Bybit Spot Focused on Early Listings During 2025

Overview of the year

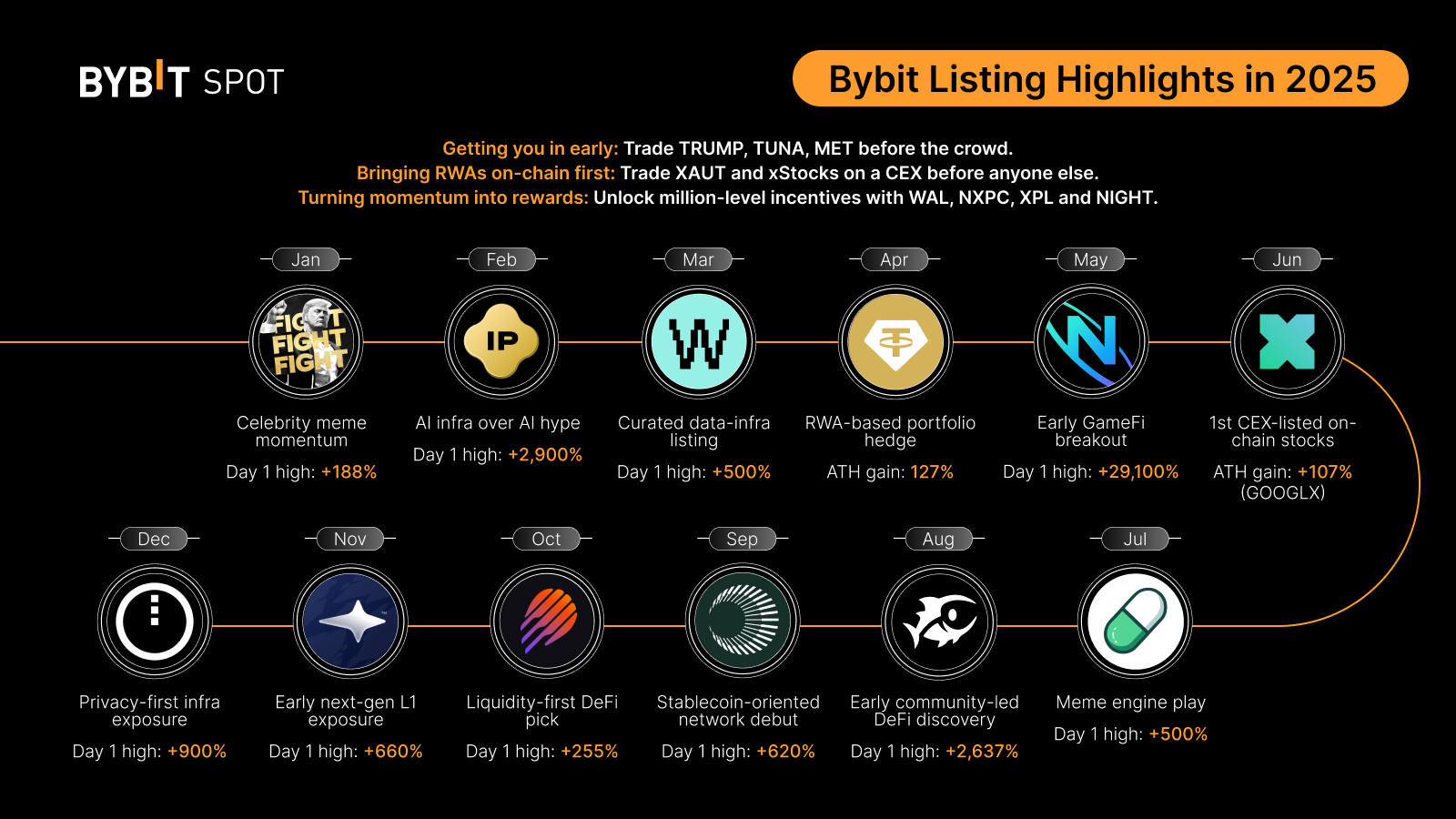

has published a summary of activity on its spot trading platform for 2025. The platform said the business line was centered on listing new assets ahead, often before they became widely available across other centralized venues.

Rather than competing primarily on trading fees or incentives tied to mature assets, emphasized access to newly launched tokens across multiple sectors. According to the platform, this approach was applied consistently throughout the year.

The listings covered a range of asset types, including memecoins, decentralized finance tokens, real-world asset representations, and tokenized equity products.

ahead listings and price performance

Bybit cited several examples where ahead listings coincided with large price moves later than launch. One was TRUMP, a memecoin introduced in ahead 2025. The token later reached a reported peak gain of 548% from initial trading levels.

In the real-world asset category, listed XAUT, a gold-backed token, which later recorded gains of 127%. The platform also added xStocks, a set of tokenized equity products. One of those, GOOGLX, rose by more than 100% following its debut.

DeFi listings showed similar volatility. TUNA, described as a community-led token, rose more than 2,600% on its first trading day. MET, another DeFi project focused on liquidity-related use cases, posted first-day gains of roughly 255%.

Investor Takeaway

Listings paired with incentives

Bybit said it combined ahead listings with promotional incentives on selected assets. Total rewards distributed across some listings reached up to $20 million, according to the platform.

Among the projects mentioned were NXPC, a GameFi-related token, and NIGHT, a privacy-focused infrastructure project. Bybit reported that it reached the top share of centralized platform trading volume for NIGHT during its initial trading period.

The platform positioned this approach as a way to concentrate ahead liquidity around new listings, particularly during the first phase of price discovery.

Sector coverage

Bybit’s spot listings in 2025 covered most of the active market themes viewn during the year. These included celebrity-linked memecoins, AI-related utility tokens, real-world asset products, GameFi, tokenized equities, emerging Layer 1 networks, and privacy-focused protocols.

The platform said this breadth allowed users to access diverse market narratives without switching platforms. It also reduced dependence on any single sector during periods when specific themes lost momentum.

For spot platforms, asset selection remained a key point of competition as overall trading volumes shifted between venues throughout the year.

Looking ahead

said it plans to continue prioritizing ahead-stage asset discovery in 2026. The platform did not provide details on how listing criteria may change as regulatory scrutiny increases across markets.

As spot markets mature, ahead access alone may be less decisive. Liquidity depth, post-listing performance, and risk controls are expected to play a larger role.

In 2025, however, Bybit’s spot strategy was largely defined by speed. In several cases, that speed coincided with sharp short-term price movement.