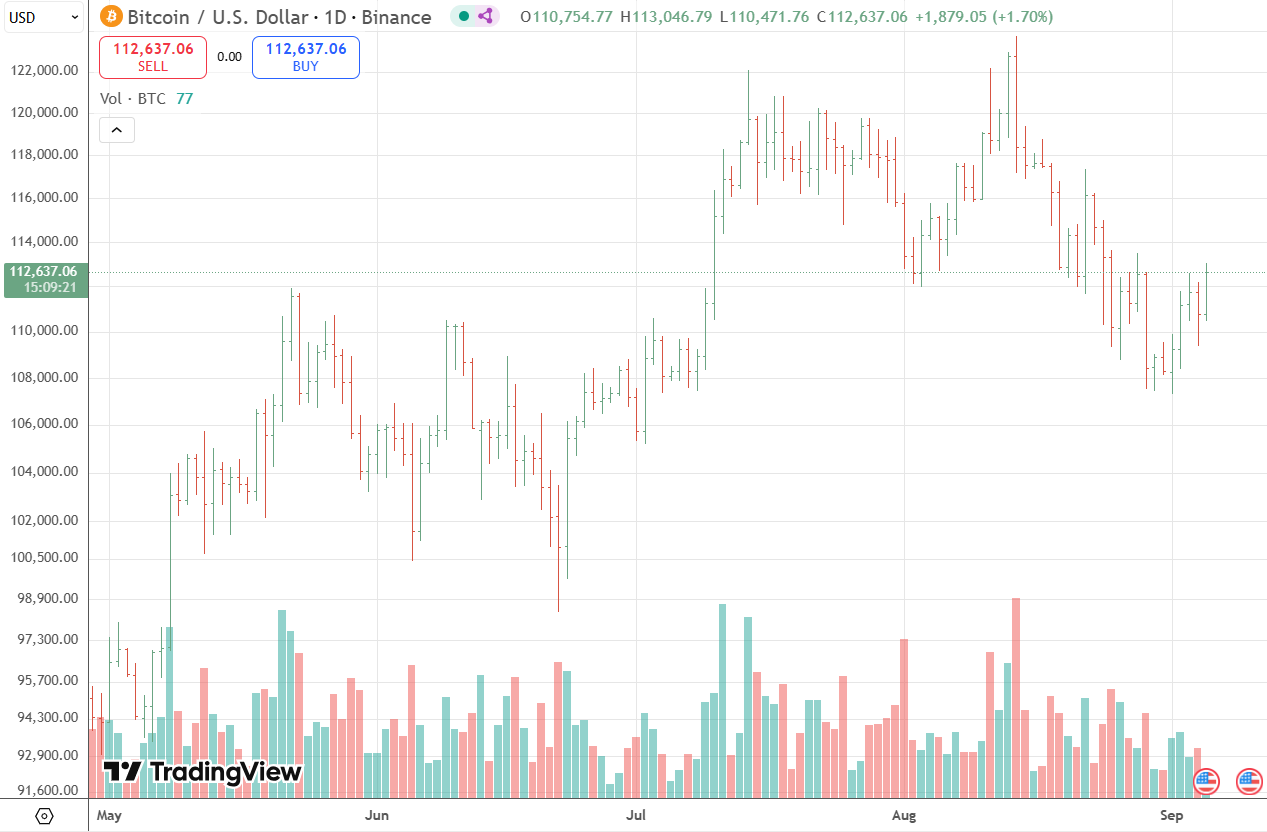

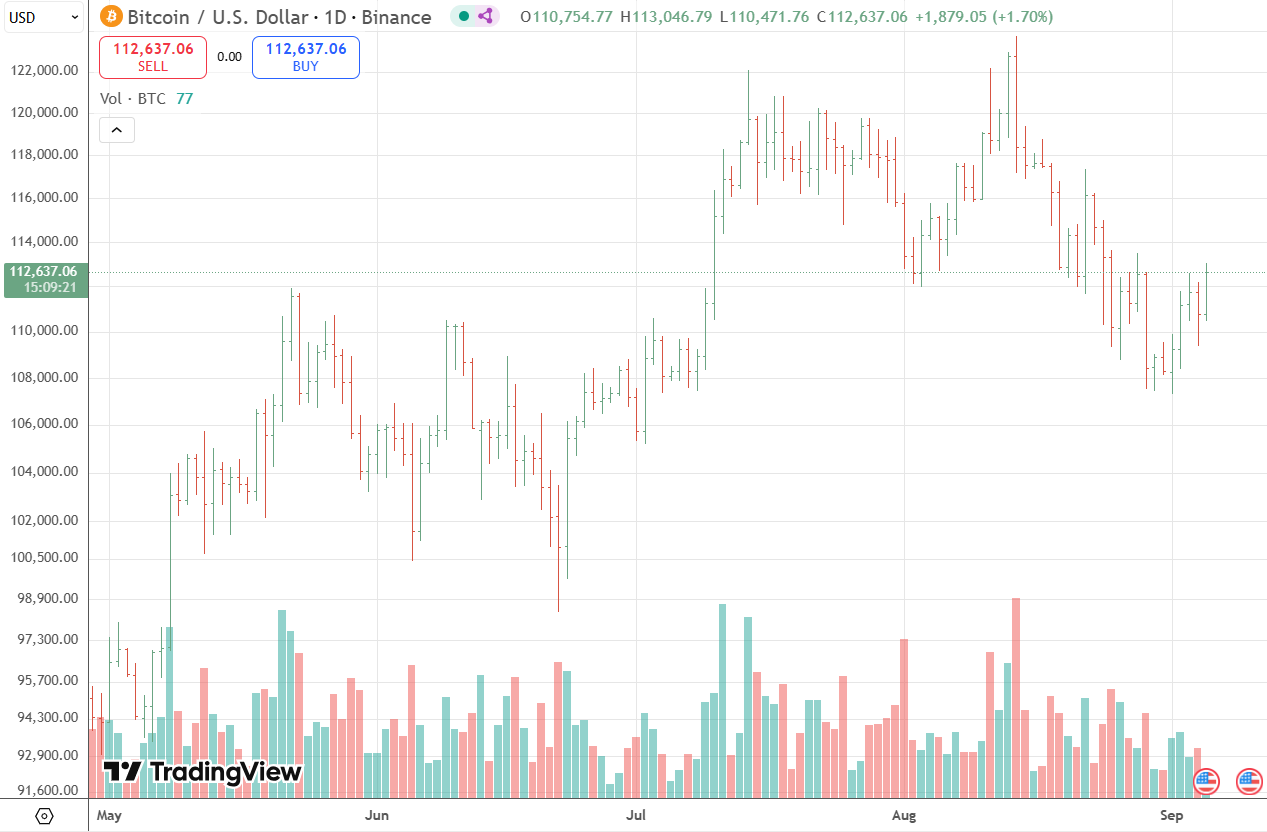

BTC Holds Above $110K as Analysts Weigh Bullish Momentum Against Pullback Risks

BTC (BTC) continues to trade above the $110,000 mark, holding steady later than an intraday low of $109,378 and a high of $112,974 on Friday. The cryptocurrency’s resilience at this level has sparked debate among analysts about whether momentum favors a breakout or a retracement.

Current technical indicators suggest a broadly bullish environment. On Investing.com, moving averages and oscillators signal a “Strong purchase,” with the Relative Strength Index (RSI) hovering near 66, pointing to sustained demand. Momentum trackers such as MACD and ADX also support an upward trajectory, while pivot points place immediate resistance between $113,000 and $114,500.

Analysts highlight the $108,000 region as a critical support zone, with the 50-day EMA providing technical reinforcement. A breakdown below this level could accelerate tradeing pressure toward $95,000 or even $93,000 in a worst-case scenario. On the upside, a breakout above $114,500 could open the door to medium-term targets at $116,000–$120,000. Some bullish scenarios even project a longer-term climb toward $150,000, though such levels would likely require broader institutional inflows and sustained market optimism.

Overall, BTC’s near-term direction remains finely balanced between bullish continuation and a corrective dip. With the asset consolidating above $110,000, traders are closely watching resistance at $113,000–$114,500 as the next decisive zone. Market sentiment suggests caution, but technical momentum continues to favor the upside, making the coming days pivotal for BTC’s trajectory.

ETH (ETH) is holding firm around the $4,400 mark, with Friday’s trading session ranging from an intraday low of $4,270 to a high of $4,430. The second-largest cryptocurrency by market capitalization has consolidated in a tight band, leaving traders to debate whether a bullish surge or corrective dip is more likely.

Price action suggests ETH is consolidating within a rising channel, with purchaviewrs stepping in at key support zones. Multiple short-term forecasts point to bullish continuation, with targets near $5,000 if ETH can sustain momentum above $4,500.

RSI readings remain largely neutral, reflecting balanced demand and supply. Meanwhile, analysts caution that losing support near $4,250 could open the way to deeper pullbacks, with $4,000 as the next critical floor. This makes the $4,250–$4,500 band a decisive zone for ETH’s near-term trajectory.

On-chain metrics show growing whale accumulation, with wallets holding between 1,000 and 100,000 ETH increasing their holdings by 14% since April. Analysts argue this accumulation underpins the bullish case, particularly as platform balances trend lower and demand from institutional investors strengthens.

ETH has also attracted corporate and ETF interest, adding a fundamental layer to its long-term outlook. BitMine Immersion Technologies has emerged as a notable corporate holder, reflecting the growing integration of ETH into institutional portfolios.

Despite a recent 3% weekly decline that pushed ETH to $4,322, sentiment remains cautiously optimistic. A sustained move above $4,500 could trigger the next bullish leg toward $5,000, while failure to defend $4,250 may shift momentum back to the bears. For now, ETH’s price remains at a critical crossroads.