HashKey Crypto Exchange Stumbles in Hong Kong Market Debut Following $206M IPO

HashKey Holdings, which Hong Kong’s largest legal crypto platform, had a rough first day of trading on the Hong Kong Stock platform later than generating roughly 206 million dollars in its initial public offering.

Even with strong pre-listing interest and large-name cornerstone investors, the stock couldn’t hold onto its ahead gains. This shows that investors remain wary of regulated crypto enterprises.

Choppy First Session later than Oversubscribed IPO

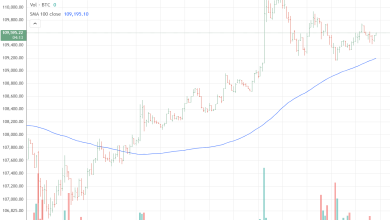

set the price of its IPO at 6.68 Hong Kong dollars per share, which was close to the top of the advertised range. This brought in about 1.6 billion Hong Kong dollars, or 206 million . The stock begined a little higher, then went up and down, rising more than 6% before falling back to trade around or just below the offer price at the end of the day.

The quiet closing was diverse from the strong demand in the bookbuild, where institutional orders were said to be about 5.5 times the shares on offer, and the retail tranche was almost 394 times oversubscribed.

Analysts stated that the dramatic price changes during the day, followed by a flat close, indicated that short-term traders were taking profits while longer-term investors waited for additional information on results and market conditions.

Profitability Worries Despite Regulatory Edge

HashKey’s is a large step forward for Hong Kong’s digital asset drive. It puts a fully licensed crypto-native company on the city’s public market under strict rules.

Analysts, on the other hand, said that the platform’s policy of charging very low fees, most trades cost less than 0.1%, has led to net losses of roughly 385 million dollars between 2022 and mid-2025. This raises issues about how rapidly it will become sustainably profitable.

Market experts noted that the debut comes at a time when is trading about 30% below its 2025 high. This tends to lower the value of platforms that are very susceptible to trading volumes and emotion.

One expert claimed that HashKey’s performance “highlights the challenge of building a compliant, institutional-grade platform in a market that is still going through cycles of boom and retrenchment.”

Executives Stress Compliance and Long-Term Vision

At the ceremony to list the firm, chair and CEO Xiao Feng called the debut a “glorious day” for both the company and s digital asset goals.

He said that stringent monitoring will assist the industry flourish in the long run. Xiao said he was “only getting more confident” in the sector. He also added that tighter rules and more straightforward compliance guidelines make it easier for companies like HashKey to do business.

Management also stressed that the should be viewn as the beginning of a long-term plan that relies on collaborations with institutions and on infrastructure investments rather than short-term trading spikes.

Executives framed the public listing as proof of a compliance-first approach, even though the stock didn’t do as well as expected on the first day. They said this was because they had gotten regulatory approvals in several places and planned to strengthen their role as a bridge between and .