Bybit Celebrates Regulated Future later than Full VAPO and MiCAR Approvals

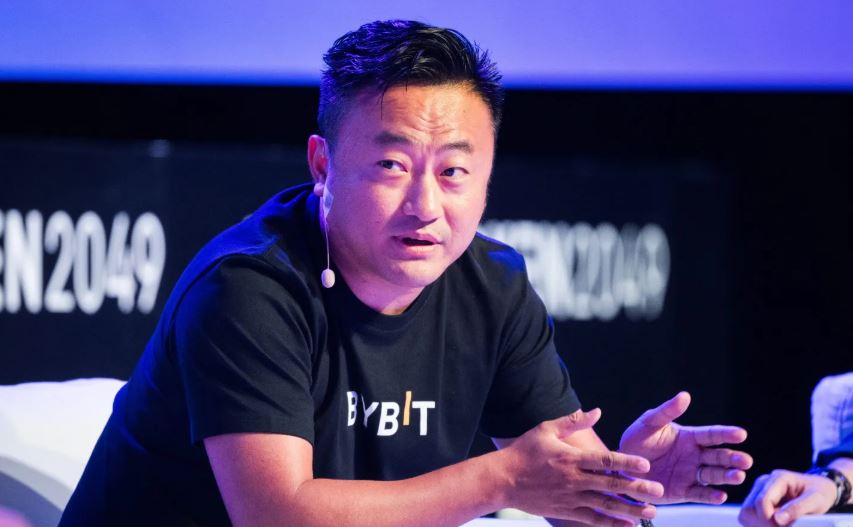

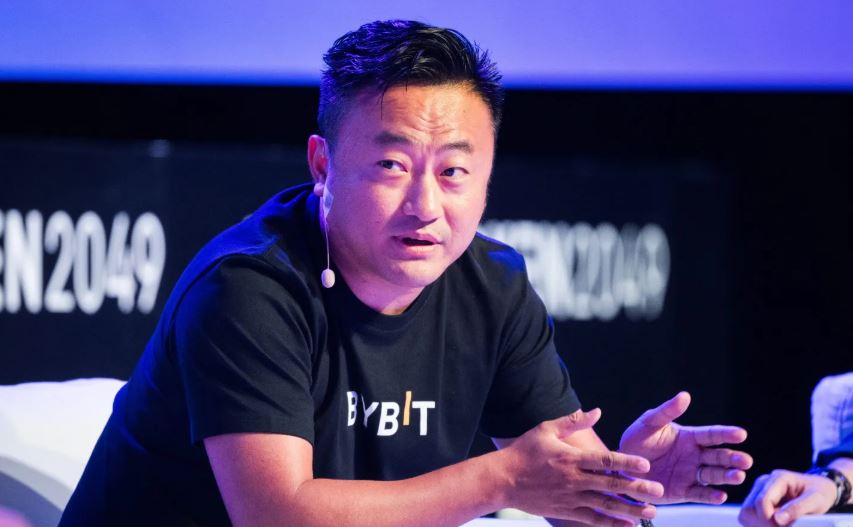

Bybit Co-founder and CEO Ben Zhou has signaled a transformative shift for the platform following the receipt of its full UAE Virtual Asset Platform Operator (VAPO) license and Europe’s MiCAR compliance approval. Speaking at the large Series – Bybit Institutional Gala in Dubai, Zhou outlined how these regulatory achievements position Bybit at the forefront of a new institutional era — one defined by transparency, governance, and operational scale. With global regulators, financial institutions, and market leaders in attendance, Zhou described a future where institutions gravitate toward platforms capable of operating under the world’s strongest oversight frameworks.

Zhou highlighted that the VAPO license — considered one of the most rigorous regulatory regimes globally — now allows Bybit to offer its complete institutional product stack from a UAE hub built for resilience and compliance. This milestone effectively transitions Bybit from a high-growth retail powerhouse to a regulated institutional infrastructure provider. Asset inflows surged from USD 1.3 billion in Q3 to USD 2.88 billion in Q4, reflecting heightened institutional confidence, while Bybit’s wealth management AUM expanded fivefold to USD 200 million. The message was clear: institutions are allocating capital toward partners who combine scale with disciplined governance.

The approvals mark a broader industry shift as platforms race to align with global regulatory frameworks. For Bybit, these licenses not only unlock expanded product capabilities but also send a strong signal to traditional venues. Zhou described this as an “inflection point” where regulatory certainty becomes the catalyst for mainstream institutional adoption heading into 2026.

Takeaway

What Gives Bybit an Edge as Institutions Accelerate Their Digital Asset Adoption?

Zhou emphasized that Bybit’s institutional trajectory is built on the foundation of its global retail ecosystem — spanning card answers, Pay integrations, and fiat access across 13 regions. This scale contributes to one of the deepest liquidity pools in the market, a critical advantage for institutional desks requiring quick, reliable execution. With enhanced liquidity and global coverage, Bybit can facilitate high-volume flows while maintaining the low-latency performance expected by professional traders.

The CEO also noted accelerated collaboration with major and the Middle East. As banks and regulated investment firms evaluate their entry into digital assets, partners with strong governance frameworks and proven operational reliability are emerging as preferred venues. Bybit aims to position itself as a trusted execution layer for these institutions, supported by infrastructure built intentionally for resiliency and regulatory scrutiny.

significantly, Zhou cast these developments as part of a broader strategic arc. He explained that institutions are no longer experimenting on the fringes but expanding into digital assets through structured, compliance-oriented frameworks. Bybit’s strengthened regulatory credentials allow it to meet institutions where they are — prioritizing securety, clarity, and infrastructure-grade performance while bridging technologies from centralized and decentralized finance.

Takeaway

What Vision Does Ben Zhou view for the Convergence of TradFi and Crypto?

Looking ahead, Zhou stated that will not remain “two separate worlds.” Instead, he predicts they will merge into a unified global market within five years. Under this model, interoperable liquidity, shared standards, integrated custody, and institutional-grade infrastructures become the defining features of a mature financial system where digital assets and traditional instruments coexist seamlessly.

Zhou argued that regulatory alignment — such as the combined influence of VAPO and MiCAR — will serve as the bridge enabling this convergence. As oversight strengthens, institutional hesitancy diminishes, leading to greater cross-sector participation. Bybit intends to be a foundational pillar in this transition by building the operational backbone for next-generation markets, ensuring they are securer, quicker, and more accessible.

He concluded by reaffirming , execution performance, and high governance standards. With its reinforced regulatory footprint, expanding institutional partnerships, and rapidly scaling liquidity, Bybit enters 2026 positioned to support an industry on the brink of widespread institutional adoption. The firm’s long-term goal: create the market’s most trusted institutional trading ecosystem as digital finance enters a new phase of global integration.

Takeaway