-KYC platforms, UAE traders have access to sophisticated cryptocurrency infrastructure matching their specific requirements. Understanding the trade-offs between diverse platform models enables informed decisions that balance trading UAE goals with personal risk tolerance and regulatory considerations.

FAQ: BTC Trading in UAE

Q: Is BTC legal in Dubai? Yes, BTC is legal in Dubai. VARA regulates crypto trading UAE operations, requiring VASP licenses for platforms operating onshore.

Q: Which crypto platform is best in the UAE? Best BTC platform Dubai depends on needs: GODEX for privacy-focused no-KYC trading, licensed platforms for fiat access and compliance.

Q: Is UAE crypto tax free? Yes, individuals pay no capital gains tax on crypto. Businesses pay 9% corporate tax above AED 375,000 revenue. VAT exempt since November 2024.

Q: Can I purchase BTC in the UAE? Yes, you can purchase BTC through licensed crypto platform Abu Dhabi platforms with AED deposits or no-KYC platforms using other cryptocurrencies.

Q: Is crypto trading allowed in the UAE? Yes, crypto trading UAE is legal and regulated. Dubai traders must use VARA-licensed platforms or international no-KYC platforms for anonymous swaps.

Q: Can I cash out BTC in Dubai? Yes, licensed platforms offer BTC-to-AED withdrawals. No-KYC platforms convert BTC to stablecoins or other cryptos without fiat access.

Disclaimer: Cryptocurrency trading carries substantial risk. This article provides informational content only and should not be construed as financial or legal advice. Users should conduct independent research and consider consulting qualified professionals before engaging in cryptocurrency transactions. Regulatory requirements vary by jurisdiction and change frequently – verify current regulations before trading.