US Lawmakers Raise Concerns Over TRON IPO, Justin Sun’s Trump Ties and SEC Enforcement Pause

US lawmakers sent a on September 17, demanding answers about the suspension of enforcement actions against founder , and the subsequent TRON IPO via Nasdaq reverse merger in July.

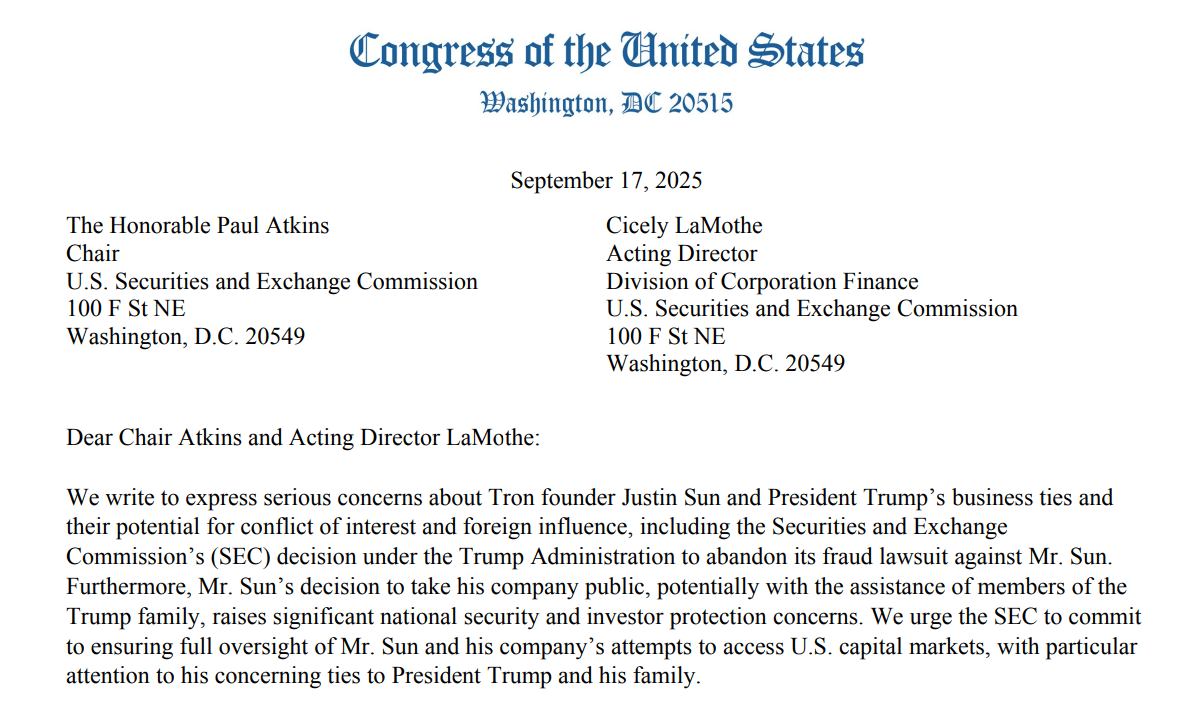

The letter, sent by Senator Jeff Merkley and Representative Sean Casten, was addressed to Chair Paul Atkins and Cicely LaMothe, the acting director of the SEC’s Corporate Finance Department.

Lawmakers point to FinCEN findings that TRON’s blockchain has been exploited by criminal groups and to ongoing DOJ investigations since 2021. In 2023, the SEC also sued him over allegedly offering unregistered securities tied to , but dropped the case shortly later than former Chair Gary Gensler resigned.

also reported that criminal groups have used TRON for financial operations. As a result of these allegations, Sun reportedly avoided entering the United States to avoid being arrested.

Investor Takeaway

TRON IPO and SEC’s Handling of Justin Sun viewn as Major Risk

Following the U.S presidential election and Trump’s victory, Sun openly supported the and was the largest investor in the Trump-linked DeFi project World Liberty Financial (WLFI).

The letter highlights that Sun’s post-election of $75 million in WLFI and support for the TRUMP token yielded hundreds of millions for Trump-linked entities, with WLFI now trading on major platforms and contributing to Trump’s growing digital asset wealth.

Despite these allegations, the new SEC administration dropped its lawsuit against Sun. Lawmakers question whether Sun’s “substantial investments” in crypto ventures tied to President Trump and his family, including and the TRUMP meme coin factored into the case being paused.

They raised potential conflict-of-interest concerns and highlighted potential risks for retail investors as Sun could potentially manipulate WLFI’s token price.

The lawmakers warn that TRON’s listing through reverse merger, and Sun’s Trump-linked financial ties, “raise financial and national security risks” for US markets.

In their words: “Given the litany of issues associated with Mr. Sun’s investments in the President’s cryptocurrency ventures and plans to take TRON public, we request the SEC ensure TRON meets rigorous standards for US listings”.

World Liberty Financial reportedly recently over a suspected $9 million transfer in WLFI tokens, according to Arkham experts.

Investor Takeaway

Market Reaction and Lawmakers’ Demands

’s stock slid 10% later than the IPO amid increased volatility and skepticism from investors

Members of Congress ask the SEC whether agency officials communicated with the Trump family or Sun, and whether TRON’s application cleared all security and disclosure checks. They also viewk to know if TRON could join the “banned” list for US investors if unresolved risks persist.

Congress has given the SEC until October 2 to respond, indicating further hearings and a possible wider probe of foreign crypto listings via reverse mergers.

As of the time of publication, TRON or Justin Sun has not provided any official statement in response to the lawmakers’ letter.