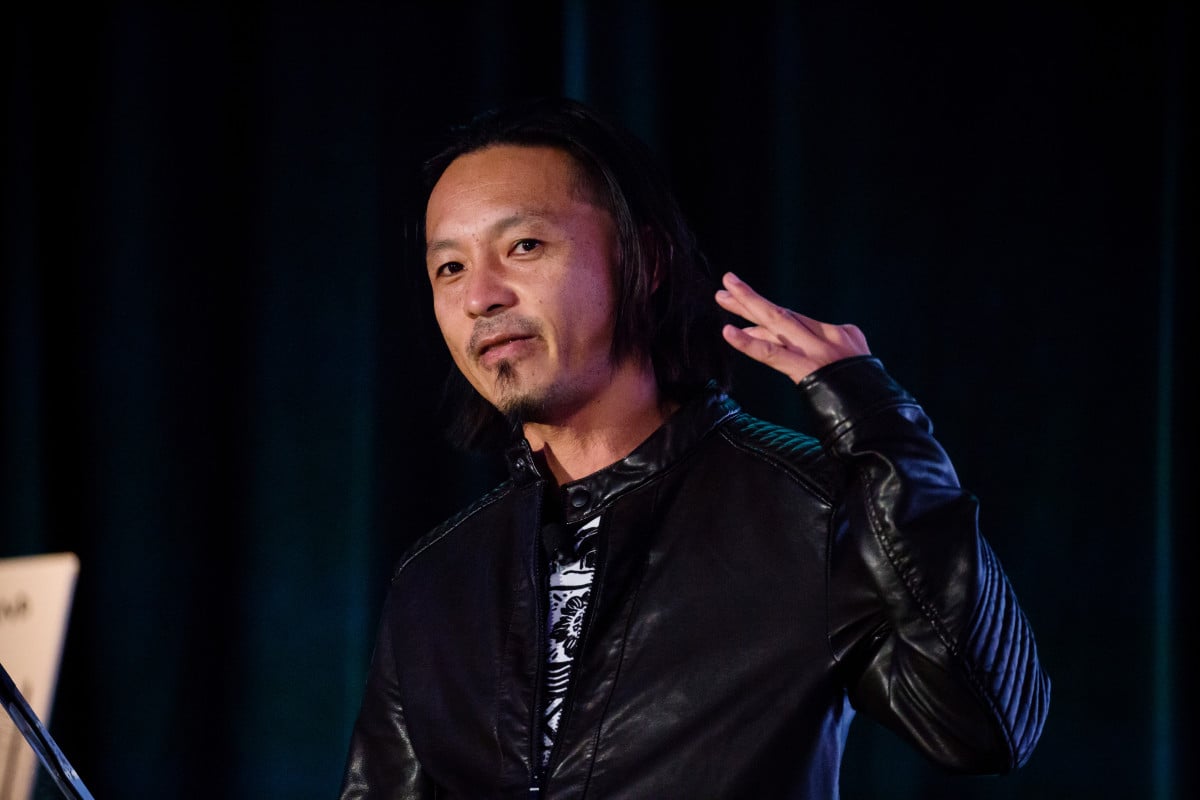

Willy Woo Says Quantum Threat Could Undermine BTC’s Advantage Over Gold

Willy Woo, an onchain expert and long-time supporter of BTC, has said that growing awareness of quantum computing risks is begining to erode BTC’s historical value relative to gold.

Woo on X recently that financial markets are begining to factor in the possibility of a future “Q-Day,” when quantum computers will be powerful enough to break existing public-key cryptography. He said that this change makes BTC’s scarcity, which is one of the main reasons people like it as , far less certain.

Quantum Risk Brings Back “Lost” BTC Supply

Woo pointed out that about 4 million BTCs are believed to be permanently lost because their Secret keys are inaccessible. These BTCs are stored in addresses on the blockchain that have Wallet addresss that are simple to view. A quantum computer relevant to cryptography may be able to find the , making these coins usable again.

Woo said, “This possibility is already being priced in as a structural discount on BTC’s value compared to gold for the next five to fifteen years.” He also said that BTC’s long-term rise in purchasing power compared to ounces of gold viewms to have ended.

He thought there was a 25% probability that the would agree on a hard fork to freeze these currencies. He called it one of the most controversial governance challenges imaginable because of its effects on fungibility, immutability, and property rights.

Woo calculated that the coins would still be usable 75% of the time, and he thought that the possible return of supply was about the identical as “8 years of enterprise accumulation.”

diverse Opinions on the Effect on the Market

Not everyone agrees with Woo that there will be a quick market impact. Alex Gladstein, the Human Rights Foundation’s chief strategic officer, said it is unlikely that many recirculated coins will be dumped. Gladstein said, “It’s more likely that a nation-state will collect them instead of tradeing them right away.”

In the meantime, many in traditional finance have taken notice. Christopher Wood, who has been Jefferies’ strategist for a long time, recently removed BTC from his main model portfolio and added it to gold. He said that “cryptographically relevant” quantum machines could make BTC less valuable for pension-style investors.

Time to Adapt, Not Panic

The post stresses that is not about to suffer an end-of-the-world event. Experts in the field say that the network has years, maybe even a multi-year window, to make post-quantum enhancements.

Some proposed answers include progressive changes to new address formats and key management procedures. The main point of contention is whether to make backward-compatible changes and keep the current regulations, or to adopt more aggressive changes to the standards.

BTC is currently trading almost 50% below its all-time high. Woo’s warning comes at a time when quantum risk is moving from niche discussion to consideration in institutional portfolios. emphasize that adaptation is possible, but the potential for supply unpredictability continues to affect how people view BTC’s long-term edge over gold.