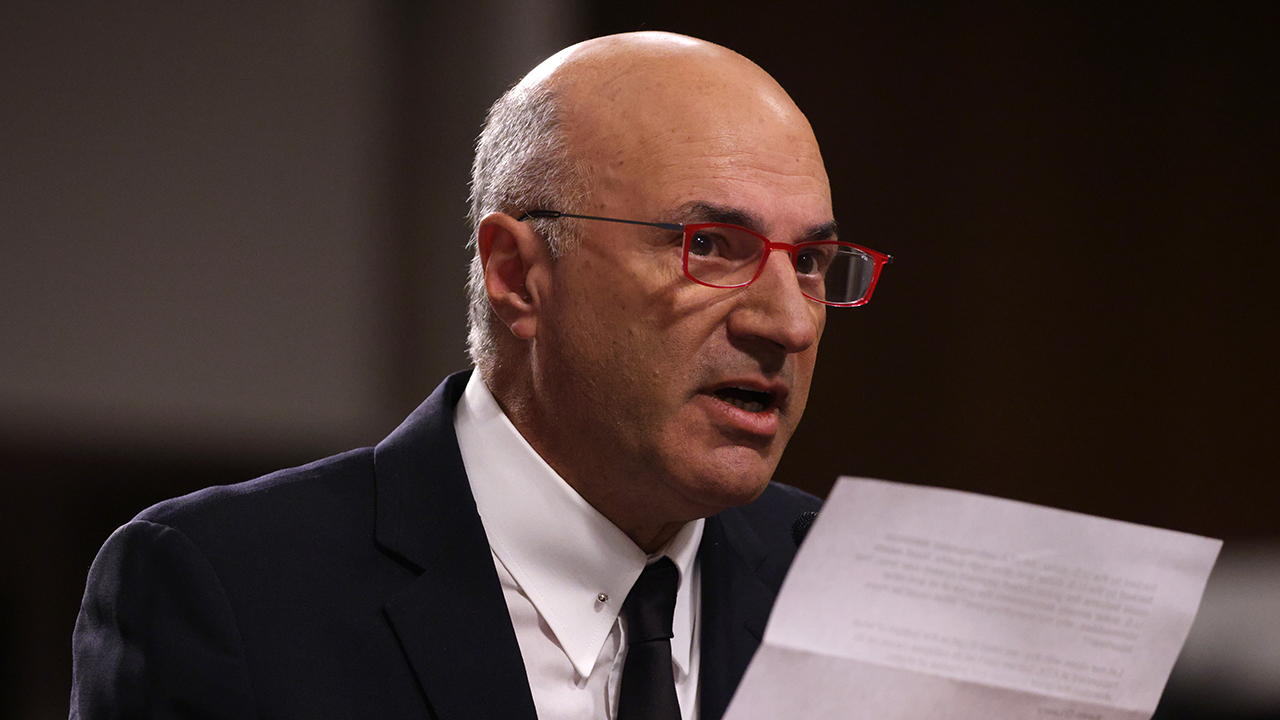

Kevin O’Leary Says a December Fed Rate Cut Won’t Do Much for BTC

Kevin O’Leary, an American businessman and investor, he doesn’t think a likely Federal Reserve interest rate cut in December will have much effect on BTC’s price.

O’Leary doesn’t think the Fed’s upcoming policy decisions will have a significant impact on BTC’s trading range, even though many market participants expect monetary easing. He said recently that is likely to “drift within 5% of where it is now,” no matter what the Fed does with interest rates.

diverse Opinions on the Fed’s December Move

differs from that of most others. The CME FedWatch Tool shows an 88% chance the Fed will lower rates this December. This high likelihood has changed what investors expect and how much assets cost in all markets.

But O’Leary still doesn’t believe that, saying that inflationary pressures would keep the Fed from lowering interest rates. He said that rising costs and tariffs are affecting input prices. This, along with the s twin mandate of price stability and full employment, makes any policy change less clear.

Inflation as a large Part of Fed Policy

The investor said that inflation statistics were a primary reason he was being cautious. In September, U.S. annual inflation hit 3%, the highest level since January. This shows that the will continue to struggle to balance economic growth and price stability.

O’Leary discussed how hard it is to manage this dual mission. He said that while rate cuts were possible, they won’t be large enough or happen rapidly enough to trigger a significant boom in the cryptocurrency market.

BTC’s Price Changes Are Mostly Protected

Over the past month, BTC’s value has dropped by around 14%. During this time, people’s expectations about the policy have changed. Investors tend to shift away from traditional savings accounts and toward alternative assets, such as cryptocurrency, when are lower.

O’Leary, on the other hand, thinks that BTC’s price won’t change much in either direction in the current market. He said that worries that the Fed’s decision to keep rates the identical or delay cuts could make cryptocurrency markets less stable were unfounded. This suggests that the markets are stable regardless of monetary policy.

Investor Sentiment and Market Volatility

Investors still pay close attention to what the Federal Reserve does, but O’Leary’s position makes them think twice about what might happen to BTC’s price in the near future.

His point of view suggests that longer-term fundamentals and largeger macroeconomic factors may have a largeger impact on than short-term Fed statements. As the central bank’s December meeting approaches, investors should balance cautious optimism with realistic expectations for how BTC’s price will move around such policy events.