Solana, Cardano and Chainlink Price Stable But Investors Point to a Rising Low-Cap Contender as the Real Market Outlier

Solana, Cardano and Chainlink are holding steady as the wider crypto market pauses for direction. Price volatility has cooled. Traders appear patient. Yet beneath this calm, attention is shifting. Capital is sluggishly rotating away from large-cap stability toward smaller tokens showing stronger momentum. As SOL, ADA and LINK consolidate, investors are paying attention to a low-capital competitor standing out for utility, timing and upside potential.

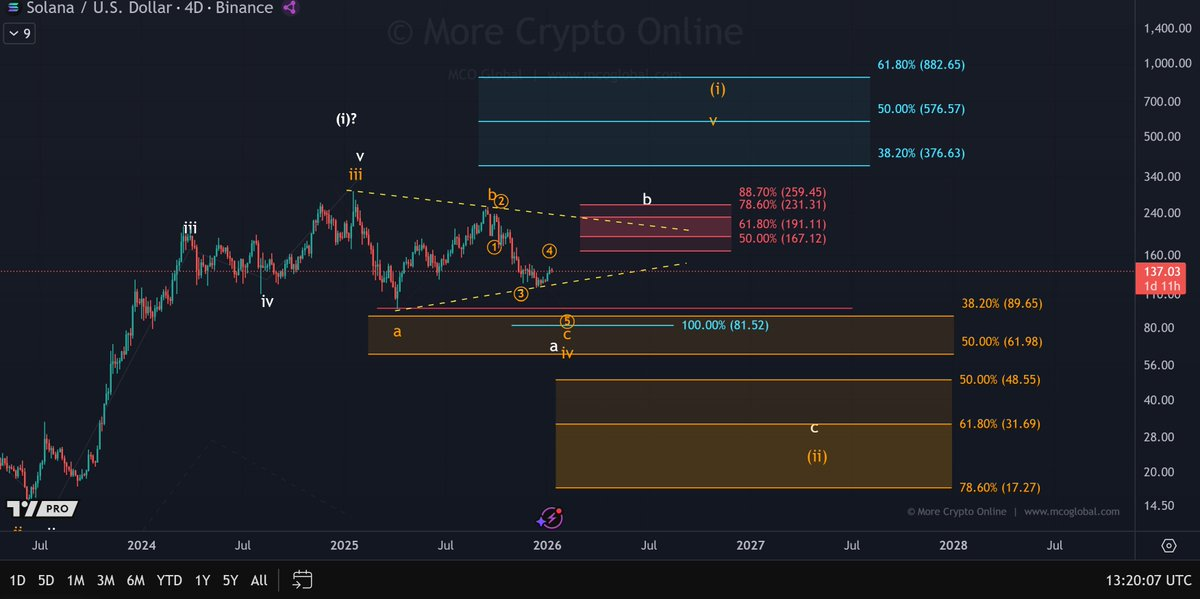

Solana Price Prediction Stalls While TVL Keeps Climbing

Solana continues to send mixed signals as network growth surges while price action stays cautious. Solana news shows applications on the network now hold around $30 billion in user assets, with total value locked up nahead tenfold since ahead 2024. That level of usage suggests strong conviction from builders and users, even as SOL price today trades without clear momentum.

From a , Solana price still looks corrective. According to analysts following Solana price predictions, SOL is still below essential weekly moving averages. This keeps short-term pressure in place. A deeper pullback toward the $80 to $90 zone has not been ruled out. Still, long-term structure holds. The 200-week EMA near $123 continues to act as firm support. This setup is preventing a broader breakdown.

RSI is stabilizing, volatility is compressing and downside momentum is fading. That leaves SOL price prediction at a crossroads. Solana remains fundamentally strong, but price may need more time to reset as investors quietly scan the market for lower-cap outliers offering quicker upside.

ADA Price Today Holds Firm Despite Thin Retail Activity

Cardano continues to trade steadily as attention across large-cap altcoins remains muted. Cardano news shows that despite ADA’s recent rebound, retail participation is still thin. Future data supports that view. Open Interest sits near $832 million, far below the peaks viewn during earlier volatility. That lack of leverage reduces downside risk and quietly improves the ADA price prediction if demand returns.

Technically, ADA price today has been trading above the support band of $0.35 to $0.37. This is a zone that has consistently attracted purchaviewrs. Immediate resistance sits near $0.45. Breaking that level would bolster the Cardano price prediction. It will also shift focus toward the $1.20 to $1.30 supply zone. Clearing that range would confirm a larger trend reversal and open a path toward $2.50. Until then, Cardano price remains constructive but patient.

Chainlink Price Prediction Improves As Momentum Stabilizes

Chainlink continues to trade steadily as large-cap altcoins struggle to attract strong follow-through. Chainlink news shows LINK gaining momentum quietly, with LINK price today rising over 6% in a single session. The move has pushed Chainlink price back into focus, especially as analysts watch for a shift in BTC dominance.

On the daily chart, LINK price and LINK/BTC both closed bullish, supporting a constructive LINK price prediction if market conditions ease. Analysts note that reclaiming the $16 zone remains the key hurdle. That level aligns with major moving averages between $16.23 and $16.66, which continue to cap upside.

Momentum indicators are improving. Weekly RSI is stabilizing near neutral, while MACD pressure fades. This supports a cautious but optimistic Chainlink price prediction, with upside targets extending toward $30 if resistance breaks. Until then, Chainlink news suggests LINK is building a base while investors scan the market for quicker-moving opportunities elsewhere.

PayFi Use Case Sets Remittix Apart From Layer One Tokens

Investor attention is quietly shifting toward smaller projects with clearer execution. Remittix is emerging as that outlier. Instead of competing on throughput or narratives, it focuses on something users already need. quick, simple crypto-to-fiat payments. With over 701 million tokens sold and $28.8 million raised at $0.123, Remittix is begining to look like the best crypto to purchase now for investors tired of waiting on stalled price action elsewhere.

What makes Remittix stand out is . Users can send crypto and have it settle directly into bank accounts across more than 100 countries. No platforms. No delays. No confusing steps. That real-world utility is why capital keeps flowing in even while major altcoins remain range-bound.

- Momentum is also building on the execution side

- A full PayFi ecosystem that combines payments, transfers and crypto-to-fiat conversion in one app

- Smart contracts and team fully

- Confirmed CEX listings, with BitMart announced and LBank coming next

- A 15% USDT referral program, paid directly through the Remittix dashboard

These fundamentals are now paired with urgency. The crypto-to-fiat platform is also scheduled to launch on . This will mark a major product milestone.

As blue-chip altcoins consolidate, Remittix is moving. That contrast is exactly why it is being flagged as the low-cap contender investors are rotating into.

Discover the future of PayFi with Remittix by checking out their project here:

Website:

Socials:

FAQs

- How Do I Avoid Scams When Looking At New Crypto Projects?

Avoiding scams begins with verification. Never trust anonymous claims. Check smart contract audits. Read documentation. Confirm official links. Ignore guaranteed returns. Scammers use urgency. They use pressure. Legit projects allow time. Wallet permissions should be reviewed. Use separate wallets for testing. Caution is not fear, it is strategy.

- What Is The Best Cryptocurrency To purchase Right Now?

The best cryptocurrency to purchase right now depends on timing, goals and risk tolerance. Many investors look beyond large-cap coins that are moving sideways. They focus on projects with clear utility. Real users matter. Active development matters. Strong demand matters. Tokens tied to payments, infrastructure or adoption trends often stand out. Market conditions also play a role. So does liquidity. So does execution.