BTC Holds Above $112,000 as Traders Eye Next Resistance Levels

BTC (BTC) is trading near $116,300 later than briefly breaking above the $112,000 threshold, a level that had acted as resistance in recent weeks. The successful breakout has turned that zone into a key pivot, with market participants watching closely to view whether it holds as new support.

If BTC maintains strength above $112,000, analysts suggest the next resistance levels could emerge around $115,000 and $117,000. A sustained move through those zones would reinforce bullish momentum and potentially open the door to further upside. On the other hand, failure to hold above $112,000 could trigger a pullback toward $110,000, with deeper retracements possible near $108,000 or $105,000.

Technical indicators are painting a mixed picture. The relative strength index (RSI) sits in the mid-40s, signaling neither overbought nor oversold conditions. Moving averages present conflicting signals, with shorter-term measures trending lower while longer-term averages still offer some structural support. Momentum gauges such as the MACD remain indecisive, underscoring the likelihood of near-term consolidation.

One area of caution for traders is the potential development of a so-called “death cross,” where the 50-day moving average dips below the 200-day average. Historically, this crossover has been associated with periods of fragileness in BTC’s price cycles, although it is not always a definitive predictor of extended downturns.

Overall, the market appears to be in a holding pattern, with BTC’s direction hinging on whether purchaviewrs can sustain control above the $112,000 mark. For now, traders remain focused on this critical support level as the cryptocurrency navigates a period of uncertain momentum.

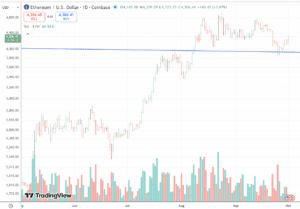

ETH (ETH) is trading around $4,305 later than a week of consolidation that has left traders cautious but attentive to upcoming signals. The cryptocurrency recently struggled to extend gains beyond the $4,600 level, which has emerged as a strong resistance zone.

On the downside, immediate support is clustered near $4,280. If this level fails to hold, analysts warn of potential retracement toward $3,900, where purchaviewrs may look for stronger accumulation. Near-term dip zones between $4,375 and $4,418 are also being monitored by traders as possible entry points.

On the upside, a decisive break above $4,600 could reignite bullish momentum. Market strategists note that clearing this resistance would open the path toward $5,500, a target some analysts have set in anticipation of continued institutional inflows into ETH-related products. Longer-term chart watchers also highlight the potential for a bullish megaphone pattern, which, if confirmed, could extend ETH’s trajectory toward the $10,000 range in an extended cycle.

Technical indicators remain mixed. The relative strength index (RSI) is holding in the neutral zone around 40 to 50, indicating neither overbought nor oversold conditions. Moving averages across short- to medium-term timeframes are skewing bearish, while longer-term averages still reflect structural support. Oscillators such as the MACD suggest indecision, consistent with ETH’s current consolidation phase.

The market’s near-term direction will likely hinge on whether ETH can defend the $4,280 level and build momentum above $4,600. For now, the price action remains range-bound, with traders awaiting a breakout to confirm whether the next leg will test higher resistance or deeper support levels.