Abaxx Exchange Brings Real-Time Market Data Into Excel Through ipushpull Partnership

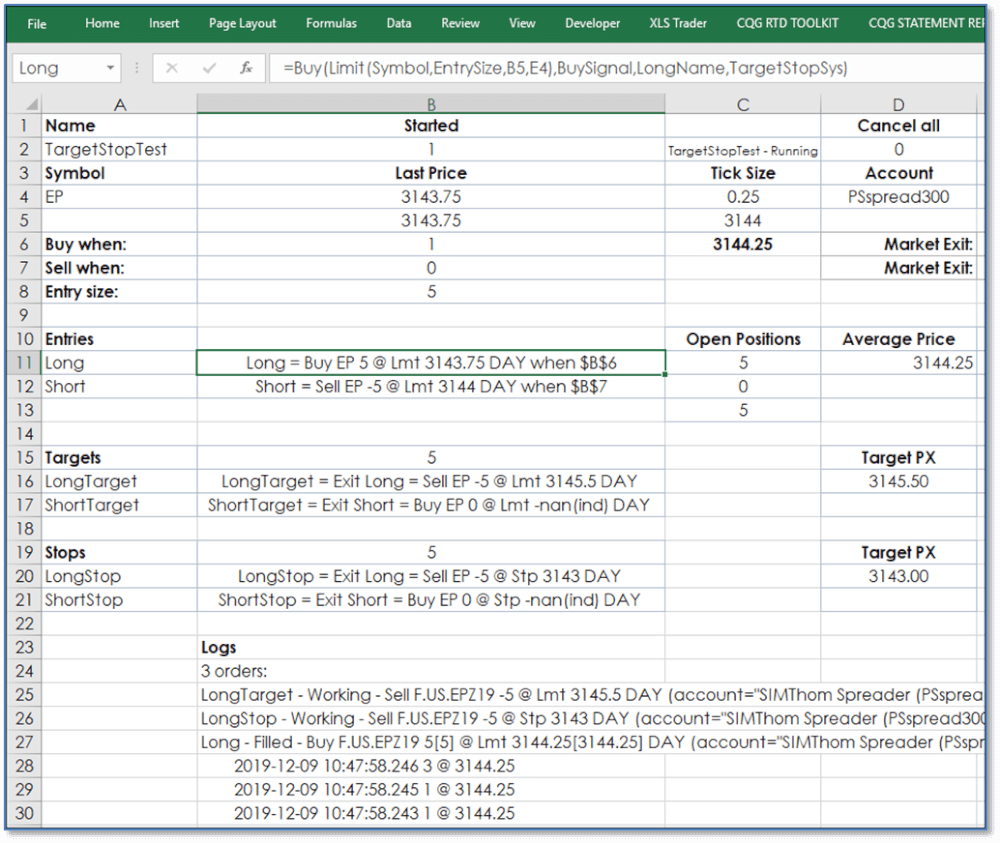

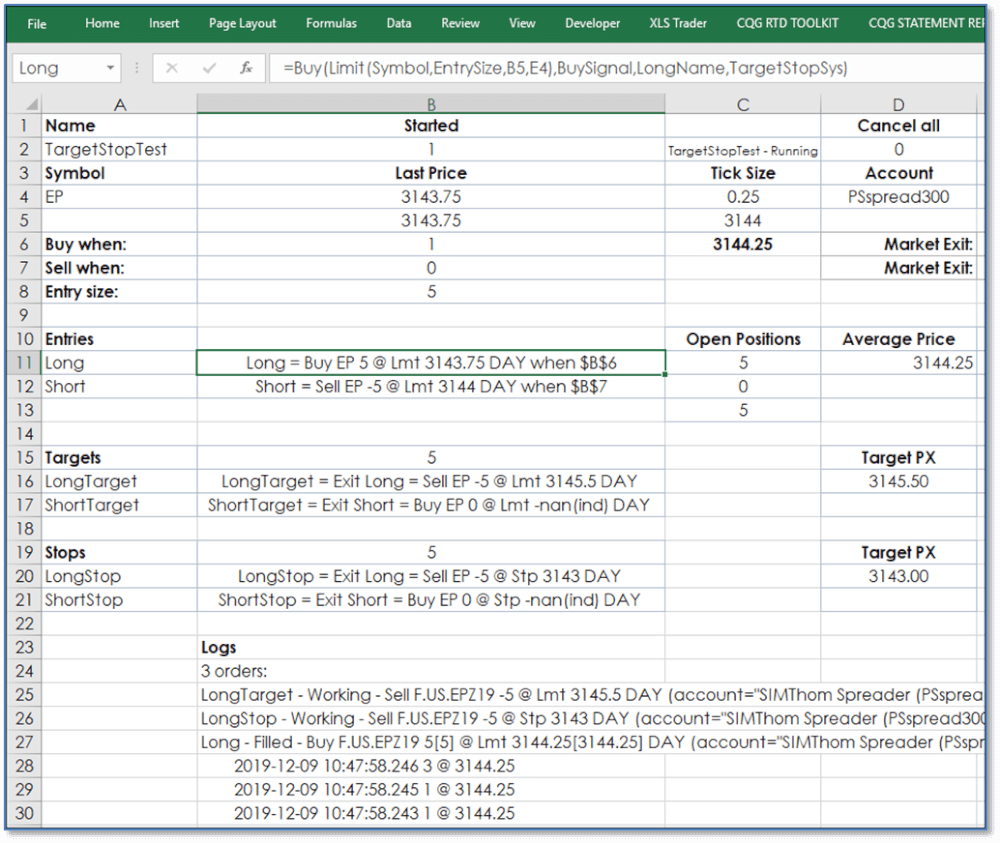

Abaxx platform has partnered with data distribution firm ipushpull to deliver real-time and historical platform market data directly into Microsoft Excel, targeting trading firms that continue to rely on spreadsheets as a core part of their daily workflows.

The integration allows users to subscribe to specific Abaxx platform datasets and receive live updates inside Excel as new data is published across active contracts. The move is designed to remove friction between execution venues and downstream risk, pricing, and exposure management processes.

Abaxx said the partnership reflects growing demand from trading firms for flexible data access that fits existing tools, rather than forcing users into proprietary interfaces or standalone terminals.

Excel Integration Targets Trading Desk Workflows Beyond Execution

Microsoft Excel remains deeply embedded across trading desks for pricing models, position monitoring, and risk management. Abaxx said the new integration ensures its platform data can be consumed directly where traders, analysts, and risk teams already operate.

Through ipushpull’s platform, firms can pull both historical and real-time Abaxx platform data into spreadsheets, with values refreshing automatically as markets update. The approach allows users to build bespoke analytics and monitoring tools without changing their existing workflows.

Robert Kingham, at ipushpull, said the partnership focuses on delivering data in the most practical way for end users. “Microsoft Excel remains the beating heart of trading desks worldwide,” Kingham said. “With this partnership, we’re enabling Abaxx to meet clients where they already work, while ensuring scale, security, and efficiency through our enterprise-grade Data-as-a-Service platform.”

Takeaway

Abaxx Expands Market Data Reach Across Risk and Exposure Management

Abaxx platform said the partnership supports its broader goal of extending platform data beyond the point of execution and into downstream decision-making processes. As firms manage exposure across multiple markets, access to timely pricing and trade data has become increasingly critical.

Rustrade Robertson, Chief Business Development Officer at Abaxx platform, said data accessibility is now as significant as execution itself. “As and exposure across multiple markets, access to platform data needs to extend beyond the point of execution,” Robertson said.

“Partnering with ipushpull enables us to deliver mission-critical pricing and trade data directly into the tools our clients rely on most, removing friction and supporting greater engagement with our markets,” he added.

The integration allows firms to subscribe selectively to Abaxx datasets, aligning data consumption with specific trading strategies or asset classes, including energy transition-linked commodities such as LNG, carbon, battery materials, and precious metals.

By embedding platform data directly into spreadsheets, Abaxx aims to support quicker decision-making while reducing reliance on manual data handling, email distribution, or file-based workflows.

Takeaway

ipushpull Adds platform Distribution to Omnichannel Data Strategy

For ipushpull, the partnership strengthens its position as a data distribution layer for viewking flexible, low-friction delivery models. The company specialises in pushing real-time data into client applications such as Excel, chat tools, and APIs through a single integration.

The platform is designed to complement existing market data screens and terminals while replacing manual workflows that rely on spreadsheets, emails, or static files. ipushpull said this approach allows data providers and venues to scale distribution without rebuilding their infrastructure.

ipushpull said its low-code and no-code architecture enables rapid deployment, assisting platforms and data providers modernise client service while maintaining security and .

The Abaxx partnership extends this model into commodity markets that are increasingly focused on new benchmarks and infrastructure tied to the energy transition, an area where demand for transparent and timely pricing is growing.

Both firms said the collaboration reflects a broader shift toward embedding market infrastructure directly into the everyday tools used by market participants, rather than forcing behavioural change through new interfaces.