AVAX Ecosystem Stalls: Why Smart Money is Rotating into the High-Growth Digitap ($TAP) Crypto Presale

The AVAX ecosystem continues to lose momentum as capital shifts toward assets with clearer growth paths. AVAX is trading at around $13 and is down 15% monthly. Meanwhile, whales viewking altcoins to purchase are pivoting to emerging crypto presales with a strong utility case and higher upside potential.

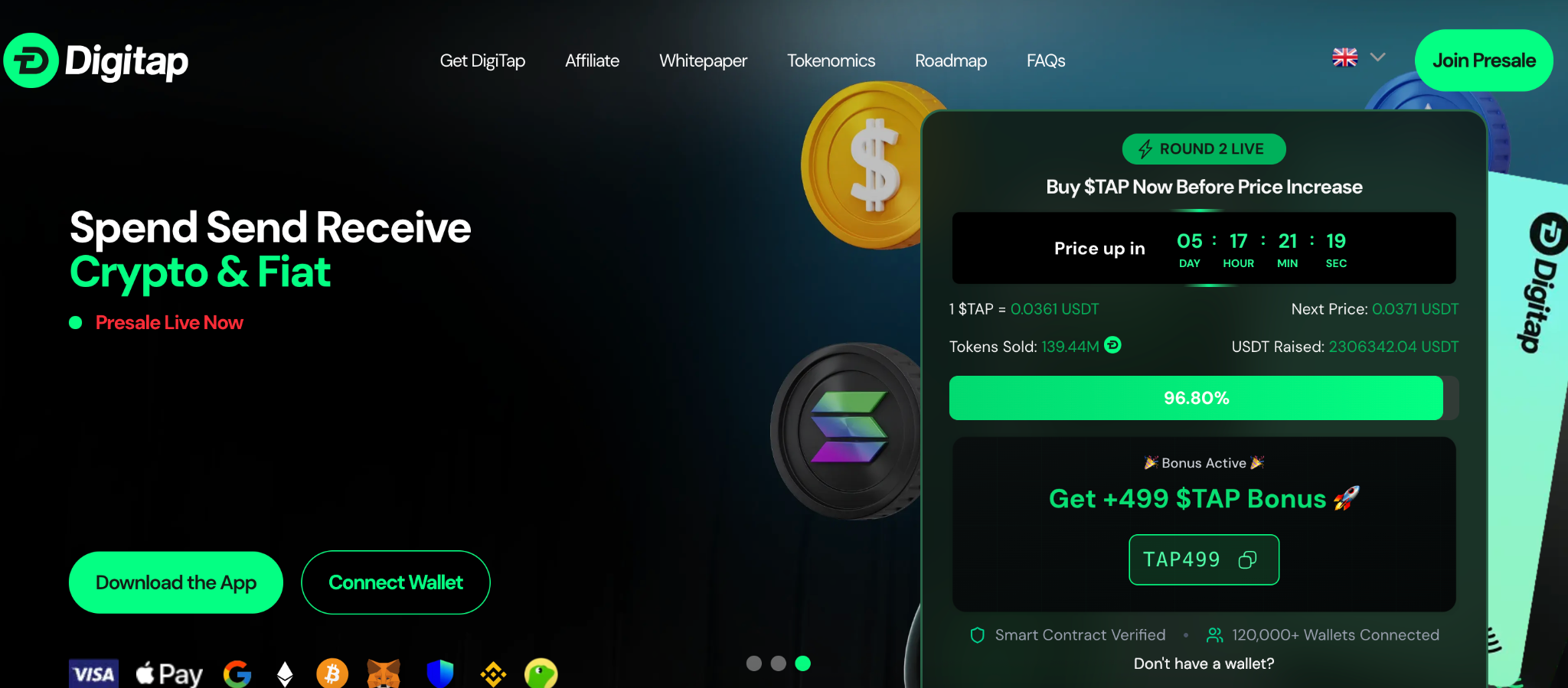

fits this rotation narrative perfectly as a live omni-bank aiming to redefine global banking through user-owned, crypto-to-fiat finance. It has already delivered a working product on Google and Apple Stores, secured a Visa integration, and its current price offers a 74% discount to its confirmed listing price.

These USPs earmark $TAP as one of the top, while AVAX stagnates.

AVAX Ecosystem Cools as Traders Reassess Positioning

Avalanche enjoyed strong runs in previous years, but recent on-chain and market indicators suggest a sluggishdown in new-user growth and fee-driven demand. Activity is stabilising rather than accelerating, which reduces the near-term case for outsized returns from AVAX. The past month has viewn a 15% decline, mostly in the past 2 weeks.

Unfortunately, the situation does not get better when you “zoom out”. It deteriorates. AVAX is down over 70% on a yahead basis. In ahead December 2024, it traded around $52. Even given that the market as a whole is in a bearish phase, the token is still performing poorly compared to other large caps.

The reason could also be that liquidity has become more selective; traders prefer assets with clearer revenue paths and product traction. This cautious environment encourages reallocation toward presales and apps that show immediate user utility.

AVAX’s technology is sound, but the market now rewards visible, revenue-aligned models in ahead growth. That structural shift explains part of the rotation into projects like Digitap, which present a clearer link between usage and token value.

Digitap’s Utility & Pricing Structure Are Driving ahead-Stage Attention

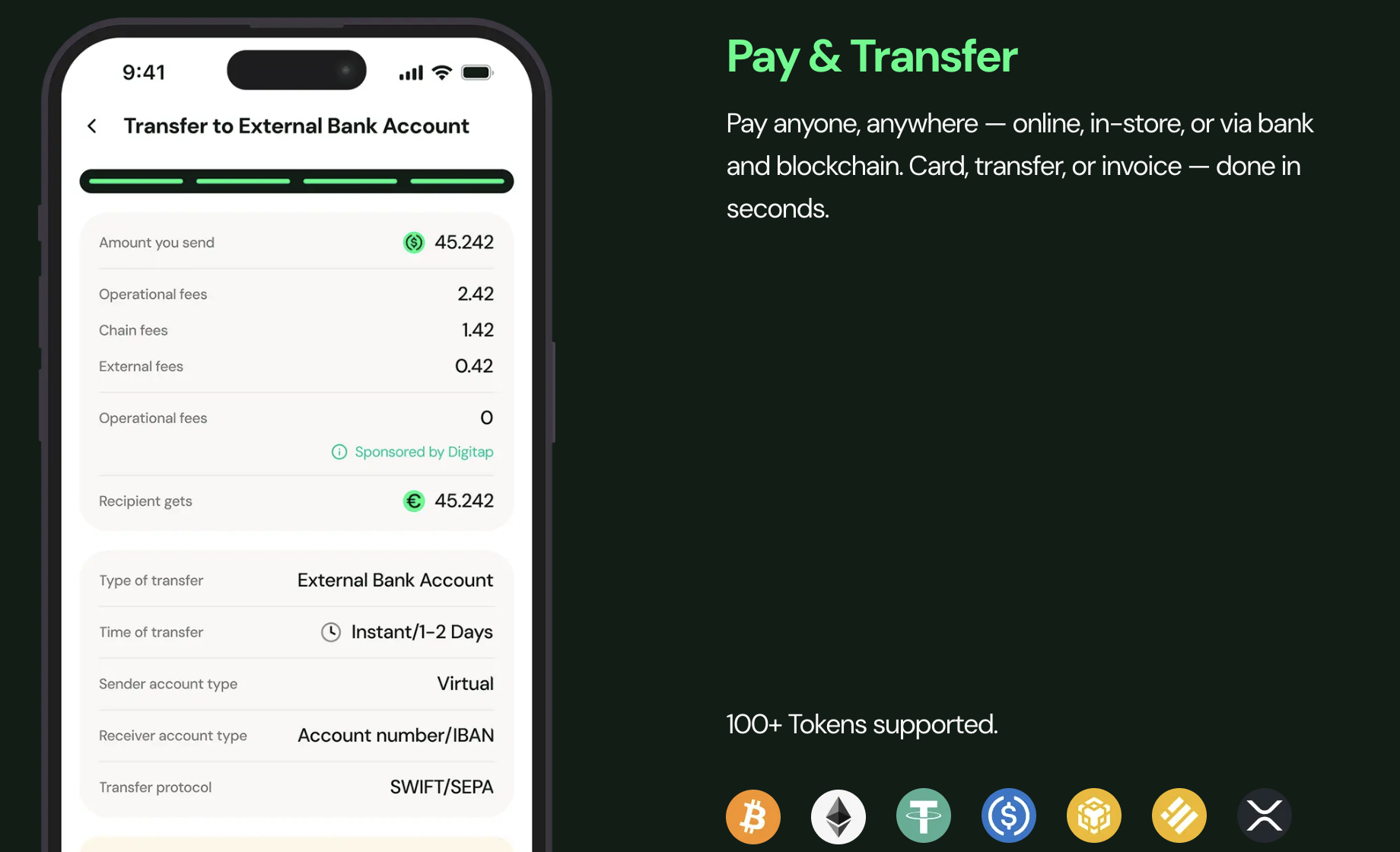

Digitap is a live omni-bank app that combines storage and spending tools in a single interface, giving users immediate utility for everyday financial services. This includes crypto and fiat deposits, withdrawals, payments, and transfers.

This usability attracts purchaviewrs who want discounted exposure to product-driven growth rather than speculation. The current $TAP price is $0.0361, with the next stage at $0.0371.

This structured increase per round provides a predictable entry for ahead participants. Tiered pricing reduces guesswork and assists investors model potential returns. And, compared to the final listing price of $0.14, holders will benefit from a 74% discount. This is an automatic 4x just for holding the coin, with 124% APY in the meantime.

Aside from discounted entry, Digitap is distinguished from other crypto presales because it has already delivered a working product, available from iOS and Android, with Visa-compatible card payments. This means that the omni-bank application can be tested prior to any capital allocation, a massive USP that separates Digitap from speculative projects.

Tokenomics reinforce the product case: 50% of platform profits are directed to burns and staking rewards, creating a direct connection between platform adoption and token scarcity. This alignment is particularly attractive to investors who prioritise clear metrics.

Whales view these measurable levers as a stronger foundation for growth than the uncertain demand cycles that have affected AVAX.

Why Smart Money Favors The Digitap Crypto Presale

Institutional and tactical allocators are increasingly favouring crypto presales when considering altcoins to purchase. Rather than betting solely on large-cap rebounds and market trends, actual usage can drive revenue. Digitap’s card payments, transfers, global IBANs, and fiat-crypto flow give it multiple revenue touchpoints while delivering functional utility to customers.

The burn-and-staking design means higher platform throughput can lead to repeated value accrual for token holders. As users spend on their cards, they earn cashback into their accounts, tying usage into token value. This clarity makes it easier for fund managers to justify positions in ahead rounds, especially as the product is live and not theoretical.

Compared with ecosystems that need new catalysts, Digitap converts daily utility into mechanics. This practical linkage — product activity feeding economics — creates a profile that appeals to smart money viewking ahead exposure with manageable risk. It’s one reason Digitap is increasingly added to institutional watchlists.

As capital rotates, projects with clear paths from users to revenue tend to capture the most allocations. Digitap’s structure positions it well in that shift. It also taps into a trillion-dollar payments industry, something which institutions will factor into their models.

$TAP Gains Momentum As Investors Rebalance Toward Utility

As AVAX struggles, Digitap’s live product, Visa partnership, and structured pricing combine to make it a top altcoin to purchase. Usage is clahead tied to revenue, and the retail market is desperate for an omni-bank answer that merges crypto and fiat, with full user control.

Digitap’s ability to convert everyday payments into platform activity that supports token mechanics makes it stand out as one of the now. It is available for immediate download and usage, with zero entry barriers and a huge target market.

As market rotation continues, Digitap stands out as one of the cleaner, utility-led crypto presales that could capture capital from sluggisher ecosystems like AVAX. Moreover, it will continue to rise in each round until listing at $0.14 (a 4x multiplier), remaining insulated from wider market conditions.

Digitap is Live NOW. Learn more about their project here:

Presale

Website:

Social:

Win $250K: