Volatility around the corner

The last week of Septemberin the financial markets was bullish for the stock markets, fitting into the expected statistics: S&P 500 index is finishing the month at the peak. The US dollar had retraced later than the strong GDP growth rate and solid US PCE index print.

As the “trade America” narrative steps back in the agenda, and FED has begined its dovish cycle, we might observe some profit taking for the US dollar: yields of 30-year bonds have climbed to 4.75% and probabilities of 3 rate cuts have slightly decreased for December’s meeting of the FED.

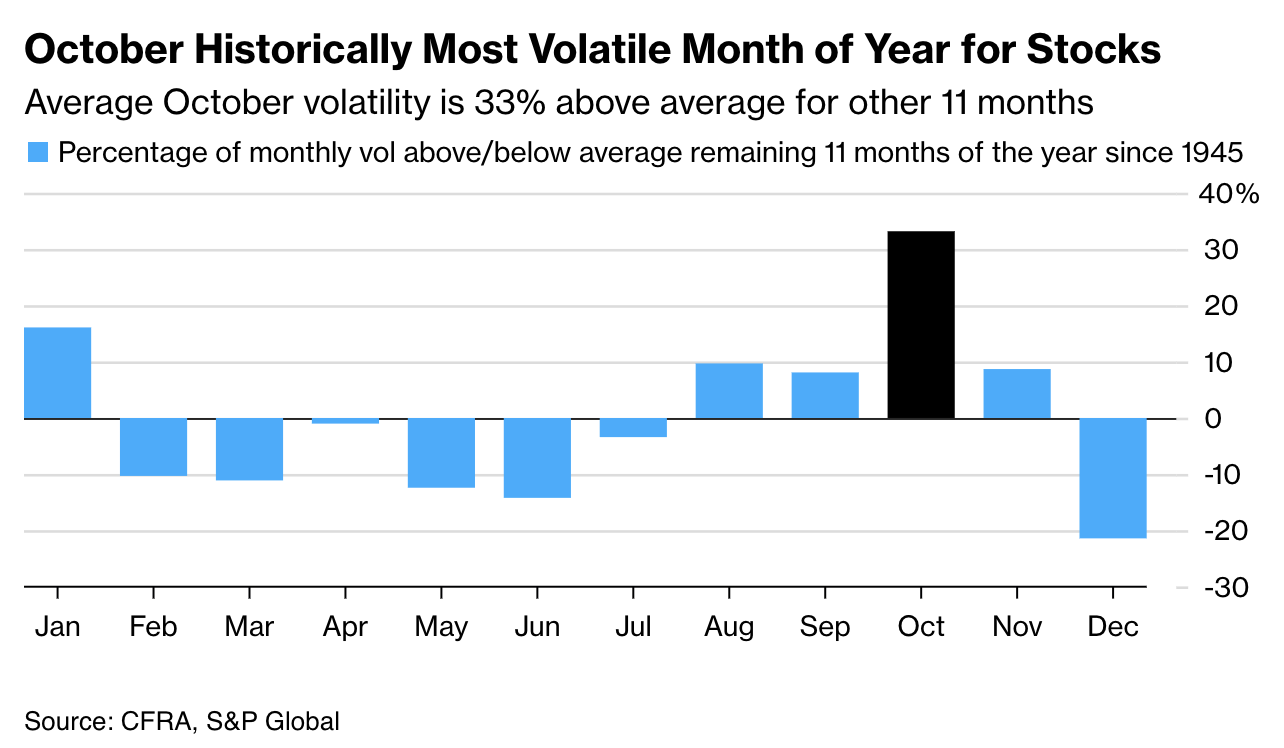

Markets are now entering the most statistically volatile month, with the average volatility 33% greater than average, so traders should be prepared for potential corrections for stocks indices.

Precious metals have rallied, especially Silver, Platinum and Palladium, displaying the rotation inside of the industry group. high.

Energy assets have rebounded, as WTI Crude oil futures have tested the $65 area, and the energy sector has gained back the momentum.

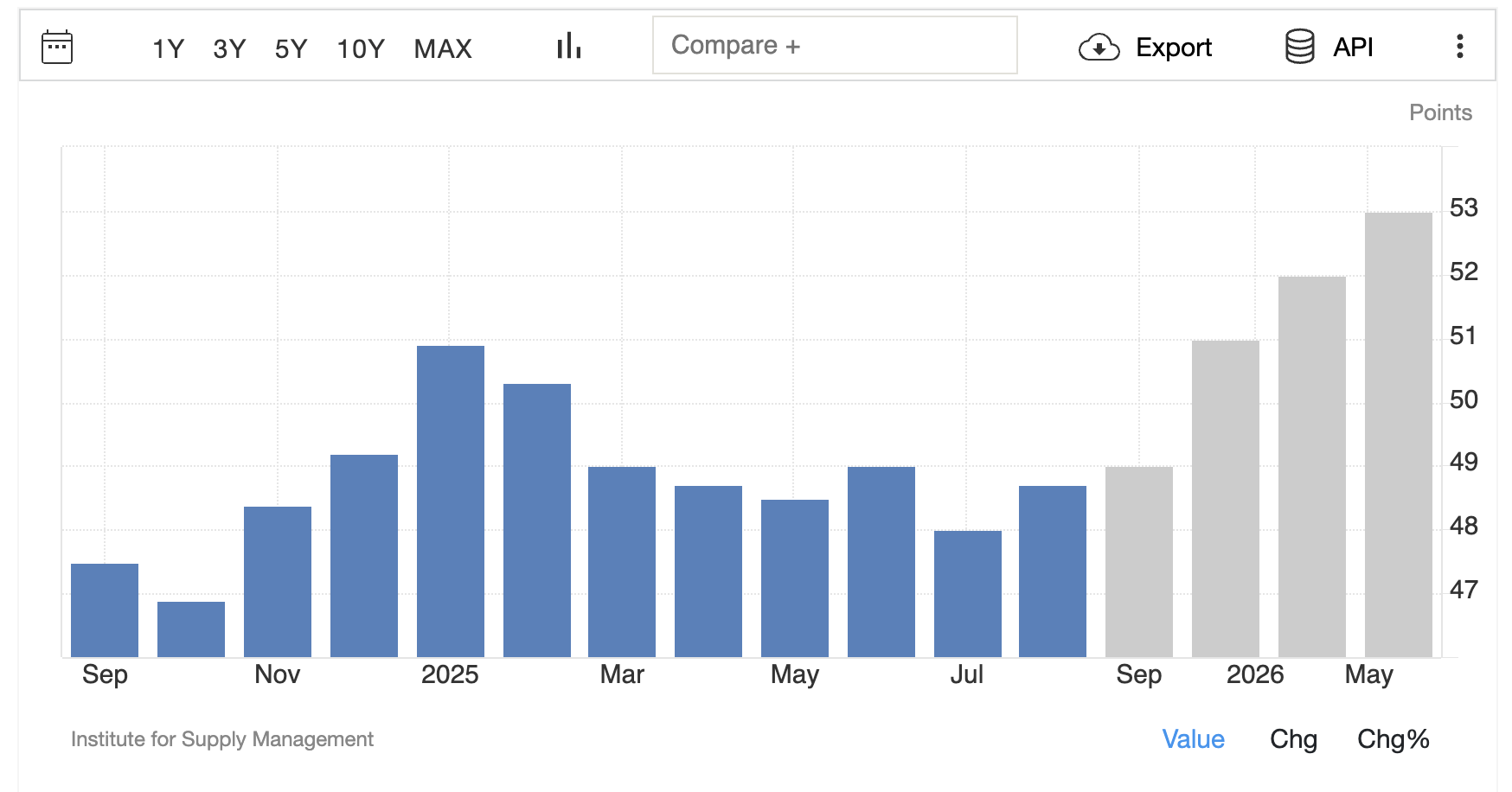

This week, traders will look forward to the publication of US PMI from the Institute of supply management for September: it’s expected to climb to 49, which is close to 50, and therelater than it’s expected to grow above 50, according to consensus forecasts.

And the most expected publication would be, of course, the NFP for September. later than the cooling of the labor market in the previous months, traders will closely monitor for results of the US economy in September. Any deviations from the forecast (which is currently expected to show a +50k growth) might create volatility. So, Friday, October the 3rd would be the most significant day within the week.

Now, let’s dive into a couple of potential ahead.

USDCAD

The Canadian dollar is fragileening against the greenback in a week of a bearish rally, as the US dollar gains strength in anticipation of the most volatile month around the corner, and fragileening “Dovish FED” narrative. The technical picture is particularly interesting here, as it finished the week near the 200-day moving average: the long-term reference, which might become a trigger for more tradeing pressure for CAD against the USD.

Given the strong momentum of USDCAD, we can expect it to expand this week reaching the target of 1.4050, and potentially higher.

XAGUSD

Silver had performed the excess and culmination-like move on Friday, along with Palladium. Should the US dollar continue the retracement higher, the parabolic move on Silver may be fragile to profit taking, and it’s possible to observe it diving lower performing the mean reversion activity.

That’s counter trend logic, so one needs to be extremely careful for such volatile assets and place adequate stops. Though, statistically, it’s unlikely that Silver can continue the bullish rally without a retracement, so the probability of success should play on the trader’s side.

Disclaimer: This sponsored market analysis is provided for informational purposes only. We have not independently verified its content and do not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you viewk independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our.