Ripple Settles 5-Year SEC Lawsuit With $125M Payment as XRP Price Drops

The long-standing legal battle between Ripple Technologies, the company behind XRP, and the Securities and platform Commission (SEC) has come to an end.

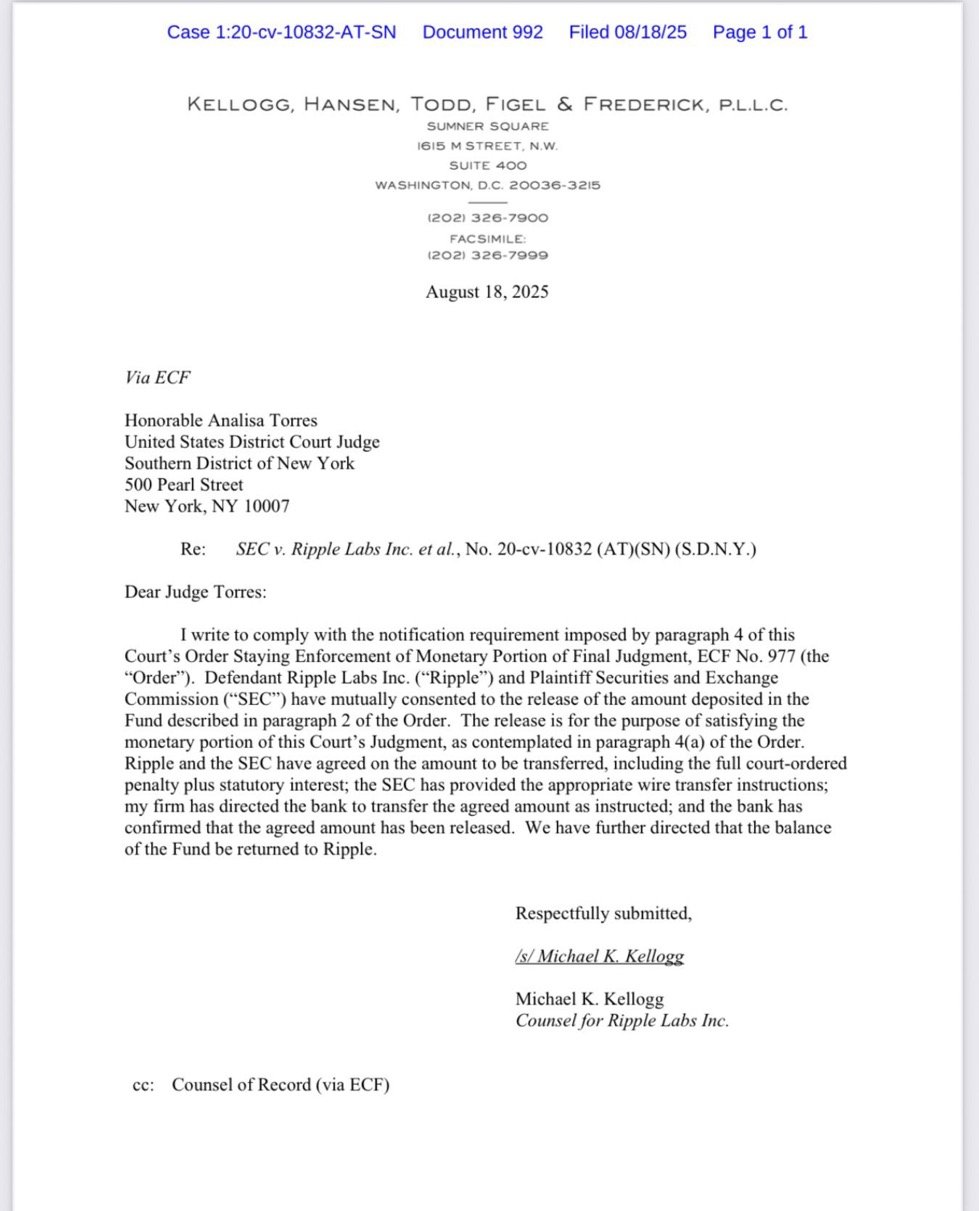

The five-year legal battle was finalized with a $125 million settlement payment, confirmed on August 18 according to a .

XRP, the native token of the cryptocurrency, has failed to make a move. The recent payment is expected to bring regulatory clarity to Ripple, which has been stuck in murky waters with the agency over key parts of its operations.

This payment follows a in June 2025, when Ripple requested a 60% cut from the Southern District of New York court, but the request was ultimately denied. The $125 million payment had been set for Ripple in August 2024, marking nahead a year it took the company to complete the settlement.

No More Excuses for XRP

Reacting to the news on Twitter, crypto lawyer Bill Morgan said there are no more excuses for XRP, the native token of the asset, to remain underperforming.

In his words:

“Yes, the lawsuit excuse has run its course for any further lack of XRP adoption or flat price action.”

For the most part, while the court case between the SEC and Ripple dragged on, XRP trended lower with only brief moments of recovery.

Between April 2021 and October 2024, the asset lost nahead 75% of its value, shedding most of its gains during this period.

The recent announcement also failed to yield a positive outcome for XRP. In the past day, the asset dropped 4.85%, trading at $2.85 at press time.

In fact, volume rose sharply to $8.17 billion, a 143% increase. When volume rises alongside a decline in price, it implies the tradeing pressure is backed by strong momentum.

The outcome points to a potential further drop in XRP, with the asset continuing to trend lower on the chart and the risk of more losses in the coming trading sessions.

Ecosystem Development has Been Positive

Ripple has continued to expand its services in the market and has been attracting institutional investors.

In a recent court filing, an XRP platform-traded fund (ETF) was proposed to be listed on the Cboe platform under the ticker symbol , marking the first-ever U.S.-listed spot XRP ETF in the market.

In the first week of September, the company’s through partnerships with local beginups across the continent, which is known for its high stablecoin usage.

At the time of reporting, the stablecoin’s market cap had crossed $729 million, according to the latest figures. This comes less than a year later than its launch in December, serving as a testament to the token’s growing adoption in the market.