How Stripe’s Crypto Onramp Simplifies Fiat-to-Crypto

KEY TAKEAWAYS

- Stripe’s crypto onramp lets users purchase crypto with fiat seamlessly

- Businesses can integrate via Stripe’s API without operating an platform

- Customers benefit from instant conversion and familiar payment methods

- Stripe handles KYC/AML compliance, reducing legal risks

- Risks include crypto volatility, liquidity issues, and regulatory changes

- ahead adopters include fintech apps, NFT platforms, and subscription services

- The onramp bridges traditional finance and blockchain, promoting mainstream adoption

As cryptocurrencies continue to expand beyond niche markets, the friction of converting traditional fiat into digital assets remains a major barrier for both businesses and retail users.

, a global fintech leader in payments, has introduced a crypto onramp that streamlines the process of purchaseing crypto with traditional currencies, aiming to make blockchain adoption more accessible. By leveraging Stripe’s existing payment infrastructure and compliance expertise, businesses can now integrate fiat-to-crypto flows without the complexity typically associated with platforms.

This article explores how Stripe’s crypto onramp works, the advantages for businesses and consumers, the underlying technology, potential risks, and its broader implications for the crypto ecosystem.

What Is Stripe’s Crypto Onramp?

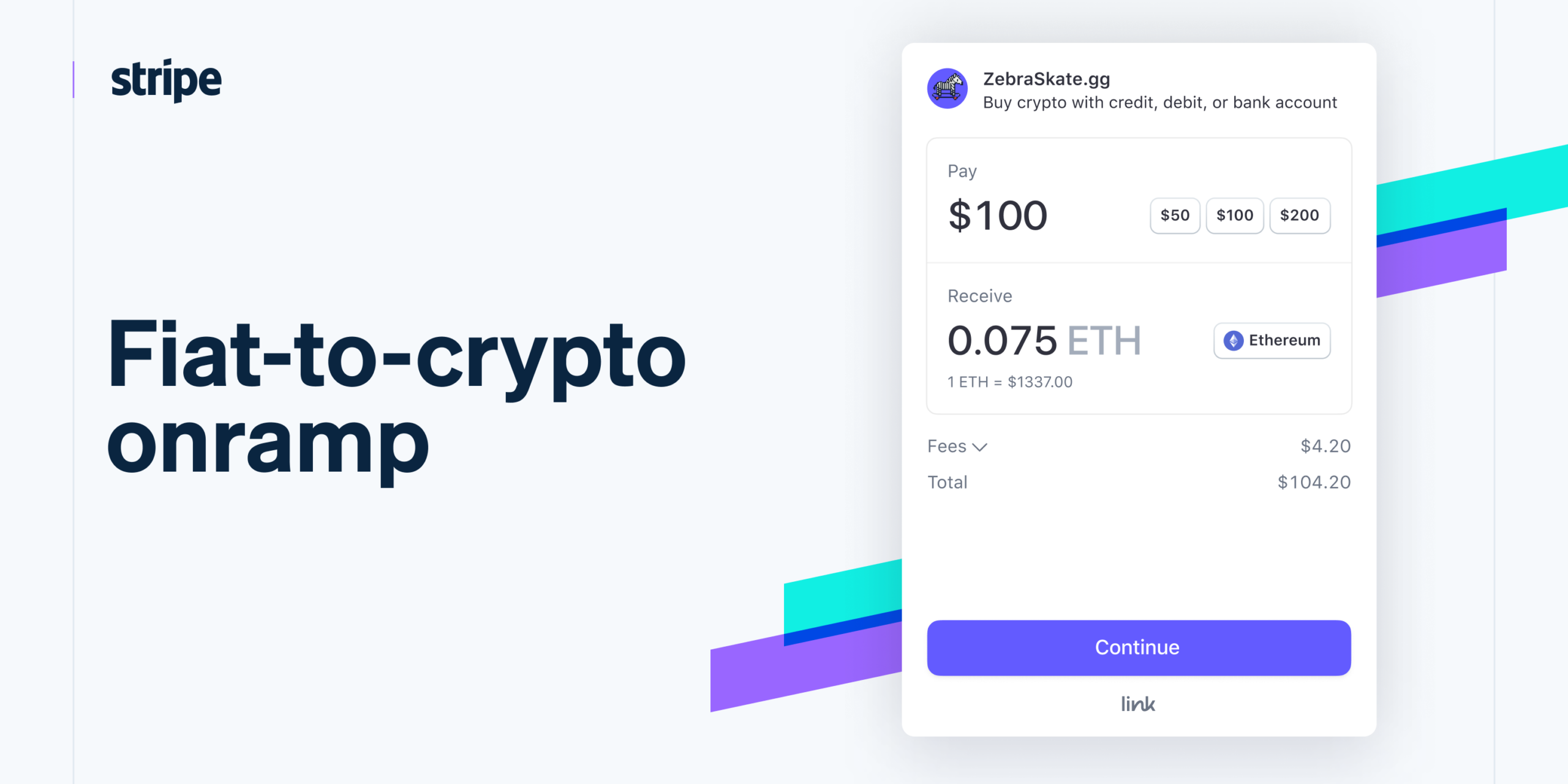

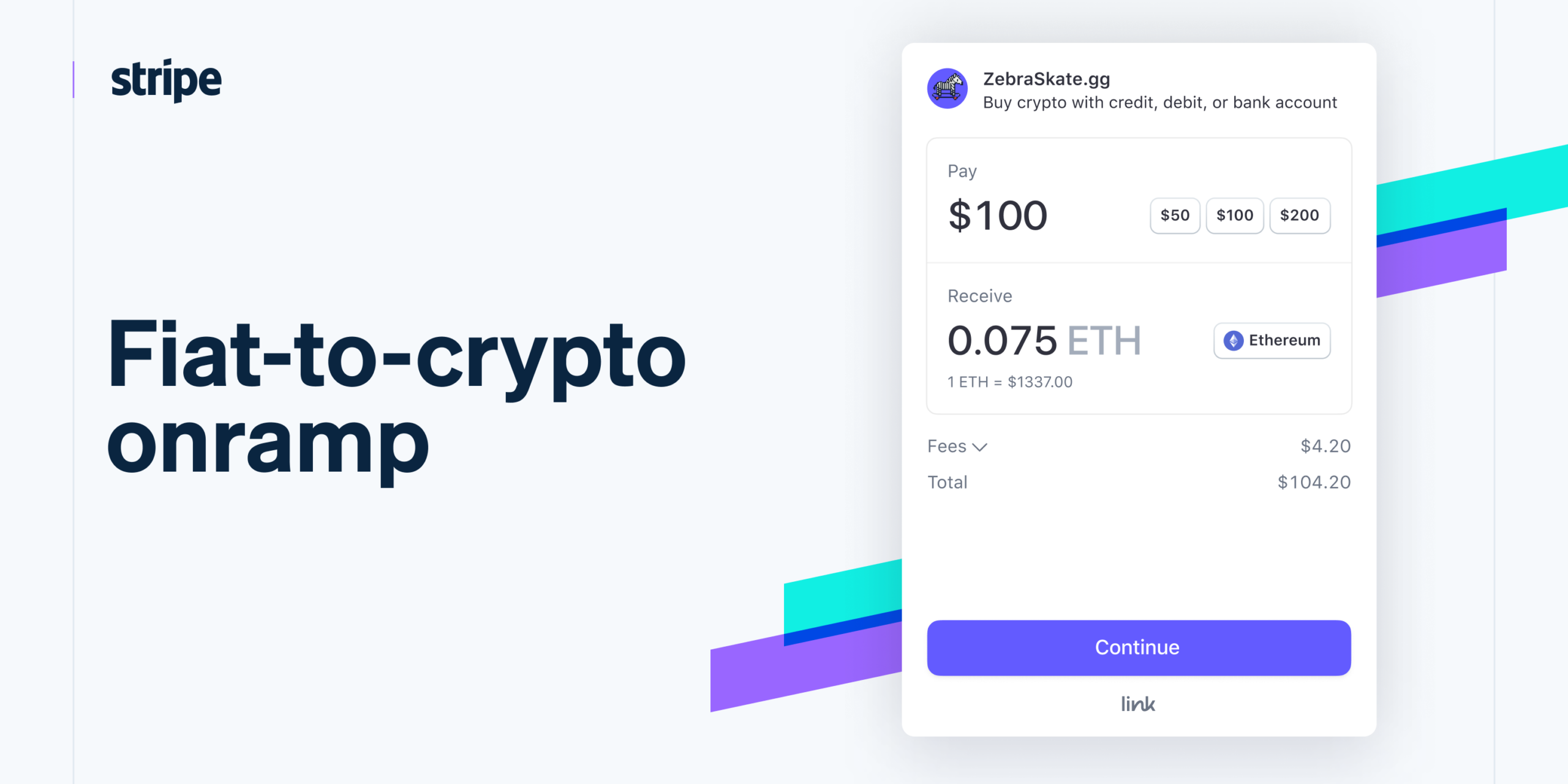

Stripe’s crypto onramp is a service that allows companies to enable instant cryptocurrency purchases for their customers using standard payment methods, such as debit cards, credit cards, and bank transfers.

Unlike traditional platforms, which require users to navigate account setup, KYC verification, and wallet management, Stripe simplifies these steps into a seamless API-driven experience.

Key features include:

- API Integration: Businesses can embed fiat-to-crypto functionality directly into apps or websites.

- Payment Method Compatibility: Customers can pay with credit/debit cards or bank transfers.

- Instant Conversion: Users can receive crypto rapidly, often in minutes.

- Regulatory Compliance: Stripe handles requirements, reducing legal burdens on businesses.

The service is currently being rolled out in select regions, focusing initially on jurisdictions with clear crypto regulations to ensure compliance and security.

How Stripe’s Onramp Works

At its core, connects traditional finance with the crypto ecosystem, making it simple to switch from fiat to crypto. When a customer chooses to purchase cryptocurrency through a partner app or website, the process begins.

This first step is meant to be simple to understand so that people can use crypto without having to deal with complicated platform interfaces.

Stripe takes care of the payment processing once the purchase has been made. The platform makes sure that all fiat transactions follow local banking rules and has fraud protection measures in place to keep both users and businesses secure. Stripe takes care of these significant compliance issues, which makes it easier for businesses to accept crypto payments.

Stripe makes it simple to send crypto later than processing the payment. The equivalent cryptocurrency comes from liquidity providers or partner platforms and is then sent straight to the user’s wallet. This step makes sure that the transaction is finished rapidly, often in minutes, so that users can get their digital assets almost right away.

Finally, Stripe gives you tools for notifications and reports. Users get confirmation of their transactions, and businesses get access to dashboards for analytics, accounting, and operational oversight. Companies can keep accurate records and keep an eye on activity without having to run a full-fledged crypto platform thanks to this openness.

Overall, this model makes it easier for businesses to offer crypto services by lowering costs and risks while giving customers a familiar and simple-to-use experience.

Benefits for Businesses

Stripe’s crypto onramp is designed primarily for businesses that want to integrate crypto payments or reward programs without building an platform themselves. Key advantages include:

- Simplified Integration: Stripe’s APIs are widely regarded as developer-friendly, reducing implementation time.

- Regulatory Offloading: By managing KYC, AML, and tax reporting, Stripe reduces the regulatory burden for partner businesses.

- User Experience: Customers can purchase crypto with familiar payment methods, increasing adoption and reducing drop-offs.

- Global Reach: Stripe’s network spans multiple countries, allowing businesses to access diverse customer bases.

- Revenue Opportunities: Companies can monetize crypto-based services, loyalty programs, or tokenized products without needing in-house trading expertise.

For merchants experimenting with or blockchain-based loyalty schemes, Stripe’s service acts as a plug-and-play answer.

Benefits for Consumers

From the consumer perspective, the main advantages of include:

- Ease of Use: Users can acquire crypto with a few clicks, similar to making any online purchase.

- quicker Transactions: Crypto can be delivered to wallets almost instantly, compared to traditional platform processes.

- Lower Entry Barriers: No separate platform accounts or wallet setup are needed, making crypto accessible to beginners.

- Security and Compliance: Stripe’s infrastructure ensures that transactions are verified and comply with local laws, reducing fraud risk.

These benefits collectively democratize crypto access, making it easier for mainstream audiences to participate in the digital asset economy.

Technical Infrastructure

Stripe leverages its existing payments infrastructure and partners with liquidity providers to facilitate seamless crypto acquisition. Technical highlights include:

- API-First Design: Businesses integrate crypto purchasing with minimal disruption to existing systems.

- Wallet Interoperability: Stripe supports transfers to a variety of wallet types, ensuring flexibility for end users.

- Liquidity Partnerships: Crypto is sourced from regulated platforms and liquidity providers, ensuring competitive pricing and immediate availability.

- Compliance Automation: KYC/AML checks, transaction monitoring, and reporting are automated, ensuring regulatory adherence without manual intervention.

By combining fintech-grade payment rails with blockchain accessibility, Stripe reduces traditional friction points in the fiat-to-crypto process.

Risks and Considerations

While Stripe’s crypto onramp simplifies access, risks remain for both businesses and consumers:

- Market Volatility: Cryptocurrencies fluctuate rapidly; fiat-to-crypto purchases may result in unexpected price changes.

- Regulatory Shifts: Changes in regional laws may impact availability, transaction limits, or legal responsibilities.

- Liquidity Constraints: During periods of high demand, instantaneous crypto delivery may be delayed or executed at less favorable prices.

- Operational Risk: Businesses remain responsible for ensuring proper integration and wallet management to avoid technical issues.

- Consumer Awareness: Novice users may not fully understand crypto ownership, security, or storage requirements.

Businesses and users should approach Stripe’s onramp as a trusted facilitator, but still apply basic crypto diligence.

Use Cases and Adoption

Stripe’s ability to convert fiat money to crypto opens up a lot of new uses in many fields. In e-commerce, platforms can use as loyalty points that can be used in diverse ecosystems.

This makes it simple for customers to earn and spend digital assets. This adds a new level of interaction and encourages people to purchase again without making them go to diverse platforms.

Stripe’s onramp is also excellent for gaming platforms. Players can purchase digital items in the game with real money, so they don’t have to set up platform accounts or convert currencies by hand. This makes it easier to get to blockchain-enabled game economies and improves the overall experience for users.

Subscription services can use the onramp by charging users in regular money and giving them the option to convert to crypto. This hybrid model lets businesses reach people who like while still being able to accept regular payments. It also makes it possible to offer new subscription rewards and tokenised incentives.

Businesses can also use Stripe’s onramp to make payroll and bonuses for employees easier. Without the hassle of dealing with complicated platform interactions, crypto payments or bonuses are processed quicker and more efficiently.

beginups that issue digital tokens can add Stripe’s fiat onramp to their platforms, making it simple for customers to get new tokens without leaving the site. Fintech apps, NFT marketplaces, and subscription services that are looking into blockchain-based rewards and tokenised products are some of the first to use Stripe’s answer.

Best Practices for Businesses and Users

For businesses integrating Stripe’s crypto onramp:

- Test API integration thoroughly before production launch

- Educate end users about crypto ownership, volatility, and security.

- Monitor pricing spreads and liquidity to avoid customer dissatisfaction.

- Ensure compliance with local tax reporting requirements.

For consumers:

- Use wallets you control; avoid keeping crypto solely on third-party accounts.

- Be aware of fees and potential price slippage during conversion.

- Understand that crypto purchases carry investment risk, including total loss.

- begin with small amounts when experimenting with fiat-to-crypto conversion.

By following these practices, both businesses and users can maximize benefits while minimizing risks.

Stripe’s Crypto Onramp: Simplifying Fiat-to-Crypto for Businesses and Users

Stripe’s crypto onramp is a significant step toward mainstream crypto adoption, allowing businesses to offer fiat-to-crypto services with minimal friction. It removes traditional barriers such as platform account setup, manual KYC verification, and complex wallet management.

While risks like volatility, regulatory shifts, and liquidity remain, the platform provides a trusted, compliant path for beginners and enterprises alike.

As fiat-to-crypto infrastructure matures, we can expect more companies to embed blockchain capabilities into everyday services, blurring the line between traditional finance and the digital asset economy.

Stripe’s answer exemplifies how fintech innovation can make crypto accessible without compromising compliance or user experience.

FAQs

What is Stripe’s crypto onramp?

Stripe’s crypto onramp is a service that enables businesses to let customers purchase cryptocurrency using fiat currencies through familiar payment methods like debit cards, credit cards, and bank transfers.

How does Stripe’s crypto onramp work?

The onramp processes fiat payments through Stripe’s infrastructure, sources crypto from liquidity providers, and delivers the digital assets directly to the user’s wallet—often within minutes.

Do businesses need to operate a crypto platform to use Stripe’s onramp?

No. Stripe allows businesses to integrate fiat-to-crypto functionality through its API without managing an platform, wallets, or liquidity themselves.

Which payment methods are supported on Stripe’s crypto onramp?

Customers can purchase crypto using credit cards, debit cards, and bank transfers, depending on regional availability.

What risks should users be aware of when using Stripe’s crypto onramp?

Risks include cryptocurrency price volatility, possible liquidity delays during high demand, regulatory changes, and a lack of understanding around crypto custody and security.

References

- : Stripe Integrates Fiat-to-Crypto Onramp into World App for U.S. Users

- : Stripe unveils embeddable fiat-to-crypto onramp for Web3 businesses

- : Stripe expands access to its crypto onramp with a new hosted option