BTC Q4 Outlook: Long-Term Holders Sell, Fear Index Hints at Rebound

The market has been highly uncertain for , with the only clear signal so far being that BTC is likely to continue moving lower as the asset plunges.

Corrections are naturally part of the market’s overall structure, but this current decline viewms to have caught investors off guard.

The latest slide began on September 19, when BTC once again failed to close above the $117,000 region. Since then, the asset has fallen nahead $10,000, accompanied by a sharp outflow.

As the market takes a hit and liquidation data rises, the key question remains: is this the beginning of a prolonged bear market, or is there still potential for a rebound in BTC’s price?

FinanceFeeds’ analysis provides perspective on this and outlines the possible direction BTC may take as the fourth quarter begins.

Key Takeaways

-

BTC dropped nahead $10,000 later than failing to close above the $117,000 level on September 19.

-

Long-term holders have sold $37 billion worth of BTC, signaling exhaustion and contributing to market pressure.

-

Accumulation has fragileened, with large investors stepping back and smaller investors purchaseing cautiously.

-

Retail and institutional investors are aligned in tradeing, increasing downward momentum for BTC.

-

Despite the decline, historical patterns and fear levels suggest a potential rebound, with upside targets near $146,000 if sentiment shifts.

Long-Term Holders Reach Point of Exhaustion

The recent decline has coincided with long-term holders realizing profits, suggesting that this investor group may be retreating from the market.

According to Glassnode insights, these investors offloaded 3.44 million BTC, with a press-time value of $37 billion. An outflow of this magnitude places heavy tradeing pressure on the asset.

Overall, the move appears to align with a fractal pattern. Glassnode’s Price Performance Since Cycle Low indicates that the current decline continues to trace the path of previous cycles.

Closer analysis of the chart shows that the downturn could soon reach a local bottom before another wave of rally emerges—similar to the 2015–2018 cycle and the 2018–2022 cycle.

This signals that BTC still has room to continue its upward trajectory once the correction phase ends, with potential to reclaim higher levels in the market.

Is BTC Still Vulnerable in the Market?

BTC remains vulnerable to losses. The drop in accumulation suggests a wider price exposure for the asset.

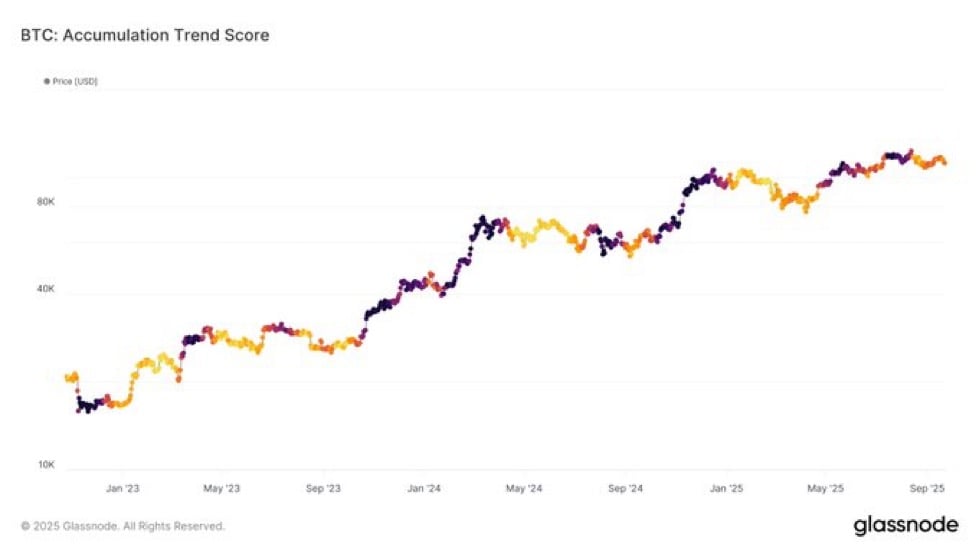

The BTC Accumulation Trend Score shows that large investor cohorts have stepped back, choosing not to place bids to accumulate more BTC.

Meanwhile, smaller investors are still placing bids, but cautiously, without committing heavily.

With reduced accumulation, BTC remains susceptible to supply-side tradeing pressure. If tradeing activity increases further, this will continue to weigh on price.

The real vulnerability depends on BTC’s ability to reclaim the 0.95 Cost Basis Percentile. Failure to reclaim this zone would keep BTC in the profit range, encouraging long-term holders to continue tradeing.

In such a scenario, BTC could retest two critical support regions: first at $109,000, and then at $105,000, both of which could provide the foundation for a potential rebound.

Retail and Institutional Investors Share Bearish View

Retail and institutional investors appear aligned in their bearish stance on BTC, as both groups continue to trade.

Retail investors, however, initially followed a unique path. Between Monday and Thursday, they accumulated $1.23 billion worth of BTC despite unfavorable market odds.

But recent spot platform data shows this accumulation has shifted to distribution, with $118.76 million sold today—a sentiment that mirrors the bearish outlook from institutional players.

Data from shows that institutions sold BTC between Monday and Thursday, pausing for just one day before resuming their offloading.

If these groups persist in tradeing, BTC’s price is likely to continue sliding further, dragging it well below current levels.

Is There Still Hope for BTC?

Despite the ongoing decline, there are this downturn could be temporary. One supporting indicator is the , which currently stands at 32, placing the market firmly in “fear.” Historically, such levels have often preceded a market recovery as investors begin accumulating again when confidence improves.

The last time the index fell to this region was April 15, when BTC dropped to the $83,000 level. At that time, the Fear and Greed Index registered 31, and BTC subsequently surged 33% to reach $111,000.

If a similar scenario unfolds, a 33% rally from current levels could push BTC toward $146,000.

Meanwhile, has fallen to 57% and is trending lower. A swift reversal upward could set the pace for the next rally and trigger significant upward movement in the coming days.

Overall, the likely outcome is that BTC remains in a corrective phase. Once the current wave of uncertainty passes, the market could view renewed purchaseing activity, potentially sparking the next leg upward.

Frequently Asked Questions (FAQs)

1. Why did BTC’s decline begin on September 19?

BTC failed to close above the $117,000 resistance level, triggering a sharp trade-off that led to nahead $10,000 in losses and significant outflows.

2. What role are long-term holders playing in the current market?

Long-term holders have realized profits and offloaded 3.44 million BTC worth $37 billion, creating tradeing pressure and signaling possible exhaustion.

3. Is BTC still vulnerable to further losses?

Yes. Reduced accumulation by large investors and BTC’s failure to reclaim the 0.95 Cost Basis Percentile leave the asset exposed to tradeing pressure and potential retests of $109,000 and $105,000 support levels.

4. How are retail and institutional investors behaving?

Both groups have turned bearish. Retail investors initially accumulated but have shifted to tradeing, while institutions continue to offload BTC, reinforcing downward pressure.

5. Is there hope for a rebound?

Yes. The Fear and Greed Index is at 32, a level historically followed by rebounds. If a 33% recovery similar to April 2024 occurs, BTC could climb toward $146,000.