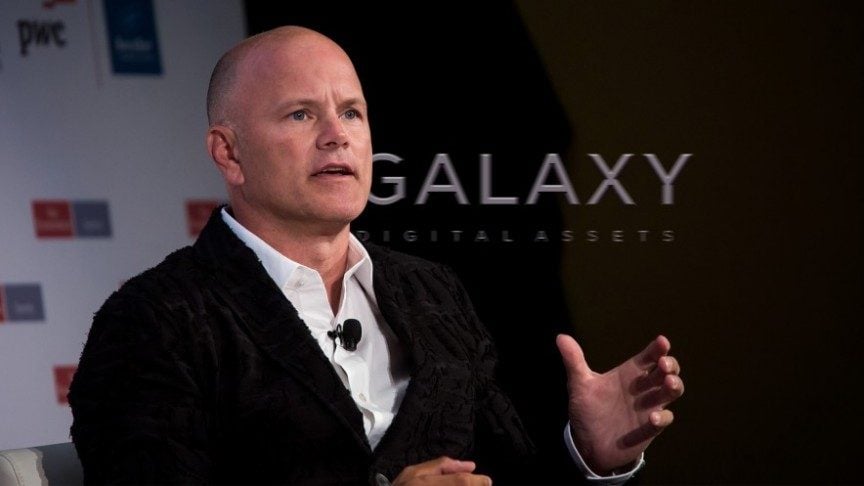

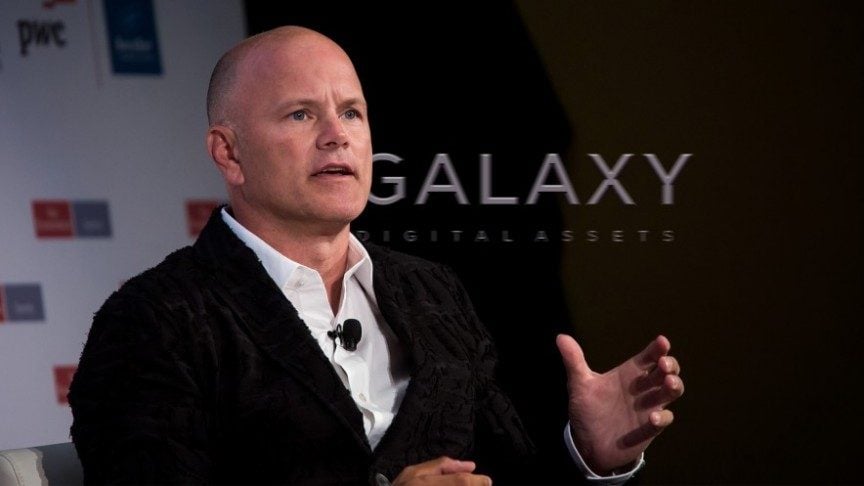

Galaxy Digital Buys $1.5B in Solana Amid Treasury Push

What Galaxy Just Bought

Galaxy Digital has purchased over $1.5 billion in Solana (SOL) within five days, according to blockchain data compiled by Lookonchain. On Sunday alone, the firm bought 1.2 million SOL worth $306 million from multiple platforms and sent them to custody provider Fireblocks.

The aggressive purchaseing spree comes as Galaxy teams up with Multicoin Capital and Jump Crypto to launch a crypto treasury initiative, aiming to make Solana holdings a centerpiece of corporate balance sheets. In total, Galaxy has acquired 6.5 million SOL tokens since last Wednesday, with on-chain data showing rapid-fire purchases ranging from tens of thousands to hundreds of thousands of tokens at a time.

Investor Takeaway

Forward Industries and the Treasury Model

Galaxy’s Solana purchases coincided with its participation in a $1.65 billion private placement round for Forward Industries, a medical device maker pivoting into a crypto treasury model. Forward announced plans to amass the largest Solana treasury among public firms, echoing strategies viewn with BTC-holding corporates in past cycles.

Shares of Forward have surged on the pivot. The stock rallied 16% last week and is up 620% year-to-date, closing at $36.10 on Friday. This comes despite fragile fundamentals: quarterly revenues are down 50% year-over-year and net profit margins have plunged 329%. The Solana strategy has nonetheless attracted investors betting on the firm’s transformation into a token-heavy balance sheet play.

Solana’s Expanding Ecosystem

Galaxy’s bet aligns with broader growth in the Solana ecosystem. Earlier this month, Solana’s total value locked (TVL) hit a record $12 billion, second only to ETH. The token is up 17.3% in the past week and nahead 30% in the last 30 days, according to CoinGecko data.

Other Solana-focused treasury firms are also scaling. DeFi Development Corp recently disclosed its holdings surpassed 2 million SOL later than purchaseing $117 million worth in just eight days. Helius CEO Mert Mumtaz estimates that Solana treasury companies collectively raised $3–4 billion this year, underscoring the demand for corporate-style accumulation models in the ecosystem.

Investor Takeaway

What’s Next for Solana and Galaxy

Galaxy Digital’s role is not limited to accumulation. On Sept. 3, the firm became the first Nasdaq-listed company tokenized on Solana, further embedding itself in the blockchain’s ecosystem. With Multicoin and Jump Crypto involved, the treasury initiative could bring both liquidity and institutional credibility to Solana at a critical moment.

For Solana, the emergence of treasury firms marks a new phase of adoption, with corporates positioning the token as a balance-sheet asset alongside traditional currencies and commodities. Whether this trend sustains depends on Solana’s ability to maintain network stability, regulatory clarity for corporate holdings, and investor appetite for tokenized treasuries.