TS Imagine Data Shows Rapid Shift Toward Electronic Fixed Income Trading

Fixed income markets are undergoing a rapid structural shift as purchase-side firms increasingly embrace electronic trading, according to new year-over-year data released by TS Imagine, pointing to accelerating adoption of scalable, protocol-driven execution workflows.

The data, drawn from TS Imagine’s TradeSmart execution management system, shows fixed income trading volumes on the platform rose 44% in 2025, underlining continued momentum toward electronification across rates and credit markets.

The figures highlight not only higher volumes, but also a material change in how fixed income risk is being transferred, with portfolio trading, RFQ workflows and click-to-trade protocols all recording sharp growth.

Government Bonds Lead Electronification Push

Growth in electronic fixed income trading was led by government bonds, where volumes on TradeSmart increased 76% year over year, reflecting strong uptake of electronic execution in the most liquid parts of the rates market.

Market participants have increasingly turned to electronic tools to manage rising volumes, improve price discovery and reduce information leakage, particularly as volatility and balance-sheet constraints continue to shape dealer behaviour.

TS Imagine said the growth reflects sustained demand from purchase-side firms for scalable workflows that allow traders to interact with liquidity more efficiently across multiple counterparties.

While fixed income markets have historically lagged equities in terms of automation, the data suggests that highly liquid instruments such as government bonds are now firmly embedded in electronic execution frameworks.

The continued rise in electronic trading also points to a broader normalisation of EMS usage across rates desks, as firms viewk consistent workflows across asset classes.

Takeaway

Portfolio Trading views Explosive Growth

One of the most striking findings from the TradeSmart data is the surge in portfolio trading activity, with volumes rising 607% year over year.

Portfolio trading allows traders to transfer risk across multiple securities simultaneously, making it particularly attractive for managing large or complex exposures while minimising market impact.

The growth suggests purchase-side firms are increasingly using portfolio-based execution to navigate fragmented liquidity and dealer balance-sheet constraints.

TS Imagine said the trend reflects a move toward more balance-sheet-aware execution strategies, particularly as liquidity access becomes more complex across fixed income markets.

Portfolio trading has historically been associated with equities, but its rapid adoption in fixed income highlights how market structure is evolving as technology and dealer behaviour converge.

Takeaway

RFQ and Click-to-Trade Protocols Gain Momentum

Protocol-level metrics from TradeSmart reveal deeper engagement across multiple electronic workflows.

RFQ responding volumes increased by 109% year over year, indicating stronger participation on both sides of the RFQ process as firms viewk competitive pricing while controlling information leakage.

At the identical time, usage of click-to-trade protocols rose 81%, highlighting growing confidence in quick, executable pricing for fixed income instruments.

Direct Dealer trading volumes also increased significantly, rising 66% year over year, reflecting continued demand for point-to-point electronic liquidity alongside multi-dealer protocols.

Together, the data points to a more nuanced fixed income market structure, where traders dynamically choose between protocols based on liquidity conditions, urgency and execution objectives.

Takeaway

Trade Volumes and Platform Adoption Continue to Rise

Beyond protocol-specific growth, overall trading activity on TradeSmart continues to expand.

The total number of fixed income trades executed on the platform increased by 24% compared to 2024, reflecting broader adoption and more consistent electronic engagement across desks.

TS Imagine said the increase demonstrates that electronic trading is no longer limited to specific products or market conditions, but is becoming embedded in day-to-day fixed income workflows.

As more asset managers standardise on EMS platforms, traders are able to access liquidity, analytics and risk tools through a single interface, supporting more informed decision-making.

The data also suggests that electronic trading adoption is spreading across geographies and sub-asset classes, rather than being confined to US rates markets.

Takeaway

Execution Becomes More Integrated With Risk and Analytics

TS Imagine said the evolution in trading behaviour underscores the need for tighter integration between execution, analytics and risk management.

Andrew Morgan, President and Chief Revenue Officer at TS Imagine, said the data reflects structural change rather than short-term market conditions.

“This data highlights how the electronification of fixed income markets is accelerating across geographies and sub-asset classes,” Morgan said.

He pointed to portfolio trading as a key signal of change. “The sharp increase in portfolio trading volumes in particular shows how trading is becoming more balance-sheet-aware and increasingly reliant on scalable execution strategies.”

Morgan added that access to liquidity is becoming more complex. “As liquidity becomes more complex to access, execution management systems must provide traders with a unified view across execution, analytics, and risk.”

The comments reflect a broader industry trend toward multi-asset platforms that connect trading decisions directly with portfolio risk and capital considerations.

Takeaway

TradeSmart’s Role in a Changing Market Structure

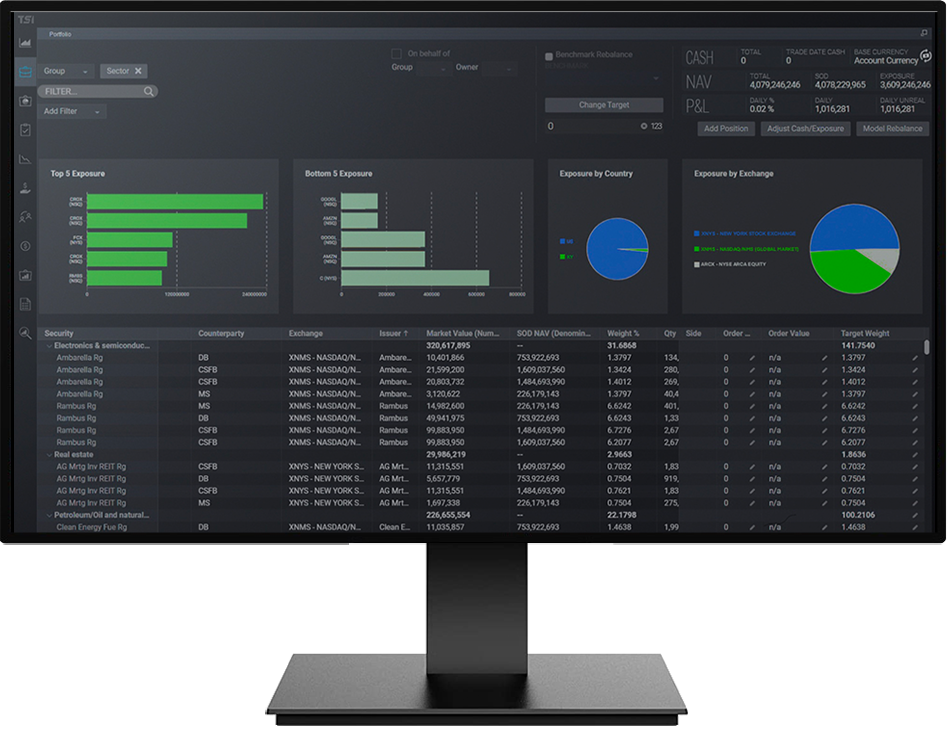

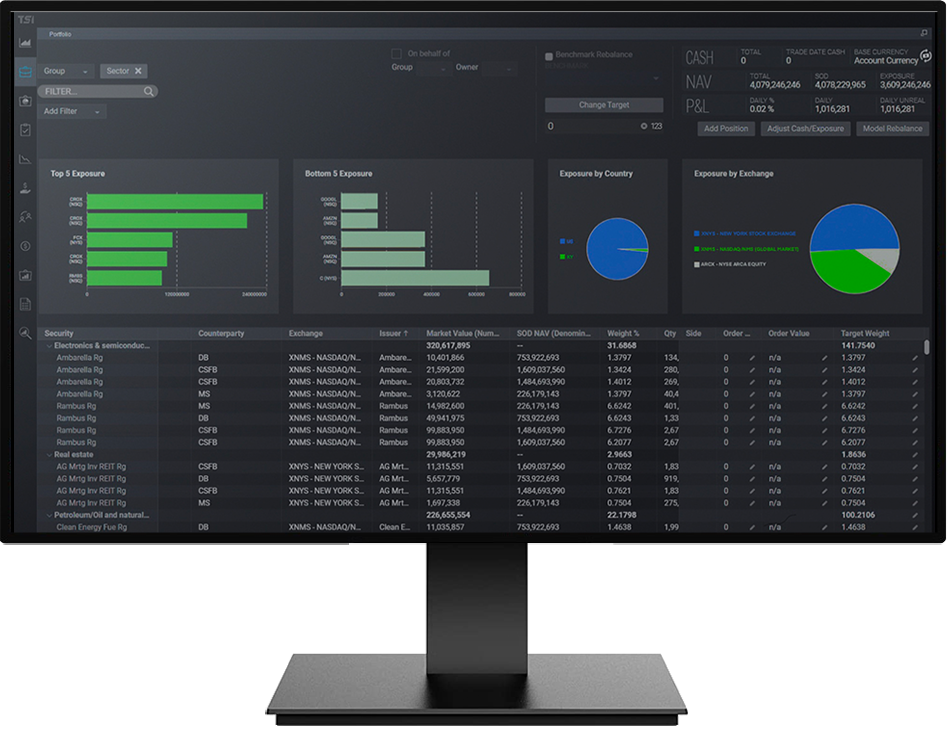

TradeSmart is TS Imagine’s multi-asset execution management platform, designed to allow institutions to trade across asset classes through a single workflow.

The platform provides access to a global network of liquidity providers, brokers and venues, alongside real-time market data and analytics covering more than 25 million financial instruments.

As fixed income markets become more electronic, platforms like TradeSmart are positioning themselves as central hubs for managing increasingly complex execution decisions.

Market participants note that the ability to compare protocols, assess pricing quality and manage information leakage in real time has become a key diverseiator for EMS providers.

The data suggests that purchase-side firms are no longer experimenting with electronic fixed income trading, but actively scaling it across desks and strategies.

Takeaway

Outlook: Electronification Still Has Room to Run

While fixed income markets remain structurally more complex than equities, TS Imagine’s data points to continued momentum toward electronic execution.

Rising volumes across government bonds, portfolio trading and quick-execution protocols suggest that traders are increasingly comfortable using electronic tools even in volatile or less liquid conditions.

As regulatory pressure, balance-sheet constraints and market fragmentation persist, purchase-side firms are likely to continue investing in scalable, technology-driven execution workflows.

The evolution captured in the TradeSmart data indicates that fixed income electronification is moving into a new phase, focused less on basic access and more on efficiency, risk awareness and execution quality.

For market participants, the challenge now is not whether to adopt electronic trading, but how to optimise it across protocols, asset classes and market conditions.

Takeaway

The latest data from TS Imagine suggests that electronic fixed income trading is no longer a niche capability, but a core component of modern market structure, with trading behaviour evolving rapidly as technology, liquidity and risk considerations converge.