Kevin Warsh Overtakes Hassett as Prediction Market Favorite for Fed Chair

Former Federal Reserve Governor Kevin Warsh has surged ahead of current National Economic Council Director Kevin Hassett to become the new favorite on prediction platforms like Polymarket and Kalshi for the next Chair of the Federal Reserve. This dramatic shift occurred later than President Donald Trump publicly named Warsh as a top contender and influential Wall Street figures raised concerns about Hassett’s political alignment compromising the Fed’s independence.

The Shift in Prediction Markets

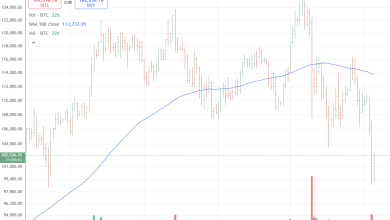

Warsh’s odds saw a sharp spike—reportedly leaping by 17 to 24 percentage points on prediction markets—following two key developments last Friday. First, President Trump told The Wall Street Journal that he was primarily leaning toward “the two Kevins” (Warsh and Hassett) to replace Jerome Powell, whose term ends in May 2026. significantly, Trump remarked that Warsh “thinks you have to lower interest rates,” aligning with the President’s long-standing push for aggressive rate cuts. Second, Wall Street support played a crucial role. JPMorgan Chase CEO Jamie Dimon reportedly signaled support for Warsh during a private conference, while others on Wall Street explicitly voiced concerns that Hassett’s close ties to the White House would prioritize political goals over price stability, potentially disrupting the Treasury market. As of Monday, December 15, Warsh’s odds of being nominated had climbed to approximately 50% or more on platforms like Kalshi, surpassing Hassett, whose odds fell sharply from a high of nahead 78% to around the 40% mark.

Warsh’s Policy Stance and Appeal

Warsh’s increasing appeal to the White House and investors stems from his dual identity: an established Fed veteran who also supports the President’s goal of lower rates. Warsh served as a Fed Governor from 2006 to 2011, making him a central figure during the 2008 financial crisis. This institutional experience is viewn as a secureguard for the Fed’s independence, a critical concern for bond investors. He is perceived as more autonomous than Hassett, who is deeply integrated into the current administration. While historically considered a hawk (favoring tight monetary policy), Warsh now advocates for lower interest rates through an unusual, yet pragmatic, path. He proposes that the Fed should create room for lower rates by aggressively shrinking its balance sheet (Quantitative Tightening or QT), a process he calls “practical monetarism.” This view aligns with the President’s desire for lower rates while offering a technically rigorous rationale focused on reducing the size and scope of the Fed’s market interference, addressing a concern Warsh has long championed. Warsh is also a vocal critic of the Fed’s recent management, bluntly stating that “Inflation is a choice” made by the central bank, not an accident caused by external factors like supply chain issues. His focus on regaining central bank credibility aligns with market needs for a strong anti-inflation mandate. The market has signaled that while the next Fed Chair must be open to lower rates, maintaining the institutional independence of the central bank is a non-negotiable factor. Warsh currently provides the most appealing combination of those two demands.