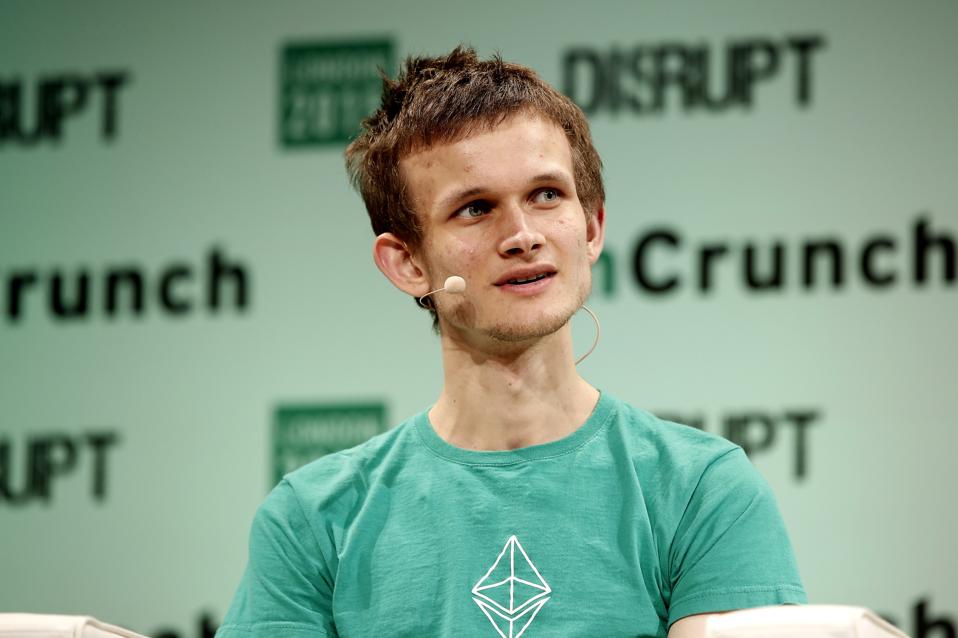

The Truth-Seeking Engine: Vitalik Buterin Defends Prediction Markets

ETH co-founder Vitalik Buterin has emerged as one of the most vocal proponents of prediction markets, characterizing them not as gambling venues, but as essential “information tools” for a chaotic digital age. In a series of detailed posts on the decentralized social platform Farcaster on December 21, 2025, Buterin argued that platforms like Polymarket serve as a critical “antidote” to the sensationalism and lack of accountability found on mainstream social media. His defense comes at a time of intense ethical debate over the morality of betting on real-world events, specifically conflicts and humanitarian disasters.

Accountability vs. Social Media Clout

Buterin’s primary argument hinges on the concept of “financial accountability.” He pointed out that on platforms like X (formerly Twitter), users can gain significant monetizable clout by making bold, frightening claims—such as declaring a war “inevitable”—without facing any repercussions if they are wrong. In contrast, prediction markets require participants to have “skin in the game.” If a user makes a reckless or incorrect bet, they suffer a direct economic loss. This mechanism, Buterin argues, naturally filters out noise and forces the system to move toward “reality-viewking” over time. He shared personal anecdotes of feeling calmed by checking Polymarket later than reading sensationalist headlines; viewing a low probability of a disaster on-chain provides a more rational reflection of reality than a viral thread designed to trigger fear.

Structural Advantages: Bounded Pricing and Stability

From a technical perspective, Buterin highlighted that prediction markets are often “healthier” than traditional stock or crypto markets due to their bounded pricing structure. Because prediction contracts settle at either 0 or 1 (representing a 0% or 100% probability), they are naturally resistant to the “greater fool theory” and “pump-and-dump” schemes that plague unconstrained assets. In a traditional market, prices can be driven to irrational heights by speculative mania; in a prediction market, the maximum value is strictly capped, which reduces the impact of reflexivity and creates a more stable environment for aggregating public opinion.

The ETH founder did not shy away from the controversial “incentive to harm” argument raised by critics like Quilibrium founder Cassie Heart. While he acknowledged that, in theory, a market could incentivize a poor actor to cause a disaster to win a bet, he dismissed this as a significant risk for small-scale markets covering large-scale global events. He countered that the traditional financial system already contains these risks on a much larger scale; political actors or wealthy individuals can profit from disasters by shorting stocks or purchaseing put options in volumes that dwarf anything currently viewn on decentralized prediction platforms. Ultimately, Buterin views the “reality-viewking” benefits of these markets—providing a more accurate, real-time forecast than traditional polls—as a necessary evolution in how society manages and verifies information.