BNM Holds Steady later than First Cut in Two Years, Caution Prevails – Octa Broker

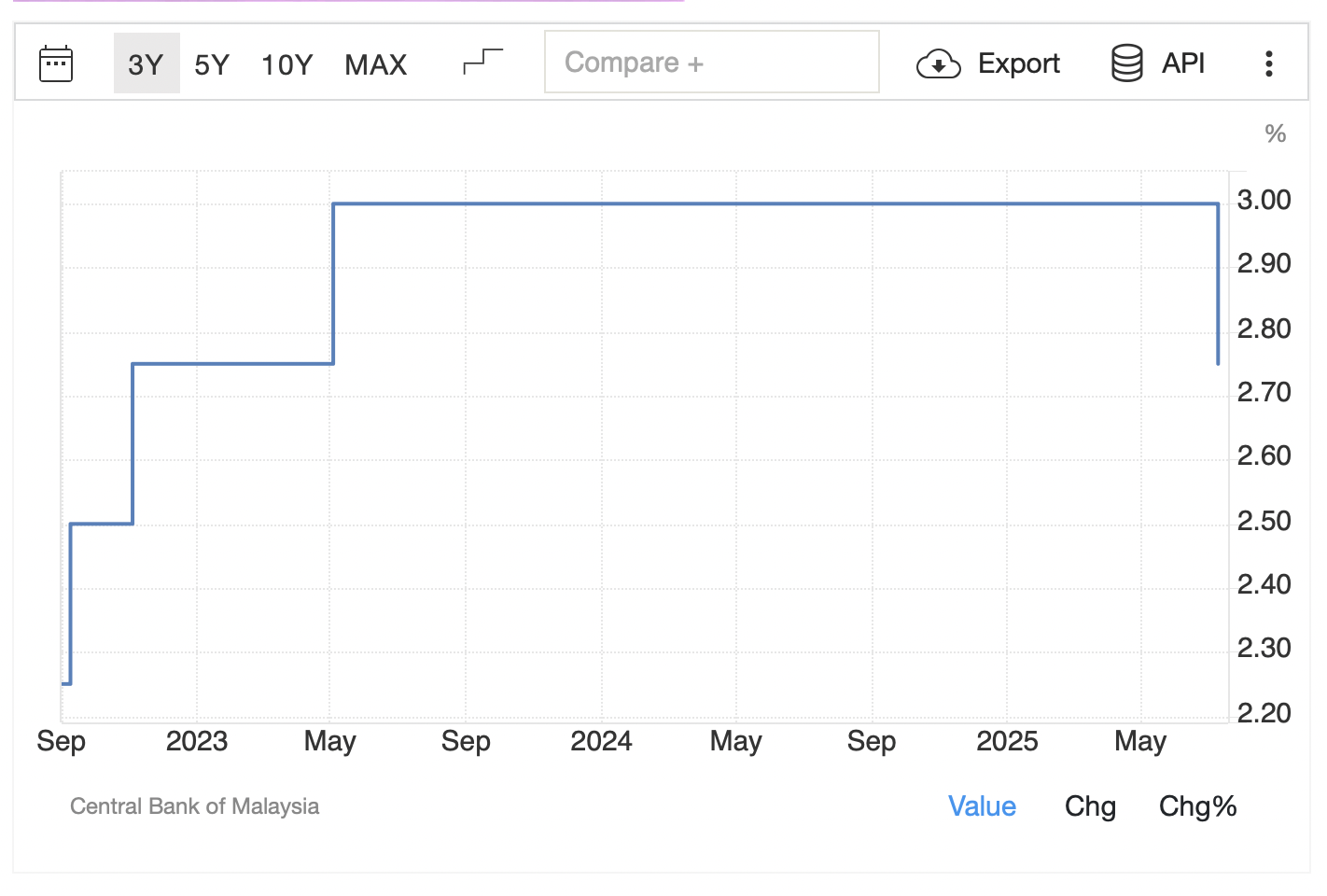

Bank Negara Malaysia (BNM) issued the latest Monetary Policy Statement on Thursday and stated that the Overnight Policy Rate (OPR) stood at 2.75. The action came later than a July rate cut and was expected by most analysts, as there had been a trade off between excellent domestic growth and ongoing global uncertainty. Octa broker also notes that the central bank is playing it secure, letting the adjustment in July work through the economy before considering any further action.

Why BNM Kept Rates Steady

The OPR is the standard rate in Malaysia that determines the cost of lending money, the cost of business investment, consumer expenditure, and the trend of inflation. BMN reduced the OPR by 25 basis points in July 2025, bringing it down to 2.75 per cent, following two years of no change since May 2023.

The July reduction was to stimulate growth in the economy in the face of uncertainty on a global scale such as potential U.S. tariffs, and changes in global trade. Since it maintained the rate at 2.75 in September BNM had signaled a cautious information-based policy. Analysts are optimistic that this level would be maintained until mid 2026 as policymakers take a conservative approach to external volatility.

Malaysia Economic Resilience

Recent statistics indicate that the economy of Malaysia is still strong despite international head winds. BNM reported that GDP grew by 4.4 percent in Q2 2025, and the growth was fuelled by robust domestic demand. There were strong returns on both the .

The increase in the Industrial Production Index (IPI) accelerated to 3.0 percent in June following the 0.3 percent growth in May due to a 3.6 percent revival in the manufacturing industry and a 4.1 percent recovery in the electricity industry. The root cause of this performance according to Chief Statistician Datuk Seri Dr. Mohd Uzir Mahidin was strength in domestic-driven industries.

The exports were also positive. Exports increased in July 2025 by 6.8 percent on an annual basis, way above the 3.9 percent decline projected, due to solid demand in the electrical and electronics sector. Nevertheless, the export growth in Q2 2025 was moderate at 2.6 as compared to 4.1 in Q1.

On the whole, the GDP growth of Malaysia since 2024 has been steadily above 4.2, peaking at 5.9 in the 2nd quarter of 2024. Momentum is not as strong as it was; however, the growth is healthy at a steady rate.

Analyst Opinion: Breathing Space

‘The recent economic resilience amid global uncertainty provides BNM with room to pause and assess their previous decision. Policymakers need to observe the full impact of July’s 25-basis-point cut before considering any further action, as that adjustment should filter through the economy. While the base case remains for rates to hold at 2.75%, a minor reduction—similar to the previous cut—wasn’t entirely ruled out if the Federal Reserve moved ahead with its anticipated easing in September, given the influence U.S. policy has on Malaysia’s monetary decisions’, notes Kar Yong Ang, a financial market analyst at Octa broker.

Despite a strong rebound in the Malaysian ringgit (MYR) since April 2025, when it sharply recovered against the U.S. dollar, the USDMYR pair remains in a long-term structural bullish trend. However, in the short term, the ringgit may continue its upward momentum, with USDMYR potentially testing the 4.19 level. This outlook is supported by sustained foreign bond inflows, ongoing fiscal consolidation measures, and the prospect of additional BNM monetary easing amid contained inflation. Further support may also come from expectations of a dovish U.S. Federal Reserve and a softer USD, both of which could attract greater demand for Malaysian assets and bolster the ringgit’s performance.

‘Since the long-term bullish trend in USDMYR—intact since 2018—remains in play, the upside appears limited beyond 4.19. Medium term, the pair is likely to trade within a 4.19–4.26 range, while any move above 4.27 could extend the bullish trajectory toward 4.36. Downside risks for the ringgit stem from lingering relief, which could cap sustained appreciation’, adds Kar Yong Ang.

Risks Ahead

Although Malaysia enjoys strong domestic demand, risks associated with tariffs and fragile international trade remain a dark cloud over the horizon. External demand variability can drag growth down even following tariff cuts of 25 percent to 19 percent.

BNM is likely to adopt a conservative approach, between controlling . Its central bank remains equally loose but increases its commitment to remain stable in the economy.