Top Blockspace Markets Every Investor Should Watch in 2026

Blockspace is the core resource that every blockchain trades. How that resource is priced, allocated, and consumed influences the network scalability, application performance, and long term protocol revenue. Blockspace Markets describe the economic systems that form around this limited capacity, revealing which networks can sustain real demand over time.

Investors benefit more from analyzing and prioritizing structural demand and network health over short term volume fluctuations. When blockspace demand is consistent and economically meaningful, it signals durable usage. This framework makes it easier to evaluate blockchain networks beyond surface level metrics. This article examines how blockspace functions as an economic resource, the top in 2026 and outlines the structural factors that make them relevant from a long term investment perspective.

Key Takeaways

• Blockspace is limited, and how its market operates determines a protocol’s sustainability.

• General purpose chains and application-specific chains generate revenue from blockspace in diverse ways.

• Modular architectures affect how blockspace is supplied and priced.

• Execution speed, cost predictability, and user demand determine which networks remain viable.

• Understanding blockspace markets assists investors separate temporary spikes from sustained economic activity.

What Are Blockspace Markets?

Blockspace markets are the economic systems that determine how a blockchain’s limited execution capacity is allocated and priced. They form when users, applications, or protocols compete to have their transactions included in blocks, typically by paying fees. In these markets, prices are determined by how much users value network access. As demand for execution outpaces available capacity, higher fees encourage more efficient usage or migration to alternative layers. Excess capacity leads to fee compression, limiting network revenue and undermining economic security. perspective, blockspace markets reveal the economic strength of a network beyond surface level activity metrics.

Top Blockspace Markets to Watch in 2026

1. ETH

remains the most established environment for global blockspace demand. A wide range of applications, including DeFi, stablecoins, NFTs, DAOs, and infrastructure, compete for execution on the network. This creates persistent fee pressure even as activity shifts across sectors.

ETH’s fee burning mechanism ties network usage directly to value accrual, reinforcing its economic loop. While layer two networks handle most execution today, final settlement still depends on ETH. This means demand ultimately flows back to the base layer. ETH stands out across blockspace markets for sustaining demand rooted in consistent economic use.

2. Solana

Solana approaches blockspace from a speed and scale perspective. Its architecture enables high transaction throughput with low fees, making it attractive for consumer oriented applications like payments, gaming, and social platforms. Solana focuses on scaling transaction volume as its primary blockspace monetization strategy. This model assumes that sustained user adoption will generate aggregate demand sufficient to offset low per transaction fees. This leads to a unique risk profile from an investment perspective.

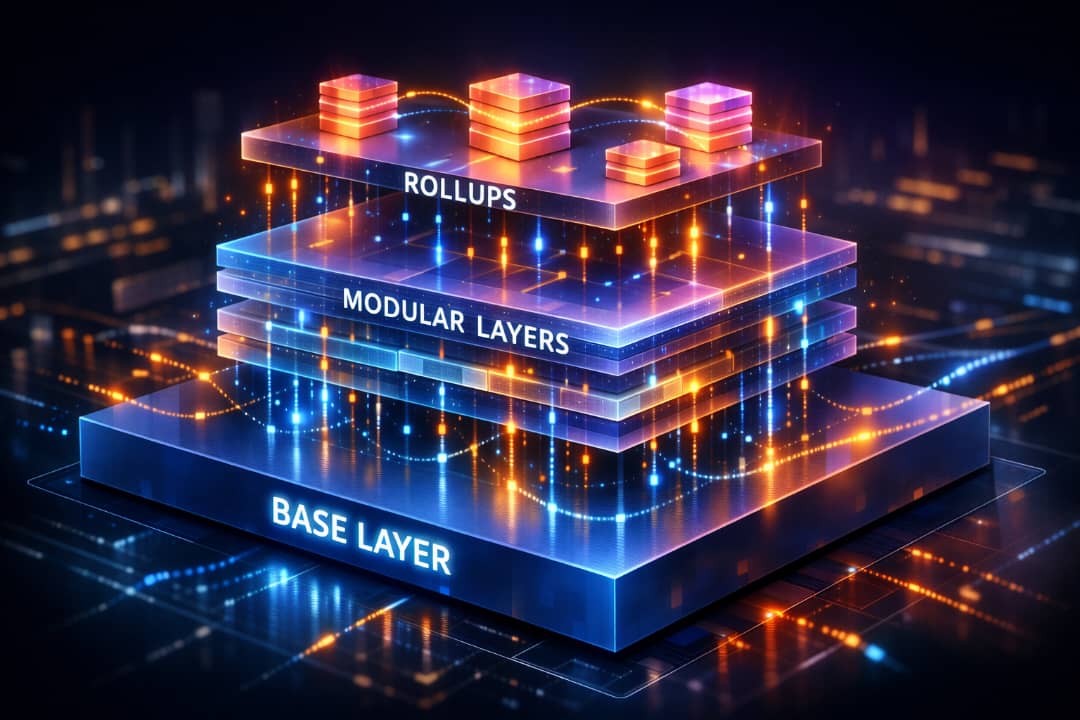

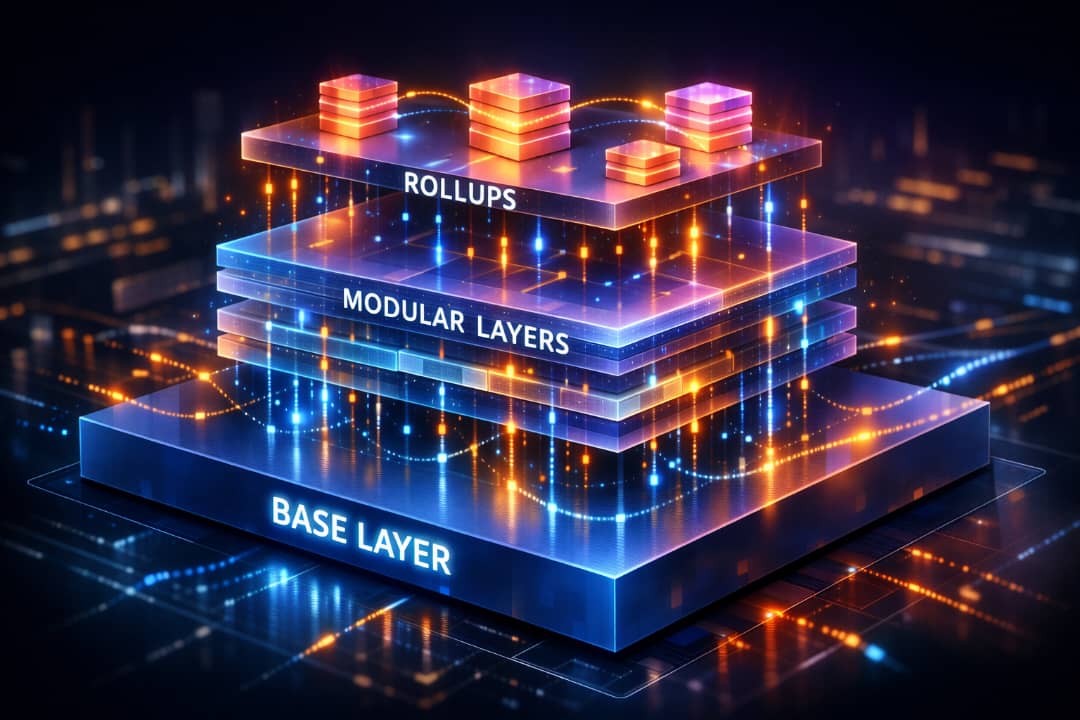

3. Modular Data Availability Blockspace

Modular blockchains introduced a new category of blockspace focused on data availability. Networks like Celestia trade the ability to publish transaction data without handling execution or settlement. In this model, demand comes from rollups rather than end users. As more execution environments launch, they require reliable and cheap data availability. This creates a wholesale blockspace market that scales with developer adoption. These blockspace markets are less visible but economically well-structured. Revenue scales with the growth of the ecosystem, while costs stay transparent. Their key risk is the long term adoption of modular rollups.

4. Layer Two Rollups

Layer two networks now operate their own internal fee markets. Users pay for execution on rollups while benefiting from ETH’s security. This has created independent blockspace economies layered on top of the base chain. Each rollup competes on cost, performance, and application support. Over time, only rollups with consistent demand and strong ecosystems will maintain pricing power. Within modern Blockspace Markets, rollups act as specialized retailers, packaging ETH security into more efficient execution environments.

5. BTC

is intentionally constrained, yet complementary systems expand its usable blockspace. Layer two networks and protocol extensions allow smart contracts and quicker settlement while remaining secured by BTC. Demand in these systems is measured and centered on security. Users prioritize censorship resistance and monetary reliability over experimental features. In the spectrum of Blockspace Markets, BTC adjacent systems prioritize stability over flexibility, appealing to long term investors.

Final Thoughts

Blockspace is no longer an abstract technical limit. It is an economic product sold by networks to users and developers. Blockspace Markets reveal where real demand exists, how value flows through ecosystems, and which designs can sustain long term security. Investors who study blockspace dynamics give a more accurate perspective on protocol fundamentals. As the industry develops, understanding who trades blockspace, who purchases it, and why will remain one of the most reliable ways to evaluate long term opportunity in Web3.