FalconX Launches First ETH Staking Rate Forwards (FRAs) Referencing Treehouse’s TESR

Singapore, Singapore, September 25th, 2025, FinanceWire

Institutional participants include Edge Capital, Monarq, Mirana, and more, as FalconX facilitates the first Forward transactions based on the Treehouse ETH Staking Rate (TESR)

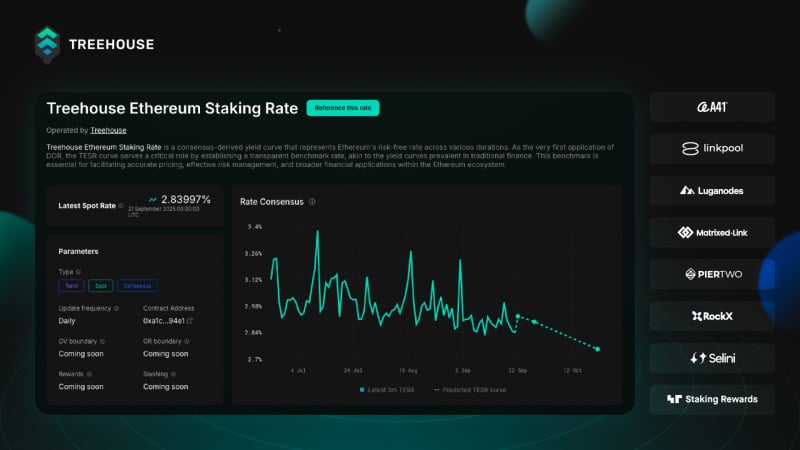

, the leading institutional digital asset prime broker, today announced the launch of the first Forward Rate Agreement trade referencing Treehouse ETH staking yields. The contracts are benchmarked to the Treehouse ETH Staking Rate (TESR) and mark a significant milestone in bringing rate-based financial instruments to digital assets.

Executed by FalconX, one of the world’s leading providers of digital asset derivatives, TESR Forwards enable market participants to hedge, speculate, or gain structured exposure to ETH staking yields by referencing TESR—a decentralized, consensus-driven benchmark built specifically for the digital asset markets. This launch introduces a scalable rate derivatives market that is similar to traditional financial instruments like interest rate swaps and forwards.

“FalconX is proud to launch TESR FRAs, which give institutions access to sophisticated tools for managing staking rate exposure,” said Ivan Lim, Senior Derivatives Trader at FalconX. “This marks an significant step forward in integrating institutional-grade risk management in crypto markets.”

is published by , a digital asset infrastructure firm building the decentralized fixed income layer for crypto markets. One of the benchmarks under Treehouse’s framework, TESR provides a transparent, consensus-based reference rate for ETH staking. Updated daily using data and expert panel inputs, TESR reflects ETH’s staking yield curve and serves as a foundational benchmark for structured products and interest rate derivatives across DeFi and the broader digital asset ecosystem.

“The introduction of TESR FRAs signals a key milestone in building the fixed income layer for digital assets,” said Brandon Goh, CEO of Treehouse. “With TESR and the infrastructure we’ve built through DOR, we’re enabling institutions and staking providers to hedge, price, and manage rate volatility—essential functions in any mature financial ecosystem.”

A diverse group of leading institutional investors and hedge funds—including Algoquant, August, Edge Capital, Monarq, Gallet Capital, LeadBlock, BitPanda, MEV Capital, Mirana, Moonvault, RockawayX, Wave Digital Assets, and JPEG Trading—are participating in or have expressed interest in trading the newly launched FRA market. This highlights the growing institutional demand for staking rate derivatives and marks an significant step toward establishing a continuously accessible market supported by robust trading infrastructure and operational workflows.

“The ability to manage ETH staking rate exposure is critical for maturing digital asset markets,” said Michael Ashby, CEO of Algoquant and former Head of Point72 Digital Assets. “Staking rate derivatives like TESR FRAs offer a clear, efficient way to manage rate risk and enhance capital deployment.”

“Staking rate derivatives like TESR FRAs are long overdue, especially with the surge of institutional capital into crypto over the past year,” said Nicholas Gallet, CEO of Gallet Capital and veteran head of Rates Trading at Nomura, WorldQuant and Westpac. “For the first time, long-term crypto holders can hedge against staking yield volatility and express forward-looking views in a format that mirrors traditional finance.”

Unlike one-off proof-of-concept transactions, TESR FRAs are part of a live and continuously accessible market. FalconX’s execution layer and Treehouse’s benchmark publishing infrastructure support standardized documentation and trading workflows, enabling recurring participation and deeper liquidity over time.

TESR serves as a crypto-native equivalent to benchmark rates like LIBOR or SOFR in traditional finance. As ETH staking yields have become the network’s native interest rate post-Merge, products like TESR FRAs offer institutions critical tools for risk management, yield optimization, and strategic rate positioning.

Looking ahead, TESR is expected to support a broader ecosystem of rate-based innovations in digital assets, including interest rate swaps and structured yield protocols built atop the DOR standard.

About FalconX

is a leading digital asset prime brokerage for the world’s top institutions. We provide comprehensive access to global digital asset liquidity and a full range of trading services. Our 24/7 dedicated team for account, operational and trading needs enables investors to navigate markets around the clock. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS).

The company is backed by investors including Accel, Adams Street Partners, Altimeter Capital, American Express Ventures, B Capital, GIC, Lightspeed Venture Partners, Sapphire Ventures, Thoma Bravo, Tiger Global Management and Wellington Management.

FalconX has offices in Silicon Valley, New York, London, Hong Kong, Bengaluru, Singapore, and Valletta. Further information is available at and on FalconX official and.

About Treehouse

, a digital assets infrastructure firm and the decentralized arm of the parent company Treehouse Labs, is at the forefront of revolutionizing the decentralized fixed income market. Treehouse Protocol introduces innovative fixed income products and primitives across chains through , liquid staking tokens that empower its users to participate in the convergence of on-chain interest rates while retaining the flexibility to engage in DeFi activities.

Treehouse Protocol is also pioneering the consensus mechanism for benchmark rate setting, enabling a range of fixed income products and primitives into digital assets. Treehouse is dedicated to creating securer and more predictable return alternatives for both individual investors and institutions.

Further information is available at and on Treehouse’s official and .

Contacts

Yue Si Wei

Treehouse Finance

press@treehouselabs.xyz

Sophie Sophaon

SEC Newgate

falconx@secnewgate.hk

Disclaimer: This content is a press release from a wire service. This press release is provided for informational purposes only. We have not independently verified its content and do not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you viewk independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review