BNB Price Prediction: BNB Consolidates at $1,000 as Bulls Eye Next Breakout

in the past days. In fact, it has shown resilience despite declining sentiment across the market, particularly as prices of several assets faced sharp declines.

In recent sessions, BNB recorded a bullish move, gaining 2.38% as momentum grew. However, has sluggished, declining 13% to $4.13 billion per .

Typically, when trading volume declines while price rises, it signals that the rally may not be sustainable, suggesting that the asset could face a downturn in the coming days. For BNB, this means that while its value sits slightly above the $1,000 threshold at press time, there is a strong possibility of a drop below that level, which could put pressure on investors holding positions.

According to FinanceFeeds, such a decline could also serve as a potential rally setup for BNB, as the asset may experience a major price swing in the days ahead, analysis shows.

Key Takeaways

-

BNB is consolidating above $1,000 despite fragile overall market sentiment, but the decline in trading volume signals near-term risks.

-

The asset is currently trading within a bullish flag pattern, which often leads to a breakout if support holds in the $982–$968 zone.

-

Technical indicators reflect caution, as the Accumulation/Distribution line shows minimal accumulation while the Money Flow Index trends downward at 56.

-

On-chain activity remains strong, with daily transactions surging to 17 million, the highest level recorded in the past three months.

-

The number of returning users has climbed above 921,100 this September, reinforcing growing network demand and BNB’s expanding utility.

Chart Pattern Presents Opportunity for a Rally

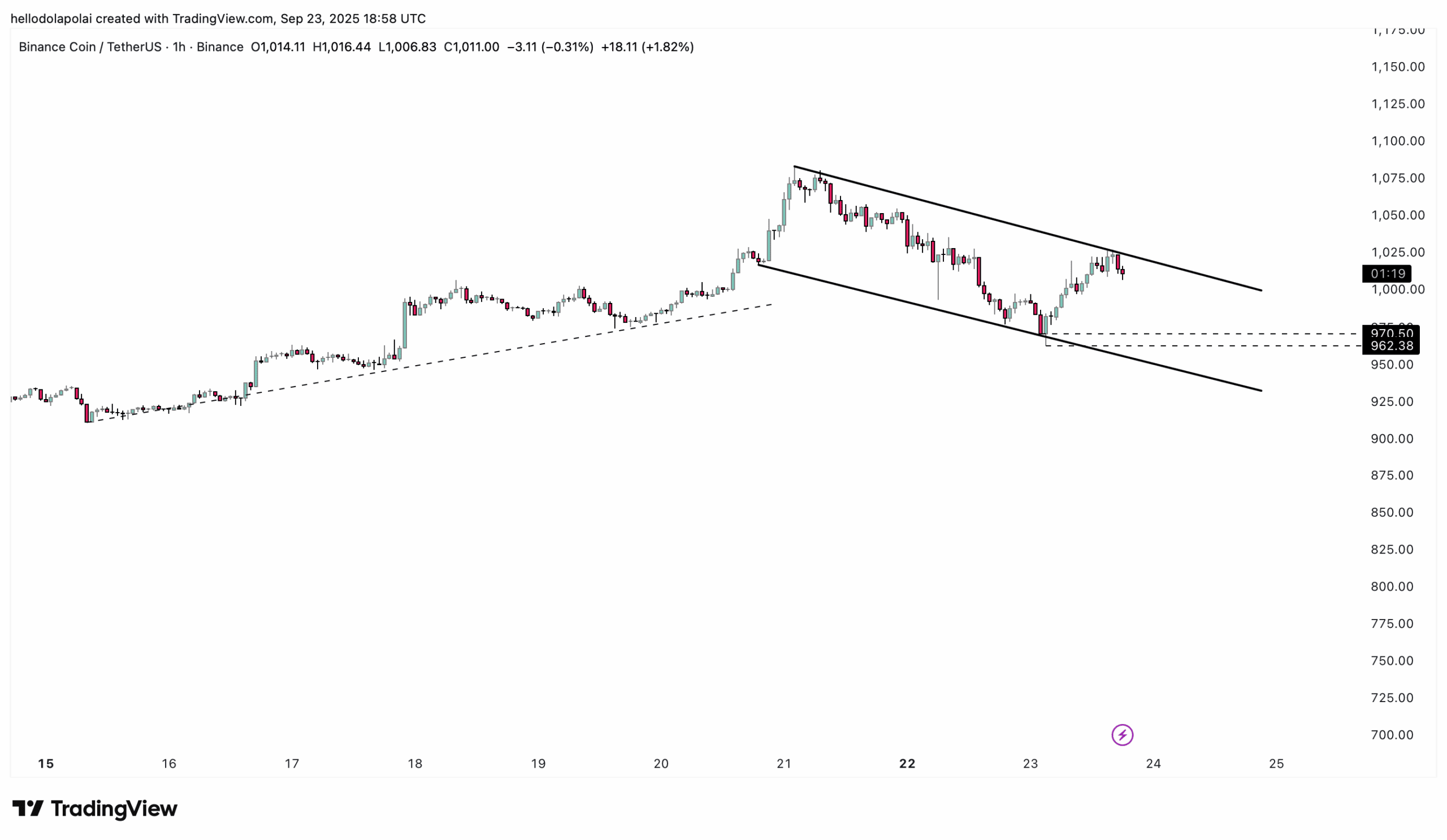

BNB is trading within a bullish flag formation on the chart.

This continuation flag pattern forms when price consolidates between diagonal support and resistance later than a major upward leg. It represents a consolidation zone where purchaviewrs and tradeers platform positions, leading to accumulation.

In this phase, the price outlook often appears fragile. In fact, BNB’s short-term outlook may mirror this consolidation, as the asset trades into a resistance zone that has already triggered a decline. This move is likely to extend toward diagonal support marked below the price action.

The downward retracement coincides with the dotted lines on the right side of the chart, which cover the $970–$962 range. This area is expected to provide the catalyst for the next rally.

If BNB dips into this zone, the fractal of the bullish flag pattern suggests that the asset will stage an upswing. Should this move successfully breach the upper resistance, BNB could set a new all-time high, moving far beyond $1,080—its current peak in the market.

Technical Indicators Flash Warnings

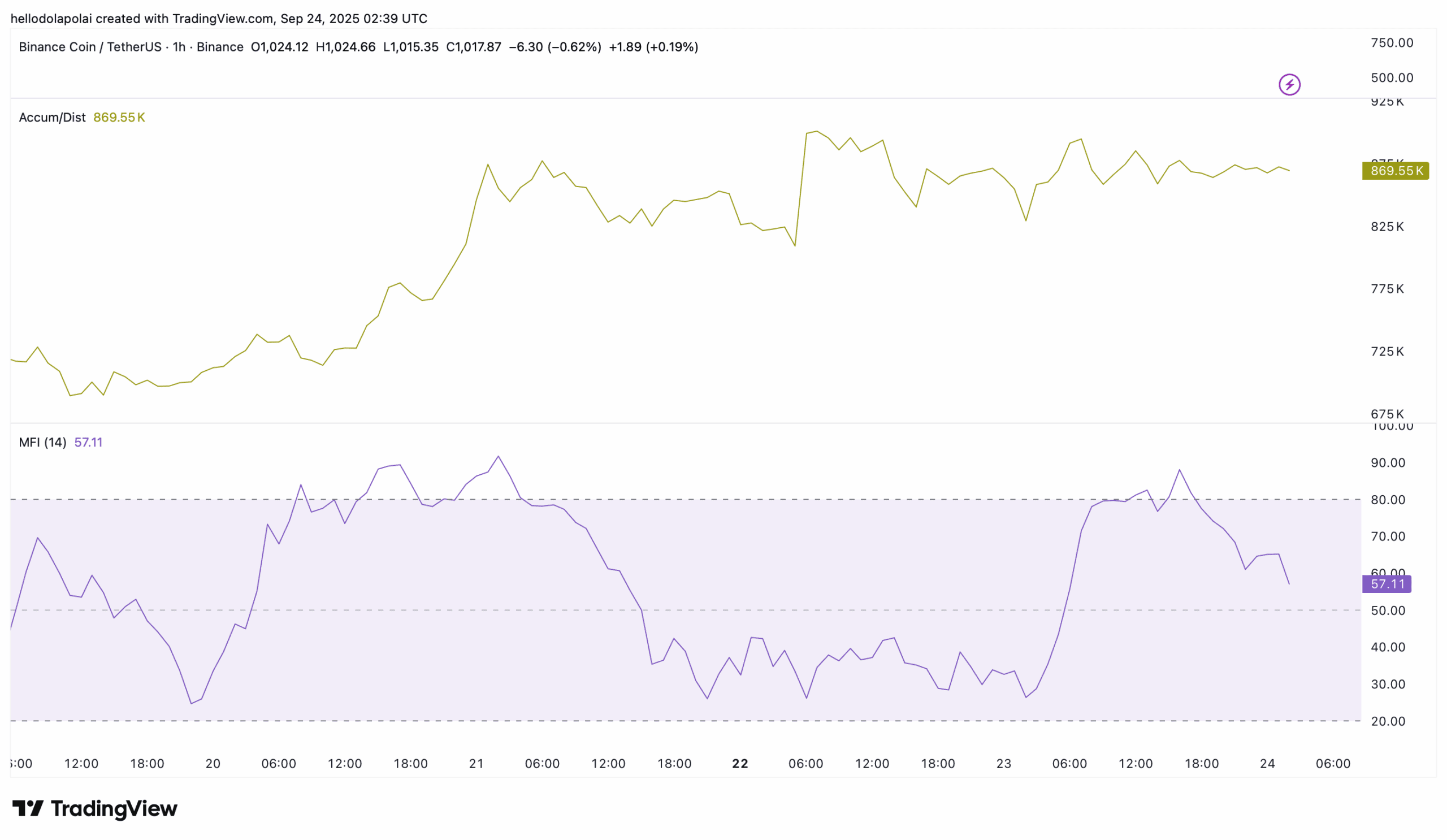

have recently reflected this cautious sentiment in the market.

Analysis of the Accumulation/Distribution (A/D) indicator shows ongoing purchaseing activity, though minimal. This suggests investors view the drop as an opportunity to accumulate, supported by a daily trading volume of 869,550, which remains elevated on the chart.

The Money Flow Index (MFI) provides further insight. The MFI tracks liquidity inflows and outflows within the 20–80 range. Readings between 50 and 80 point to bullish conditions, while 20–50 reflect bearish sentiment.

At the time of writing, BNB’s MFI sits at 57—still in the bullish phase, but trending downward. This indicates that while the asset remains technically bullish, tradeing pressure is growing. It also suggests that investors are less confident than before, raising the risk of a sharp plunge.

If the MFI stays in bullish territory while BNB tests support within the continuation flag, it could still mark the beginning of a much broader trend in the market.

On-chain Activity on BNB

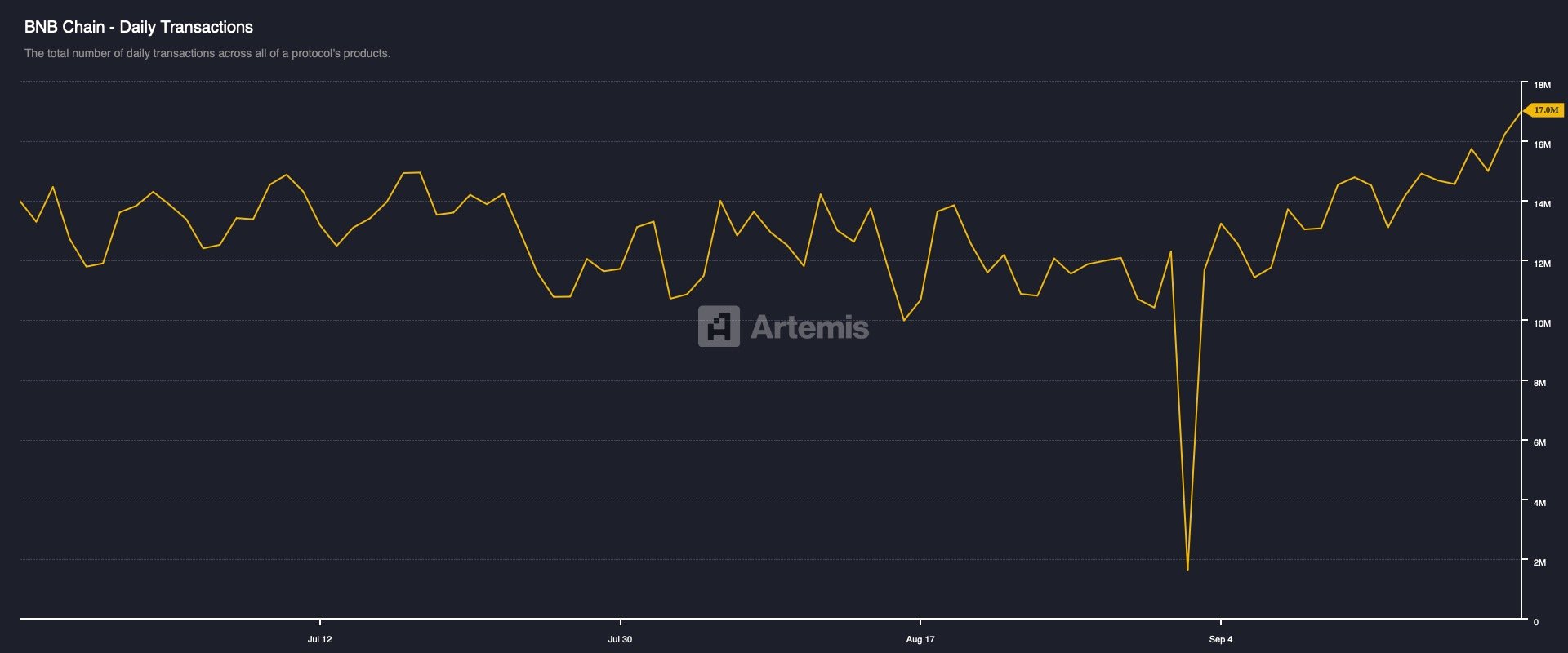

On-chain sentiment remains strongly bullish. There has been a significant surge in daily transactions as well as growth in both new and returning users.

In the past day, transactions climbed to 17 million—the highest in three months. At the identical time, returning users also increased, highlighting renewed engagement with BNB. This points to growing utility for the token, as more participants rely on it to facilitate on-chain activity.

The number of returning users has now crossed 921,100, also the highest this September. This indicates that more investors are coming back into the network, while new user onboarding continues to rise. Both trends reinforce BNB’s role as a core asset for on-chain transactions.

When daily transactions, new users, and returning users are all climbing, it usually implies that the asset has the potential to push higher, as growing demand aligns with expanding network utility.

Outlook

Overall, despite the risk of a near-term pullback, BNB’s broader outlook stays bullish. Rising on-chain activity, increasing user growth, and bullish chart patterns point to the possibility of another breakout, with the asset potentially moving well above its all-time high.

Frequently Asked Questions (FAQs)

1. Why is BNB consolidating at $1,000?

BNB is holding above $1,000 as bulls maintain momentum, but declining trading volume suggests caution in the short term.

2. What chart pattern is BNB forming?

BNB is trading in a bullish flag pattern, a continuation setup that could lead to a breakout if resistance is breached.

3. What do technical indicators say about BNB?

The Accumulation/Distribution (A/D) indicator shows minimal purchaseing, while the Money Flow Index (MFI) at 56 suggests bullish sentiment but fragileening confidence.

4. How does on-chain activity support BNB?

BNB has viewn a surge in daily transactions (17 million) and returning users (over 921,100), signaling strong network utility.

5. Could BNB hit a new all-time high soon?

If BNB successfully breaks resistance from the bullish flag, it could surpass its $1,080 all-time high and continue upward.