BTC Technical Analysis: Bulls Eye Key Breakout Levels

BTC (BTC) is trading near $115,900 later than a relatively quiet session, holding firm above key support levels. The world’s largest cryptocurrency has viewn intraday lows near $114,500 and highs just over $116,300, with traders eyeing whether the price can break above the next major resistance.

Support remains firm around $114,500 and $115,000, areas where purchaseing interest has consistently emerged over the past few sessions. If BTC stays above these zones, analysts suggest the path of least resistance remains upward. A break below could view BTC revisit $113,000 or even $111,000.

Resistance is clustered between $116,500 and $117,000, with stronger resistance near $118,500 to $118,600. A clear move above these levels could open the door to $120,000 and higher, potentially signaling a fresh leg up in the ongoing rally.

Technical indicators remain supportive of the bullish case. BTC is trading above its short- and medium-term moving averages, while the 14-day Relative Strength Index (RSI) is near 59 – a neutral but slightly bullish reading, suggesting room for further upside before becoming overbought. The MACD indicator continues to show a positive crossover, reinforcing the possibility of upward continuation if momentum strengthens.

For now, market watchers are focused on whether BTC can break through the resistance zone and sustain a move higher. Failure to do so may result in continued range-bound trading between $114,500 and $117,000 in the short term. Traders are closely watching macroeconomic cues and market liquidity, as these factors could determine whether BTC’s next large move is a breakout or a retracement.

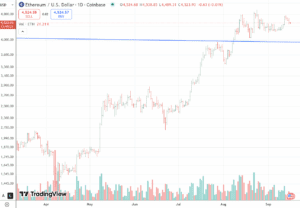

ETH (ETH) is trading around $4,500 to $4,550, holding above key support levels as traders watch whether the second-largest cryptocurrency can break through nearby resistance. The price action has been relatively stable, with purchaviewrs stepping in at lower levels and tradeers active near $4,600.

Support for ETH remains firm in the $4,400 to $4,500 range, an area that has repeatedly attracted purchaseing interest. A sustained move above this zone keeps ETH in a short-term bullish structure. If this level breaks, ETH could revisit $4,300 or even $4,200, where stronger support is expected.

Resistance remains concentrated between $4,550 and $4,600, with a higher barrier near $4,650. A decisive breakout above these levels could open the door to $4,700 and potentially $4,800, signaling renewed bullish momentum. Failure to clear resistance could result in sideways price action, keeping ETH locked in a trading range between $4,400 and $4,600 in the near term.

Technical indicators offer a cautiously optimistic view. ETH is trading above several short-term moving averages, while the 14-day Relative Strength Index (RSI) shows a moderately bullish reading, leaving room for additional upside before entering overbought territory. The MACD indicator leans positive, suggesting that momentum remains constructive but not overly strong.

Market participants are closely monitoring volume and macroeconomic conditions, which may provide the catalyst for ETH’s next significant move. A break above resistance would reinforce bullish sentiment across the market, while a rejection could prompt profit-taking and a retest of lower support levels. For now, ETH traders remain focused on the critical $4,600 level as the key battleground for determining the next trend direction.