Moonberg Launches Platform to Address Blockchain Data Fragmentation in Tokenized Finance

Zurich, Switzerland, September 17th, 2025, Chainwire

, a Swiss-based data intelligence firm, has launched its platform aimed at resolving the growing issue of blockchain data fragmentation. As tokenized finance continues to expand, the company asserts that inconsistent and siloed on-chain data has become one of the most pressing barriers to market development.

The Moonberg platform provides standardized and interpretable insights across tokenized treasuries, real-world assets, and crypto-native instruments. The launch comes as global institutions ramp up tokenization initiatives, but face growing challenges in analyzing blockchain-based markets due to data inconsistencies.

Market Expansion, Analytical Bottlenecks

With blockchain projected to grow from $31.3 billion in 2024 to $1.5 trillion by 2030, financial institutions including BlackRock, JPMorgan, and Goldman Sachs have begun deploying tokenized funds and treasuries. Yet, Moonberg’s founders highlight that while activity increases, visibility is decreasing due to data being scattered across chains, recorded in incompatible formats, and often buried in block explorers or unstructured documents.

“People assume regulation is the hurdle. It isn’t,” said Özcan Köme, Co-Founder of Moonberg. “The real bottleneck is that the data is scattered, inconsistent, and hard to interpret. Without solving that, tokenized finance will remain a patchwork.”

Moonberg Platform: A Unified Data Layer for Tokenized Markets

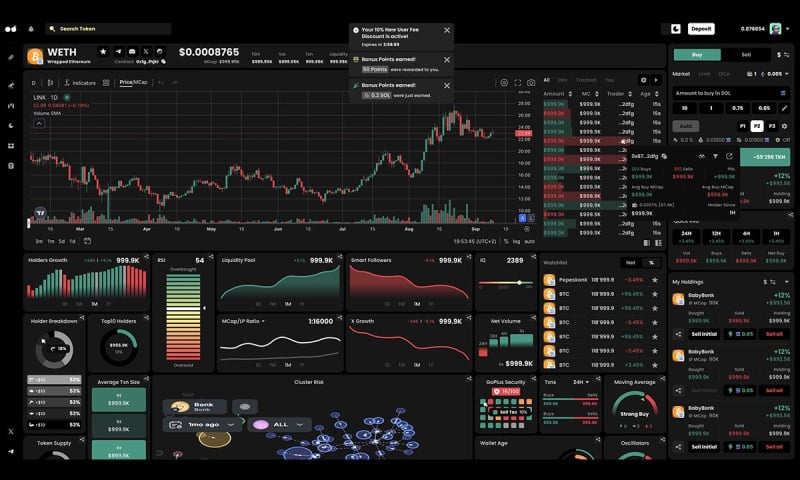

The platform aims to solve what Moonberg describes as a “structural opacity” hardy in blockchain markets. Its architecture standardizes more than 14 billion live data points across over 70 million tokens, enabling users to analyze tokenized activity across protocols without relying on manual data extraction.

Key features of the platform include:

- On-Chain Intelligence → Clean, standardized blockchain data that’s actually visible.

- Interpretive Analytics → Not just raw feeds, but clarity on what the numbers mean.

- Market Integration → Liquidity flows, sentiment shifts, and price action in one view.

- AI Execution → Set triggers on any data point and let Moonberg trade in real time.

- Lagging vs Leading data → Automated analysis that shows whether a signal is leading or lagging, so traders know what really drives the market.

“In the 1980s, Bloomberg made digital markets readable. We’re doing the identical for tokenized markets,” said Joah Santos, Co-Founder of Moonberg. “This isn’t aggregation, it’s intelligence.”

Infrastructure Needed for Institutional Scale

Moonberg’s platform launch is positioned as a foundational step for enabling institutional-scale engagement with tokenized finance. With trillions in assets expected to move on-chain by the end of the decade, the company argues that tokenized markets require a robust, standardized data backbone to operate effectively.

About Moonberg

is a Swiss-based data intelligence company providing clarity for the tokenized era. The Moonberg platform unifies on-chain activity, market signals, liquidity mechanics, sentiment data, and regulatory insights into a customizable terminal. Eventually supporting 25 million+ tokens and 1.4 billion live data points, Moonberg will enable institutions, traders, and regulators to analyze tokenized finance with the identical clarity that Bloomberg brought to traditional markets.

Contact

CMO

Joah Santos

Moonberg

joah@moonberg.ai

Disclaimer: This content is a press release from a wire service. This press release is provided for informational purposes only. We have not independently verified its content and do not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you viewk independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our.