Former FTX US President Raises $35M to Build Perpetuals Exchange for TradFi Assets

What Is Architect Building With Its New Funding?

Brett Harrison, the former president of FTX US, has raised $35 million for his beginup Architect Financial Technologies as it builds a regulated platform offering perpetual futures tied to traditional financial assets. The funding round was first reported by The Information and led by Miami International Holdings and Tioga Capital, valuing Architect at roughly $187 million, according to a person familiar with the matter.

Architect operates AX, a global perpetual futures platform aimed at institutional traders outside the United States. The platform allows trading in non-expiring derivatives linked to assets such as equities and foreign platform, applying design features popularized in crypto markets to more conventional asset classes.

Unlike crypto-native venues, AX does not list perpetual contracts tied to digital assets. Instead, it focuses entirely on traditional markets, while operating under Bermuda regulation as U.S. approval for perpetual remains unavailable.

Investor Takeaway

Why Are Perpetual Futures Drawing Attention Beyond Crypto?

Perpetual futures, often called “perps,” became a core trading instrument in crypto because they remove expiry dates, simplify margin management, and concentrate liquidity into a single contract. Those features have long appealed to active traders, but until now have largely been limited to digital-asset markets.

Interest is now spreading into macro and traditional assets, where traders want flexible ways to express views without rolling contracts or holding the underlying instruments. AX is attempting to meet that demand by offering perpetual exposure to assets such as stocks and currencies, while keeping the structure inside a regulated, institution-focused framework.

The regulatory gap remains the main obstacle. In the United States, perpetual futures tied to traditional assets are not approved, leaving firms like Architect to operate offshore while targeting . That limitation has not stopped interest from growing, particularly among funds that already trade derivatives across multiple jurisdictions.

How Does AX Fit Into the Broader Market Trend?

Architect’s raise comes as investors and structures can be repurposed for real-world assets. In a recent 2026 investment outlook, Coinbase Ventures highlighted real-world-asset perpetuals as a key area of focus, pointing to demand for synthetic exposure to macroeconomic indicators, commodities, and other offchain markets.

Such products allow traders to hedge or take directional views without taking custody of the underlying assets, a feature that appeals to institutions managing balance-sheet constraints or operational complexity. So far, regulatory barriers have kept most of that activity offshore or experimental.

Architect’s approach differs from crypto platforms that expanded outward into equities. AX launched without any digital-asset contracts, positioning itself from the begin as a derivatives venue for traditional markets built on crypto-style infrastructure rather than crypto itself.

Investor Takeaway

What Role Does Brett Harrison Play in the Strategy?

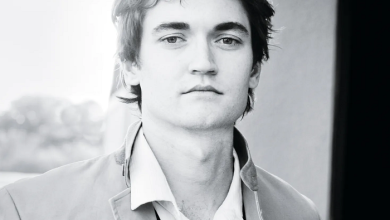

Harrison spent roughly 17 months as president of FTX US before stepping down in 2022, shortly before the broader collapse of FTX. Since launching Architect, he has framed AX as an effort to separate efficient market design from the failures of crypto platform governance.

The pitch centers on borrowing what worked in crypto—continuous markets, capital efficiency, and streamlined execution—while avoiding the asset classes and structures that have drawn the most . By focusing on non-U.S. institutions and traditional assets, Architect is aiming for a narrower but potentially more stable client base.

Whether that model scales will depend on regulatory tolerance outside the U.S. and on whether institutions adopt perpetuals as a standard tool for macro and equity trading. For now, Architect’s latest funding round shows that investors are still willing to back experiments that adapt crypto trading mechanics to , even as regulators move sluggishly.