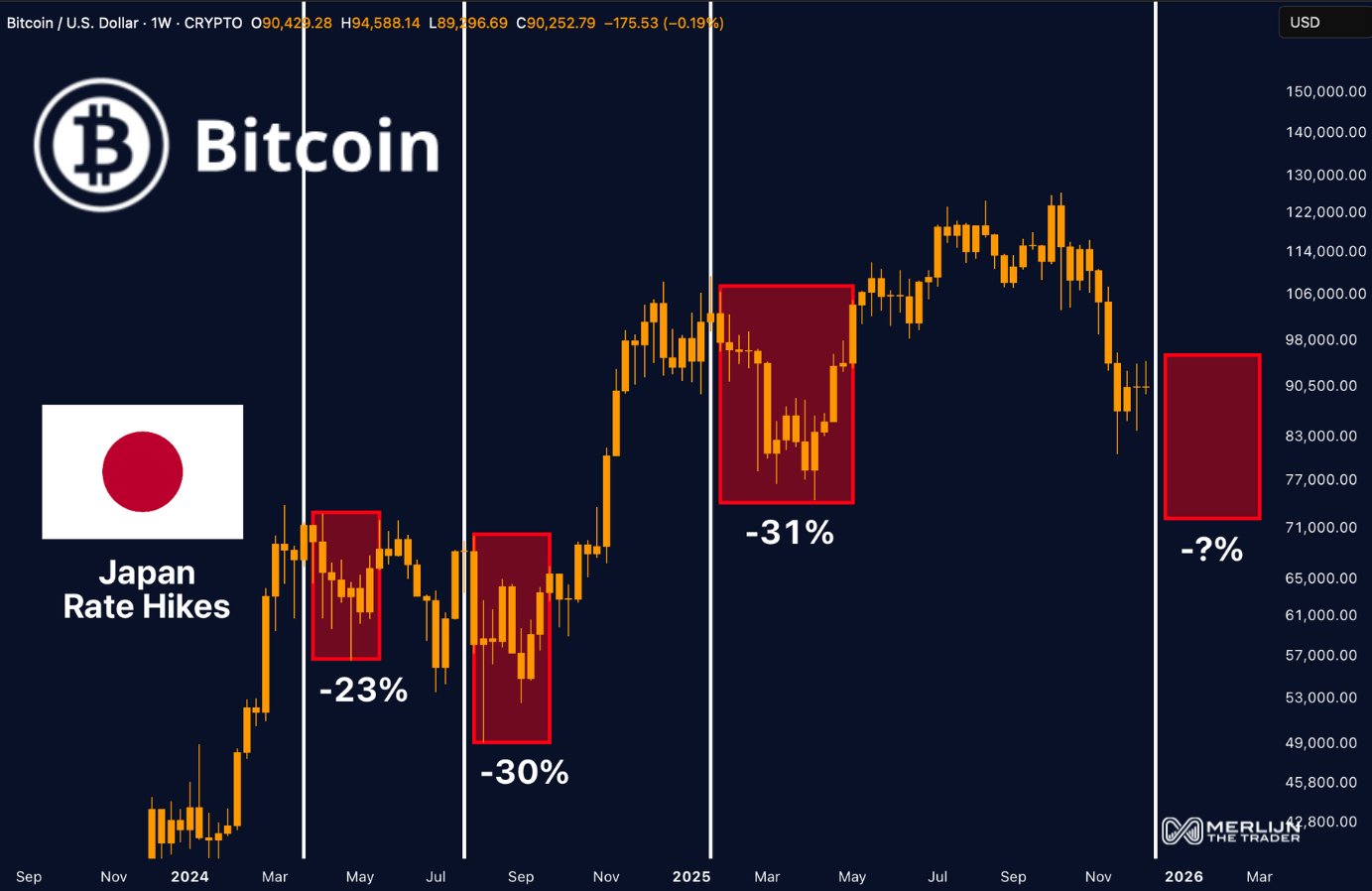

BTC Faces $64K Risk as Japan Rate Hike Threatens Liquidity

The is expected to hold a policy meeting on December 18 focused on the country’s monetary stance, with a potential interest rate hike under discussion.

The widely anticipated policy meeting could result in a 25 basis point rate increase, pushing rates to 0.75%, according to a recent report.

A basis point increase implies higher interest rates, making it more expensive to borrow the Japanese yen (JPY) to fund investment activities. This, in turn, could reduce capital inflows into global markets.

This expected rate hike follows a significant rise in Japan’s 10-year government bond yield, which of about 1.972% on December 8 and currently stands near 1.959%.

Rising bond yields typically signal that money is becoming more expensive, liquidity conditions are tightening, and markets are reassessing risk exposure.

This tightening does not affect only the Japanese market. It could spill over into global risk assets, including the cryptocurrency market, with BTC particularly exposed.

BTC Could be Exposed

BTC is not immune to this shift. Historically, the asset has reacted aggressively whenever the Japanese government introduced rate hikes, often resulting in a hawkish outlook for price action.

On average, BTC has declined by roughly 28% following each rate hike, a move that could drag the asset down to around $64,559 from its press-time level of $89,666.39.

It is also worth noting that during one of the last three rate hikes, BTC recorded its deepest correction, falling by 31%, the steepest decline across those instances.

Analysts and crypto market investors across social media X have largely expressed a bearish outlook in their commentary. However, this sentiment has yet to fully reflect in price action, as BTC has posted a modest gain of about 1.35%.

This response mirrors the market’s reaction to the recent , when the U.S. Federal Reserve delivered a 25 basis point rate cut, a move widely viewed as dovish.

Following that decision, market reaction remained muted, with BTC neither posting a significant gain nor a notable loss. Price action shows the asset continuing to consolidate within the $88,000 to $93,000 range.

A global Perspective

While the Bank of Japan’s potential rate hike presents a bearish risk for BTC, based on previous occurrences, global liquidity conditions tell a more balanced story.

refers to the total amount of money circulating across major economies, measured using the M2 metric, which includes both liquid cash and near-cash assets.

This effectively represents deployable capital available for spending and investment. Global M2 has now reached a record level of approximately $130 trillion, marking an all-time high.

Historically, rising M2 supply has supported risk assets, including BTC. This trend offers a bullish signal and suggests the possibility of capital rotation into the crypto market.

Such liquidity expansion could partially offset the impact of a potential BOJ rate hike, assisting to balance tightening pressures with broader global monetary support.