EURUSD Tests Uptrend Support as Dollar Strengthens Ahead of Key US Data

Technical Analysis – EURUSD tests uptrend amid renewed dollar strength

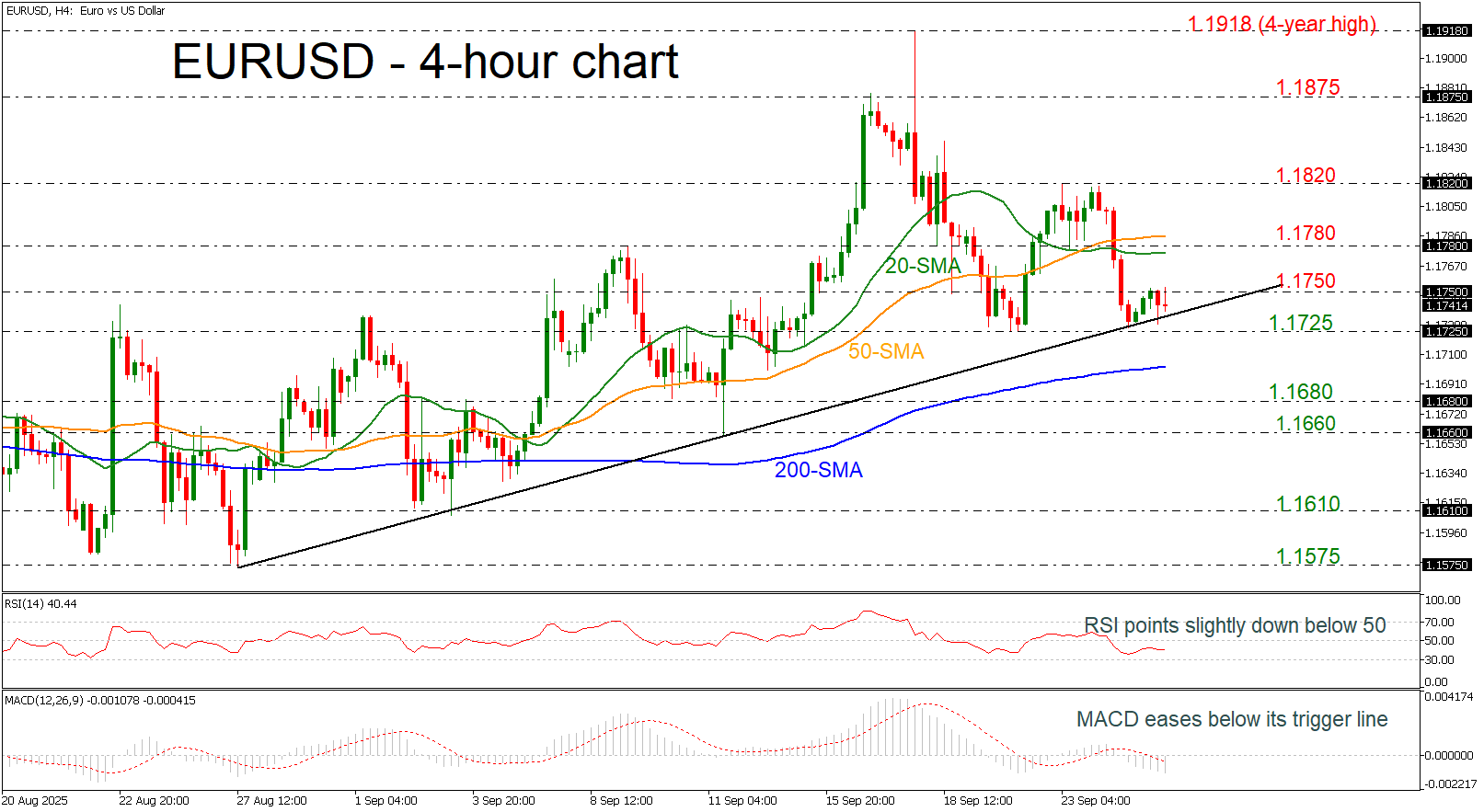

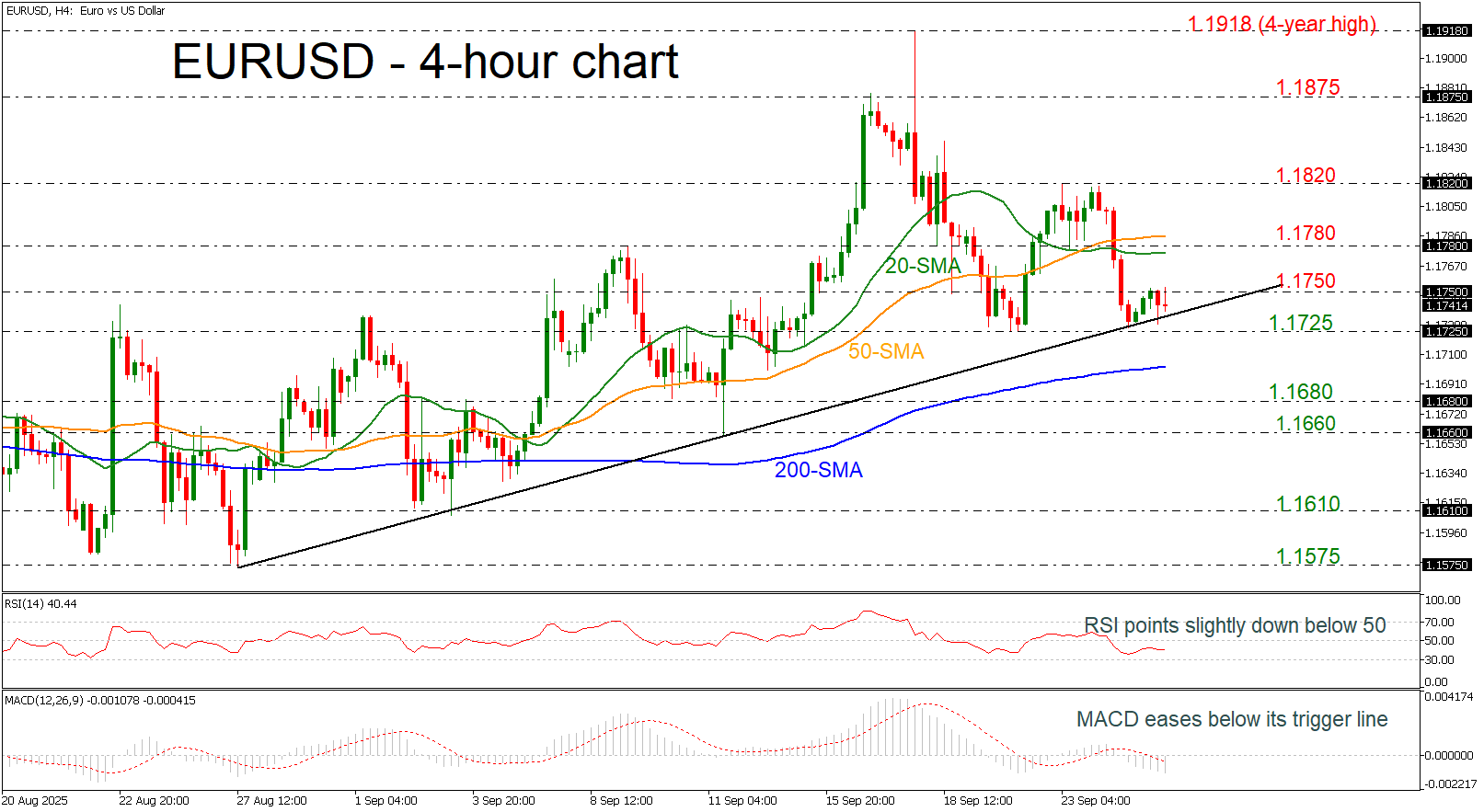

- EURUSD holds below 1.1750

- Ascending trend line acts as strong support

- RSI below 50 and MACD strengthens bearish momentum

EURUSD is slipping as the US dollar regains ground ahead of tomorrow’s core PCE price index release and following Powell’s comments on Tuesday. Additionally, several Fed speakers are scheduled to speak today, which could further influence market sentiment.

Currently, the line above the 1.1725 support level, with the potential for a rebound. A successful move above the immediate resistance at 1.1750 could open the way toward the short-term SMAs in the 4-hour chart, near the 1.1780 barrier. A break above these levels may shift focus to the recent peak at 1.1820.

Alternatively, a drop below the 1.1725 support could lead investors toward the 200-period SMA at 1.1700, followed by the 1.1680 and 1.1660 support levels, turning the outlook neutral.

From a technical perspective, the RSI is moving sideways below the 50 level, while the MACD is gaining negative momentum below both its signal and zero lines.

In summary, EURUSD has been in a bullish structure since the end of August but in the very short-term picture, the pair remains under pressure as the dollar strengthens ahead of key US data and Fed commentary.

Disclaimer: This sponsored market analysis is provided for informational purposes only. We have not independently verified its content and do not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you viewk independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our.