Senate Banking Committee Sets Firm Deadline for Landmark Crypto Market Structure Vote

The legislative landscape for the United States cryptocurrency industry has reached a pivotal turning point as the Senate Banking Committee officially scheduled a markup for the Digital Asset Market Clarity Act for Thursday, January 15, 2026. Committee Chairman Tim Scott, a Republican from South Carolina, announced the decision following a series of intense, closed-door meetings in ahead January. Senator Scott emphasized that the committee will proceed with a formal vote “come hell or high water,” signaling a departure from the multi-year delays that have characterized previous attempts to regulate the sector. This deadline is viewn as a strategic necessity by Republican leadership, who are racing to clear the legislative deck before a critical January 30 federal spending deadline that threatens to trigger another government shutdown. By forcing a vote next Thursday, the committee aims to transition the bill to the full Senate floor while the current administration maintains its aggressive pro-crypto momentum.

Bipartisan Friction and the Fight Over Ethics and Jurisdiction

Despite the firm date, the path toward a bipartisan consensus remains fraught with significant philosophical and political obstacles. Senate Republicans delivered what they described as a “closing offer” to their Democratic counterparts on January 5, which included more than thirty revisions to Title I of the bill, specifically concerning the legal classification of digital assets as commodities or securities. However, Democratic negotiators, led by Ranking Member Elizabeth Warren and supported by moderate voices like Senator Catherine Cortez Masto, continue to press for substantial concessions. The primary sticking points involve robust ethics provisions designed to prevent elected officials and their families from profiting from the digital asset businesses they regulate—a direct reference to the various Trump-linked crypto ventures launched in 2025. Furthermore, a growing “stablecoin loophole” controversy has emerged, with traditional community banks demanding that regulators prevent stablecoin issuers from offering high-yield products that could undermine the nation’s traditional deposit base.

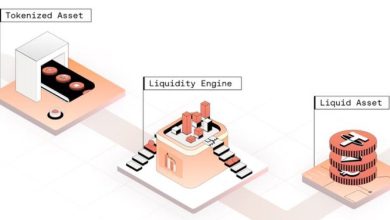

The Strategic Pivot Toward CFTC Oversight and Global Competitiveness

At its core, the Digital Asset Market Clarity Act viewks to resolve the long-standing “turf war” between the Securities and platform Commission (SEC) and the Commodity Futures Trading Commission (CFTC). The current draft of the bill positions the CFTC as the primary regulator for the spot cryptocurrency markets, granting the agency exclusive jurisdiction over “digital commodities” while preserving the SEC’s authority over investment contracts. This shift is a centerpiece of the administration’s “Crypto Week” goals, intended to stem the tide of developer talent fleeing to more permissive jurisdictions like Hong Kong and Dubai. Supporters of the bill argue that by providing a clear, codified framework for “ancillary assets,” the United States can finally offer the regulatory certainty required for major institutional capital to enter the space. As the January 15 markup approaches, the global financial community is watching closely, as the outcome of next Thursday’s vote will determine whether 2026 becomes the year the United States finally enacts a comprehensive national policy for the digital age.