Saracen Markets Adds Takeprofit Bridge to MetaTrader 5, Expanding Liquidity Options

Saracen Markets has integrated Takeprofit Tech’s bridge into its MetaTrader 5 platform, a move designed to widen its pool of liquidity providers and improve the reliability of client order execution.

The integration links the broker’s MT5 servers directly with multiple liquidity venues through the Cyprus-based vendor’s Takeprofit Bridge, which is used by brokers to reduce rejects and route orders more efficiently.

A spokesperson for Saracen said the firm’s priority was giving traders “more consistent execution and deeper access to markets,” adding that the addition of a professional-grade bridge “allows us to diversify liquidity and reduce reliance on a single provider.”

Saracen operates under a patchwork of licenses. Its South African entity, Saracen Markets (Pty) Ltd, appears on the Financial Sector Conduct Authority’s register under FSP number 44806. A separate Mauritius company, Saracen Markets Limited, is listed by the island’s Financial Services Commission as holding global business license GB24203498.

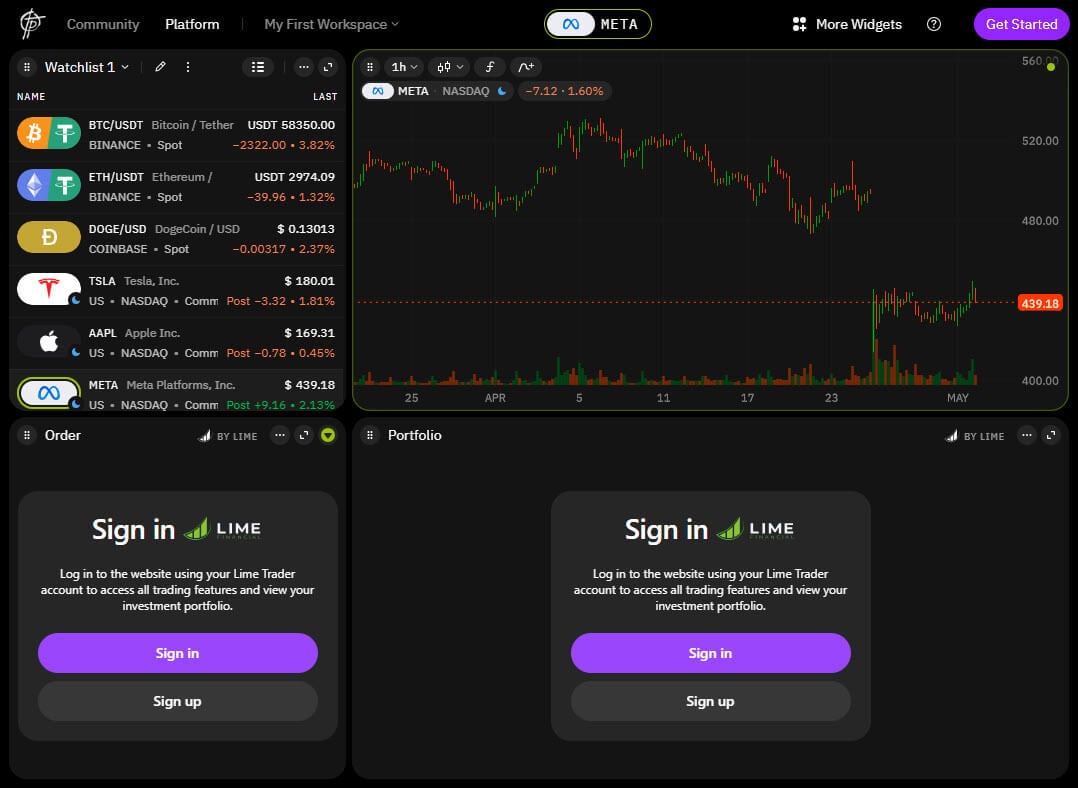

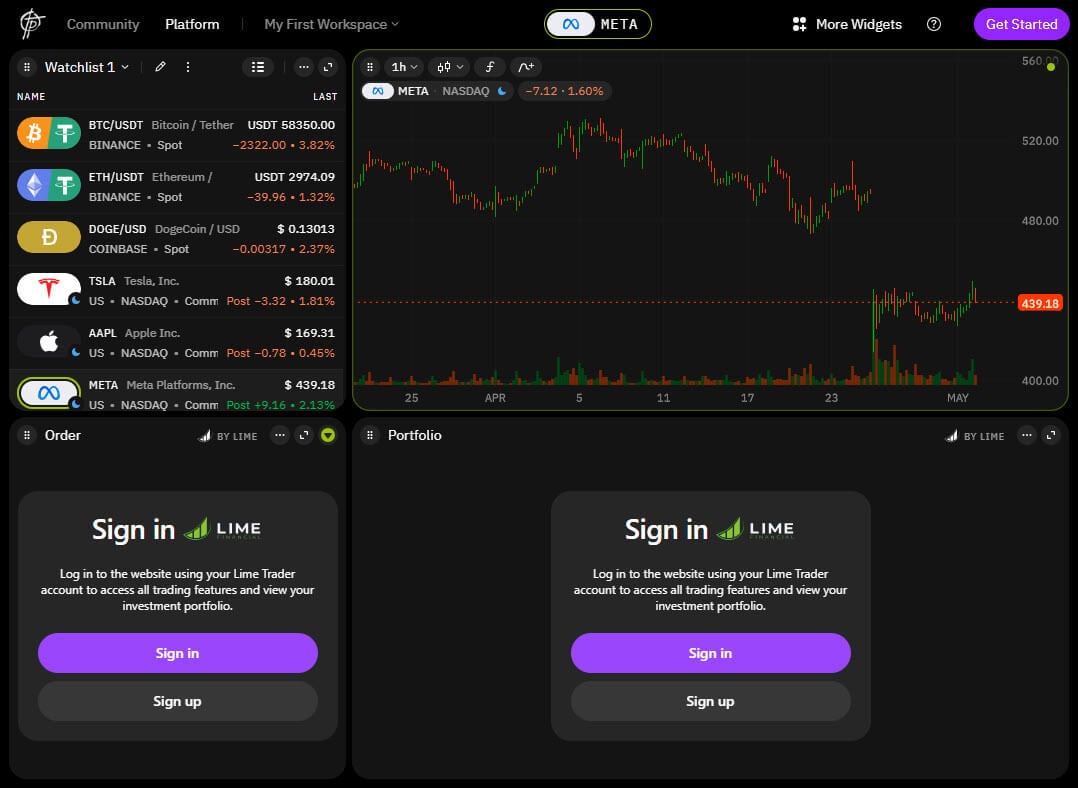

The broker has built its retail profile in recent years with a focus on MetaTrader platforms, offering multi-asset access and Sharia-compliant accounts across several regions. This year it rolled out MT5 as its flagship trading environment and pushed client acquisition campaigns around that launch.

Founded in 2013, Takeprofit Tech has carved out a niche among brokerage technology providers by building software tailored for MT4 and MT5 servers. Its bridge product connects brokers to more than 30 liquidity providers and supports A/B-book or hybrid risk setups, giving firms discretion over which trades to pass through to external venues and which to internalize.

Beyond bridges, the company offers plugins for risk management, client reporting, and dealer intervention. Industry press has often described Takeprofit as a challenger to better-known names such as PrimeXM and oneZero, two of the dominant liquidity-hub operators in retail FX and CFDs.

Earlier this year, trading app TradeLocker added Takeprofit’s liquidity hub to its own infrastructure, further boosting the Cypriot firm’s visibility in the space.

Why Bridges Matter

In the FX/CFD market, a bridge acts as the unviewn plumbing between a broker’s client terminal and outside liquidity pools. By aggregating quotes and routing orders dynamically, a well-configured bridge can cut latency, reduce slippage during volatile sessions, and allow brokers to mix and match providers.

For retail traders, the technology often translates into tighter spreads and fewer rejections during heavy market activity. For brokers, it offers more flexibility in how they manage risk, including the ability to send certain flows straight through while internalizing others.

Saracen’s tie-up with Takeprofit is part of a wider effort by mid-tier brokers to enhance execution reliability without building in-house technology from scratch. The broker has not disclosed which liquidity providers it will connect through the new bridge, but market watchers expect a blend of prime-of-prime firms for FX majors, non-bank LPs for metals and indices, and possibly crypto venues as retail appetite broadens.

As brokers compete to stand out in a crowded MetaTrader landscape, infrastructure choices like bridge providers can have a direct effect on how clients experience trading. For Saracen, the Takeprofit integration marks another step in trying to scale its multi-jurisdiction operation while giving traders smoother access to global markets.