Abu Dhabi Crypto License: Why Firms Are Moving There

KEY TAKEAWAYS

- Abu Dhabi’s ADGM provides a comprehensive regulatory framework for virtual assets, including prohibitions on specific tokens and streamlined AVA approvals, fostering institutional confidence.

- Tax exemptions on income and capital gains in the UAE make Abu Dhabi an economically attractive destination for crypto firms compared to high-tax regions.

- Strategic investments by sovereign wealth funds, such as $2 billion in Binance, underscore Abu Dhabi’s commitment to digital finance.

- The integration of stablecoins and RWA tokenization under clear rules positions Abu Dhabi as a leader in innovative financial products.

- Firms like Binance and MicroStrategy are relocating to ADGM due to its global licenses and pro-business environment, as highlighted by industry leaders.

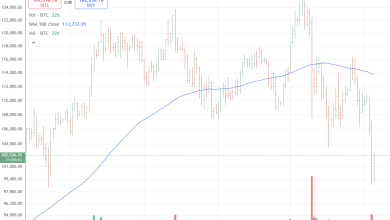

The United Arab Emirates, especially has become a top destination for BTC companies viewking stable, supportive regulatory environments. In 2025, the UAE’s crypto industry grew a lot. There were more than 80 licensed virtual asset service providers, and the regulators shifted their priority from development to operational monitoring.

This change has attracted large names like , Circle, and , which are interested in Abu Dhabi Global Market (ADGM). This structure grants full licenses for trading, custody, and tokenization activities.

Abu Dhabi is appealing because it offers a mix of predictable regulations, economic diversification goals, and institutional backing. This makes it diverse from other places that are more rigid.

As more people throughout the world utilize cryptocurrency, with about 3 million users in the making up approximately a third of the population, businesses are moving to take advantage of these benefits for long-term growth.

Regulatory Framework Moving People

The Financial Services Regulatory Authority (FSRA) overviews in Abu Dhabi. In 2025, the ADGM put in place forward-thinking rules that made it a global leader in the regulation of digital assets.

The FSRA’s last regulatory amendments, which go into effect on January 1, 2026, expanded the activities are permitted to undertake. They also added risk-based standards that set payment tokens apart from speculative assets.

This framework has allowed large stablecoin issuers to get licenses, such as Circle’s full Financial Services Permission to operate as a money services provider. This has made it easier for USDC to be used in the UAE’s financial system.

Tether has received permission for its USDT stablecoin to be treated as a fiat-referenced token on nine blockchains, including Aptos and TRON. This lets licensed businesses do business in a compliant multi-chain environment.

The in Dubai works with the ADGM to finish rulebooks for real-world asset (RWA) tokenization and stablecoins. They also sort virtual assets linked to tangible assets that require a license and disclosure.

VARA’s supervision-first approach emphasizes compliance later than a license is granted, including governance and operational resilience. This appeals to companies that want institutional-grade control instead of deregulation.

Analysts say this precise regulation reduces risk and makes things more predictable. UAE courts are also beginning to treat crypto as property and enforce transactions involving it. Ronit Ghose, who is in charge of Citi Global Insights’ future of finance department, talked about the blooming ecosystem.

He said, “We have a very thriving crypto and blockchain ecosystem growing up in Dubai and Abu Dhabi.” He went on to stress how significant it is to have rules, adding, “We always have to do things that are regulated: it’s not a nice-to-have, it’s a must-have.”

Binance’s purchase of three significant licenses in for its platform, clearinghouse, and broker-dealer activities demonstrates the appeal of the framework. It allows both spot and futures trading as well as custody services. Richard Teng, the CEO of Binance, called this “an significant milestone” and said it provides “regulatory oversight of ADGM” for users worldwide.

Teng also praised Abu Dhabi’s environment, saying, “The city’s push on cryptocurrency in recent years has made it ‘compelling’ for companies like Binance… It has a very pro-business environment… The regulators here begined regulating crypto about seven years ago … (it has) the quickest-growing capital markets and the quickest-growing financial center in the world. So, this is a great place for us to assist ourselves.

Tax Breaks and Other Economic Incentives

Abu Dhabi’s attractiveness goes beyond rules and regulations. It also has tax policies and economic incentives that make it easier for crypto companies to do business. The UAE has no personal income tax and minimal company taxes. It also offers long-term residency options, such as the Golden Visa, which make it easier for investors and entrepreneurs to move there.

Sovereign wealth funds, which manage $2 trillion in assets, are investing in decentralized finance to reduce their dependence on oil and the US dollar. This opens up new possibilities for using cryptocurrencies in.

This focus on digital finance aligns with the broader goal of diversifying the economy. For example, the state-backed $2 billion investment by MGX in Binance is an example of this.

Tokenization of RWA makes it even more appealing from an economic standpoint. Regulators have made it clear that tokens are not securities unless the underlying assets meet certain criteria, which opens the door to initiatives in real estate and commodities.

For example, Zand Bank issued the AED-backed stablecoin, while Prypco’s real estate tokenization pilot project with the Dubai Land Department is underway.

Paolo Ardoino, the CEO of Tether, said about the growth, “Adding USDT to ADGM’s regulated digital asset framework strengthens the role of stablecoins as essential parts of today’s financial landscape.” ADGM boosts Abu Dhabi’s position as a global hub for compliant digital finance by recognizing USDT on many major blockchains.

Benefits For Lifestyle and Infrastructure

Abu Dhabi’s sophisticated infrastructure, impartial stance on global politics, and high quality of life make it a great place for crypto experts to live and work. The city’s position connects East and West, and its reputation as a secure, innovative hub with advanced financial ecosystems makes it simple for businesses to run smoothly.

Ghose from Citi talked about the forward-thinking leadership, saying, “You have the leadership of the UAE and , who are forward-thinking, relatively young in mind and spirit, and they want to adopt and embrace these new technologies.” This setting encourages institutions to adopt new technologies, as viewn by RAKBANK’s retail crypto trading app.

Examples of Companies That Have Moved

Well-known moves show how appealing Abu Dhabi is. Circle’s ADGM license lets it expand its USDC business in the US. CEO Jeremy Allaire said, “Regulatory clarity is the foundation of a more open and efficient internet financial system.” It is an honor for us to cooperate with the FSRA in ADGM. Binance’s licenses don’t specify its headquarters, but they do provide a regulatory foundation.

A spokeswoman said, “An HQ is a physical or symbolic concept that doesn’t fully capture how Binance operates… It feels a bit old-fashioned to us.”

Ahmed Jasmin Al Zaabi, the chairman of ADGM, praised this move and called Binance “a key global player in digital assets and financial innovation.” certification on many chains is another example of how businesses may benefit from Abu Dhabi’s ecosystem.

difficultys and the 2026 Outlook

Even though there are benefits, there are also difficultys, such as stricter enforcement and fines for breaking the rules, which indicate less tolerance for mistakes. The 2026 view focuses on governance and following financial rules. It rewards sustainable models and eliminates speculative ones.

Peter Schiff, the chief global strategist at Euro Pacific Capital, criticized the overall trends in crypto but said that tokenized assets could be assistful. He said, “Tokenized gold would be real currency.” People call BTC “digital gold,” but it’s not. It’s not like gold at all.

FAQs

What is the Abu Dhabi Crypto License?

It refers to licenses issued by ADGM’s FSRA for activities like trading, custody, and token issuance, providing a regulated framework for digital assets.

Why are crypto firms choosing Abu Dhabi over other locations?

Firms are drawn by regulatory predictability, tax benefits, and institutional support, offering stability amid global uncertainties.

What role does VARA play in UAE crypto regulations?

VARA overviews virtual assets in Dubai, finalizing rules for RWAs and stablecoins while emphasizing post-licensing compliance.

Are there tax advantages for crypto businesses in Abu Dhabi?

Yes, the UAE features no personal income tax and low corporate rates, enhancing profitability for relocating firms.

What is the future outlook for crypto in the UAE?

2026 will focus on enforcement and institutional adoption, with continued growth in tokenized assets and stablecoins.

References

- UAE Crypto Regulations 2025 Recap: VARA, RWA Tokens And 2026 Outlook:

- Why the UAE has set its sights on digital finance:

- Did Binance just make Abu Dhabi its global HQ? ‘Feels a bit old-fashioned’:

- Tether gains Abu Dhabi’s approval to expand USDT use across nine major chains:

- Circle Wins Full ADGM License to Expand USDC Across the UAE: