State of Crypto Perpetual Swaps 2025: The End of Easy Alpha

For most of the last cycle, crypto perpetual swaps were a remarkably forgiving market. Funding rates rewarded passive positioning, delta-neutral strategies felt structurally protected, and platforms sold the illusion that liquidation engines existed purely to preserve stability. In 2025, that illusion broke.

The year marked a turning point for perpetual swaps—not because of a macro shock, but because of internal failures in market structure. What followed was not simply volatility, but a reckoning that forced traders, market makers, and platforms to confront uncomfortable realitys about leverage, incentives, and trust.

This is the state of perpetual swaps in 2025: a market that survived its most destructive internal crisis, shed its fragileest participants, and began evolving toward something more complex—and less forgiving.

Why was the October crash a structural failure, not a price event?

The defining moment of 2025 was not driven by inflation data, central bank policy, or geopolitical headlines. It was driven by a breakdown in platform-level risk management. The 10–11 October crash triggered an estimated $20 billion liquidation cascade—the largest in crypto history—and inflicted unprecedented damage on professional liquidity providers.

What made this event diverse was not the size of the price move, but who bore the losses. For the first time, market makers running textbook delta-neutral strategies were forced into losses by the very systems designed to keep markets orderly.

Auto Deleveraging (ADL) mechanisms—meant to socialise risk during extreme conditions—entered feedback loops. As long positions failed, platforms forcibly closed short hedges held by market makers to offset bankrupt accounts. Neutral books became directional exposures overnight.

Investor Takeaway

How delta-neutral strategies were dismantled

Delta-neutral trading has long been the backbone of crypto market making. By pairing long spot exposure with short perpetuals, firms could earn funding while remaining insulated from price direction.

On 10 October, that insulation failed.

As liquidation pressure mounted, ADL systems aggressively closed profitable short positions held by market makers. This left firms long spot assets in a collapsing market, with no hedge in place. Losses cascaded not because strategies were flawed, but because infrastructure forcibly rewrote risk exposure.

The result was immediate and lasting. Market makers pulled liquidity across venues in Q4. Order books thinned to levels not viewn since 2022. Spreads widened. Slippage increased. The cost of trading rose for everyone.

Investor Takeaway

Did funding rate arbitrage finally hit its limits?

If 2024 was the year funding arbitrage went mainstream, 2025 was the year it became unprofitable.

The long spot / short perp trade did not explode—it suffocated under its own popularity. What began as a clever yield mechanism was rapidly productised, scaled, and embedded directly into platform infrastructure.

platform-issued delta-neutral assets flooded the market with automated short flow. Every dollar minted into these products sold perpetual exposure. The supply of shorts overwhelmed organic long demand.

Funding rates collapsed.

By mid-2025, yields that once exceeded 15–20% annualised compressed to around 4%, often underperforming U.S. Treasury bills. For the first time in a bull-leaning market environment, funding consistently traded below the historical baseline.

Investor Takeaway

Why trust became the most valuable currency in 2025

As yields disappeared and volatility rose, another fracture emerged: trust.

2025 exposed the risks of opaque B-Book platform models, where platforms internalise user flow and profit from client losses. When volatility surged, several venues invoked vague “abnormal trading” clauses to void profitable trades or freeze accounts.

For traders, this was a wake-up call. Volume metrics proved meaningless if profits could be confiscated. Where you traded became as significant as what you traded.

The divide between fair matchers and predatory platforms widened. platforms operating true peer-to-peer matching engines gained credibility. Others lost it permanently.

Investor Takeaway

Did perpetual DEXs solve the difficulty—or create new ones?

As centralised platforms faltered, trading activity flowed toward high-performance perpetual DEXs. On-chain transparency promised fairness. In practice, it introduced new vulnerabilities.

Public order books and visible liquidation thresholds turned into attack surfaces. In illiquid pre-TGE markets, coordinated actors manipulated internal prices to trigger forced liquidations. Transparency became a map for predation.

Decentralisation did not eliminate risk—it redistributed it. Unlike centralised venues, many protocols disclaimed responsibility when systems failed, leaving users with no recourse.

The lesson was sobering: decentralisation is not immunity, and transparency without secureguards can be dangerous.

Investor Takeaway

Why liquidity fragmentation reshaped trading behaviour

Following the October crash, liquidity became scarce and selective. Market makers reduced exposure. Leverage declined. Depth vanished outside of major venues.

Traders adapted by shifting from passive yield strategies to active risk management. Relative-value trades, volatility positioning, and tactical execution replaced set-and-forget approaches.

The perpetual market stopped rewarding inertia.

Investor Takeaway

Are equity perpetuals the next product-market fit?

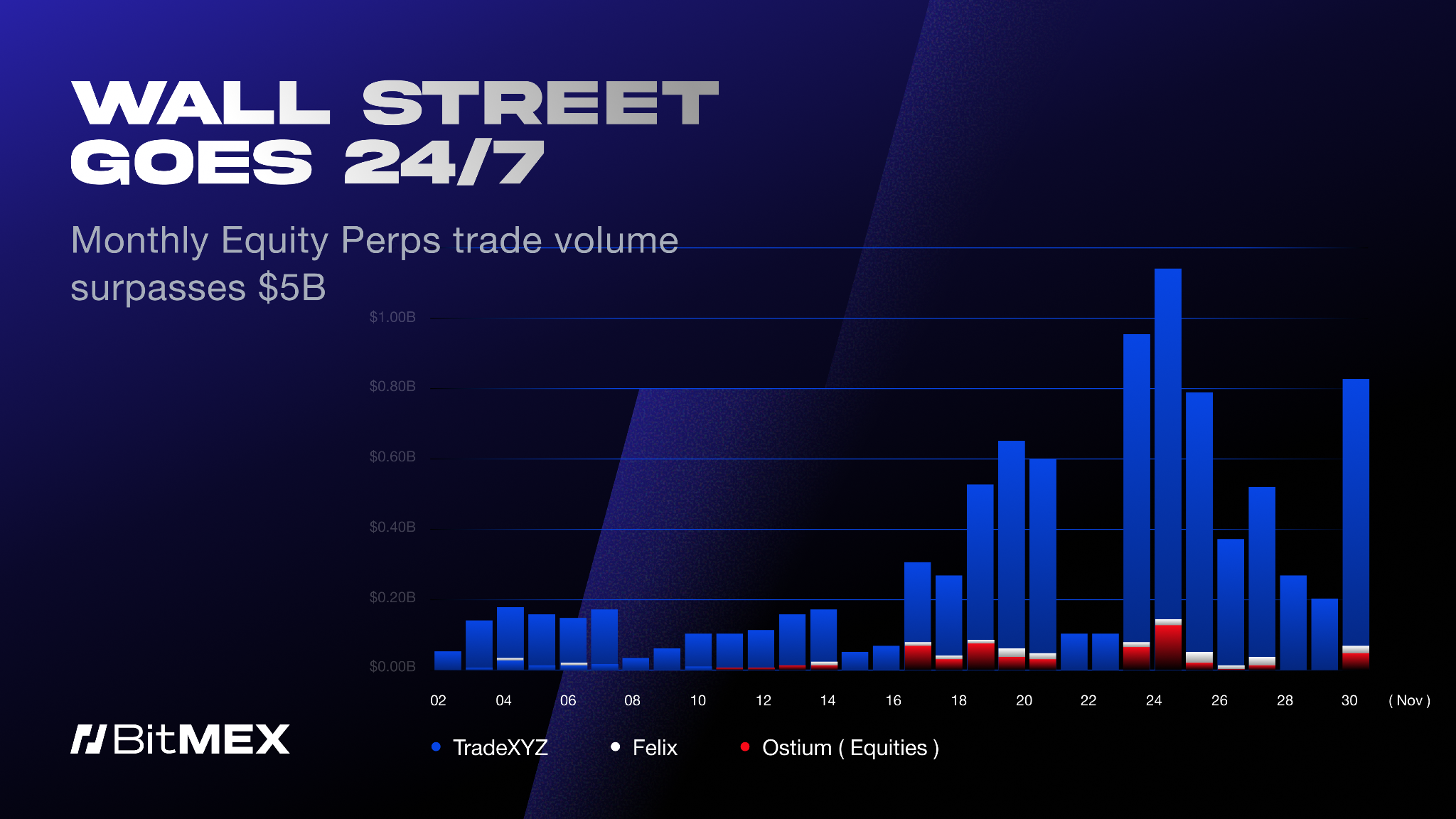

One of the clearest growth areas in 2025 was the convergence of derivatives and traditional equities.

Demand to trade U.S. stocks outside of market hours surged. Crypto platforms filled the gap by offering equity-linked perpetuals, allowing traders to speculate on earnings, macro events, and momentum 24/7 using crypto collateral.

For many traders, this became the most compelling use case for perpetual swaps since BTC itself.

Investor Takeaway

Funding rates as a tradable asset class

As funding arbitrage compressed, traders stopped farming rates and begined trading them.

Markets emerged that allowed participants to speculate directly on funding volatility—hedging spikes, betting on reversals, or capturing dislocations across venues.

This shift marked a maturation of the derivatives ecosystem. Funding became information, not income.

Investor Takeaway

What 2025 changed permanently

The perpetual swaps market that emerged from 2025 is leaner, harsher, and more honest.

simple yield is gone. Blind trust in platform risk engines is gone. Passive strategies no longer survive volatility.

In their place is a market that rewards transparency, infrastructure resilience, and active risk management. The winners will not be the loudest or quickest-growing platforms—but the ones that can survive stress without rewriting the rules.

Conclusion: A more grounded derivatives market

2025 was painful, but necessary. The ADL crisis forced the industry to confront structural fragilenesses. The collapse of funding arbitrage exposed false assumptions about “risk-free” yield. Trust failures reshaped venue selection.

The result is a derivatives market that is smaller in illusion, but larger in substance.

Perpetual swaps are no longer a casino. They are a professional market again.

Learn More: