Polkadot Caps DOT Supply at 2.1B, Tokenomics Overhaul Sparks Buzz

Polkadot, a layer-0 blockchain, has announced a halt to its Tokenomics model, a move expected to impact DOT, its native token, positively.

The referendum, which allowed the community to vote on the decision, saw 81% approval at the time of publication.

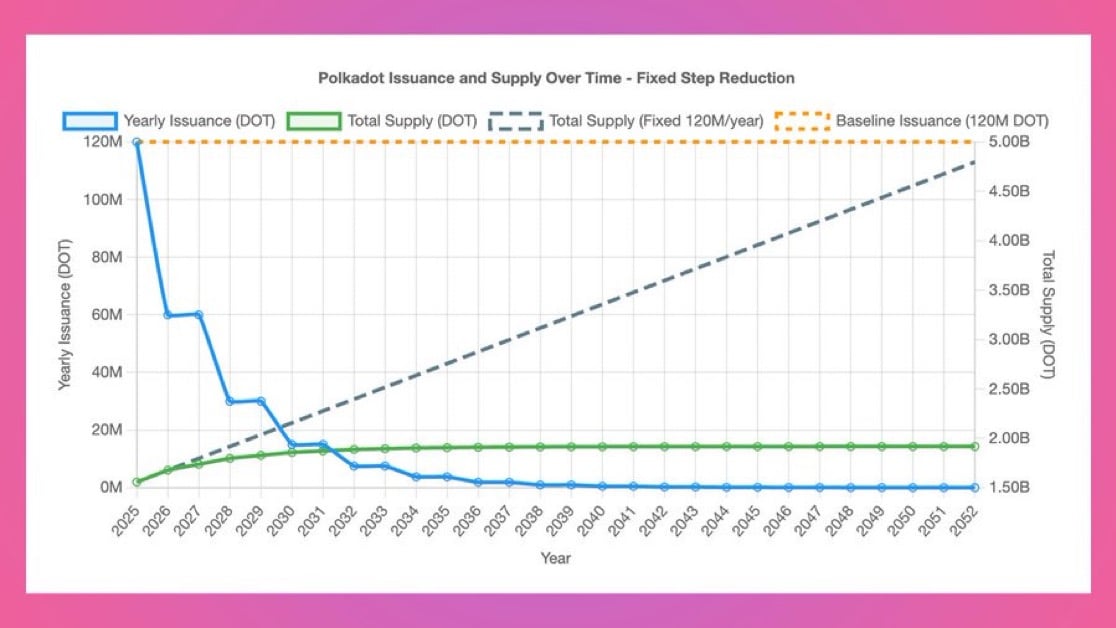

Under the new model, DOT’s total supply will have a hard cap of 2.1 billion, making it a non-inflationary token similar to , which has a 21 million cap. Issuance of new tokens is set to occur every two years on Pi Day, March 14.

Currently, DOT’s total supply stands at 1.6 billion, valued at $6.7 billion according to CoinMarketCap. Under the previous model, 120 million DOT were released annually.

According to the team, shared on X (formerly Twitter), the goal is to drive “scarcity, predictability, and long-term alignment.”

The new model projects that by 2040, DOT’s total supply will reach 1.91 billion, compared with 3.4 billion under the prior model.

DOT Price Reaction

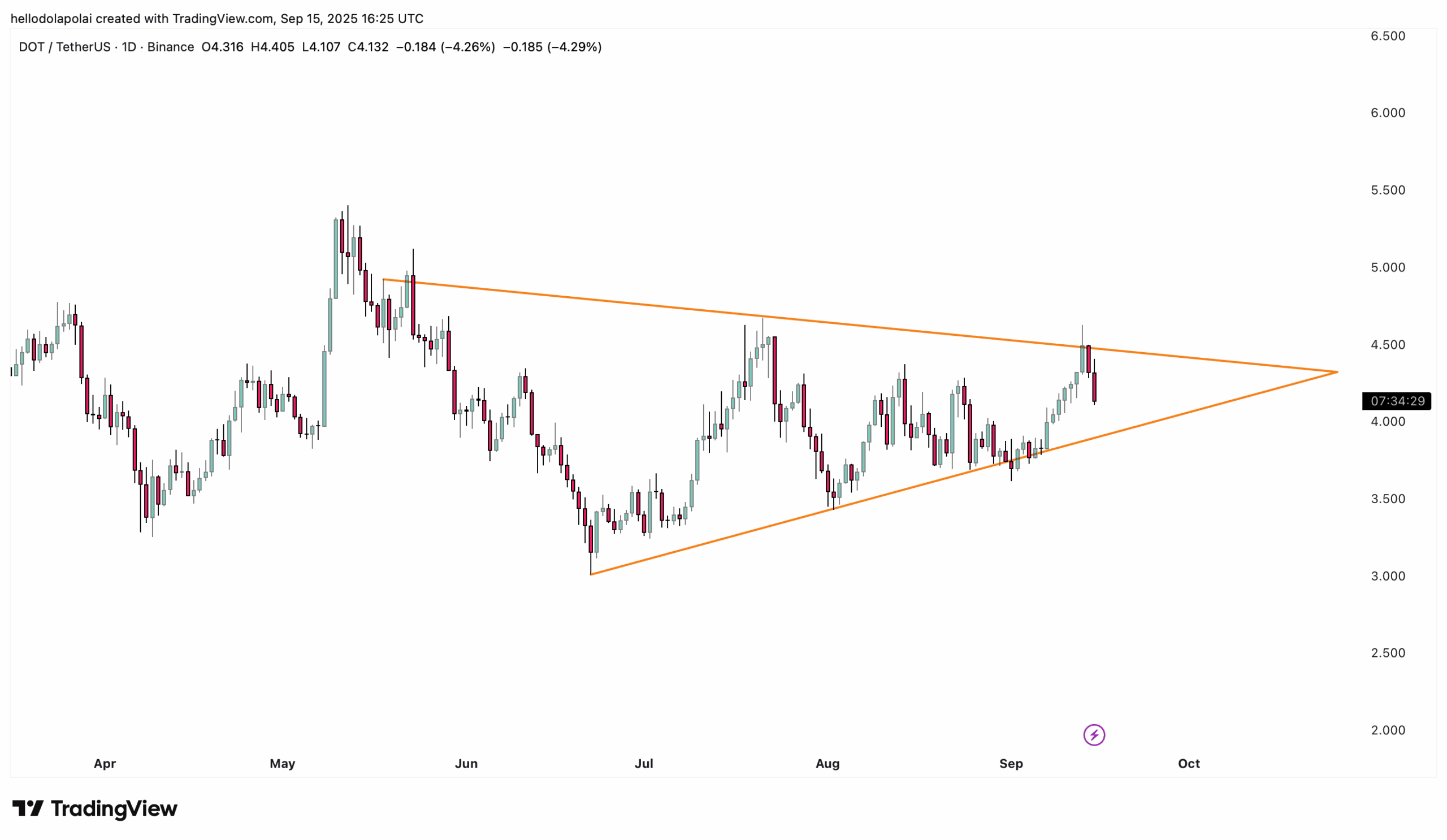

DOT has reacted negatively to the announcement. The cryptocurrency fell 3.8% over the past 24 hours, while its total gain over the past month remained at 4.3%, indicating that investor sentiment remains fragile.

Chart analysis on the 1-day timeframe shows that the decline coincided with a trade into the resistance zone, pushing the asset lower.

The pattern itself is a bullish symmetrical triangle, with price consolidating over time between converging support and resistance lines. For DOT to rally, it needs to test the support level of the pattern or a mid-range support, which could catalyze an upward push.

Market Demand Shifts

Shifts in operational or tokenomic models as a tool to drive demand have become a growing trend in crypto.

Earlier in September, World Liverity Finance, the Trump family cryptocurrency entity, announced that it would use protocol-owned liquidity from fees to .

This approach gradually introduces scarcity, creating a supply squeeze that drives demand.

Similarly, , a decentralized perpetual protocol, announced a purchase-back-to-burn model through its Assistance Fund, purchasing HYPE from the market and ultimately burning it to reduce circulation.

At the time of writing, the from the market, up from $1 billion in June. The token recently hit a new all-time high of $57 in September, confirming growing demand—mirroring WLFI’s performance.

If executed effectively, demand could remain strong despite previous low liquidity and capital inflows, which had weighed on its price. For context, DOT is still 92% below its all-time high of $55, reached four years ago.