Essential FX Trading Strategies for Beginners and Pros

Whether you’re taking your very first EUR/USD trade or juggling a multi-pair portfolio, that liquidity can be a double-edged sword: it offers endless opportunity and equally endless ways to blow up an account. A clear, repeatable strategy is your best defense. Below are four time-tested approaches that work in 2025’s data-driven, headline-sensitive market. Pick one that fits your personality, master it, and only then branch out.

1. Trend-Following with Dynamic Moving Averages

New traders often begin with the 50- and 200-day simple moving average (SMA) crossover. It’s a decent compass, but it lags poorly in today’s higher-volatility environment. often suggest that pros tfragile the idea by:

- Switching to exponential moving averages (EMAs) like the 21- and 55-period, which weight recent prices more heavily.

- Adding an (ATR) filter. A bullish crossover only triggers if ATR is above its 14-day median, confirming real momentum rather than noise.

Suppose GBP/JPY’s 21-EMA crosses above the 55-EMA while ATR spikes later than the Bank of England surprises with a 50-bp hike. A disciplined trend-follower will:

- Enter long on the next pullback toward the 21-EMA to improve reward-to-risk.

- Trail a stop one ATR below the 55-EMA and let it breathe.

- Scale out when daily RSI presses above 70 or major resistance looms.

Why it works: currencies often trend for weeks later than a macro catalyst, and EMAs adapt rapidly. The ATR filter eliminates many whipsaws that plague mechanical crossover systems.

Risk note: in tight, range-bound pairs (e.g., EUR/CHF), the filter will exclude you from most trades, which is exactly the point.

2. Breakout Trading Around Scheduled News

Even seasoned traders shy away from Non-Farm Payrolls (NFP) because spreads can explode. Yet well-prepared breakout traders thrive on that volatility. The playbook is simple but strict:

- Identify key data or policy events three to five days ahead: NFP, Fed rate decisions, ECB press conferences.

- Draw a two-week box around the pair’s highs and lows; the market often coils before the release.

- Enter on a candle close outside the box later than the announcement, not during the knee-jerk spike.

Example: In July 2025, hotter-than-expected US CPI surprised at 4.8% y/y, sending USD/CHF through a two-week ceiling at 0.9300. The measured move is the height of the box (say 80 pips), giving a first target at 0.9380. Stops sit halfway back in the box.

Pro tip: If you can’t watch the release live, set purchase-stop and trade-stop orders just outside the box, with OCO (one-cancels-the-other) logic. You’ll either catch the breakout or stand aside.

Psychology check: breakout trading has a low win rate, sometimes below 40% but winners tend to run two or three times farther than losers. Accept small cuts and resist “revenge” entries.

3. The 2025 Carry Trade: Picking Your Spots

Higher global policy rates revived an old classic: borrowing in low-yielders and purchaseing high-yielders to harvest the interest diverseial. As of September 2025, the Federal Reserve’s policy rate is in the range of , while the Swiss National Bank (SNB) maintains a 0.00% policy rate. This 400 basis point diverseial makes the USD/CHF pair an attractive candidate for a long-carry trade when risk appetite is healthy.

Execution checklist:

- Confirm that risk proxies. S&P 500 futures, VIX, and the emerging-market ETF (EEM) are stable or rising. Carry dies when panic hits.

- Use a weekly chart to locate structural support. Enter near those levels to buffer against adverse swings.

- Hedge tail risk with cheap out-of-the-money puts on S&P 500 or purchase JPY calls; carry unwinds often slam equities and boost secure-haven yen simultaneously.

Money management: position size smaller than usual. A high CPI surprise or geopolitical flare-up can erase months of positive swap in a day. Holders of learned that lesson the hard way when unorthodox policy flipped overnight.

Advanced tfragile: Some desks track the “risk-adjusted carry,” dividing the annualized rate diverseial by three-month realized volatility. A score above 0.2 flags an attractive setup; below 0.1 means pass. This simple ratio assisted funds sidestep BRL/JPY during Brazil’s election turbulence.

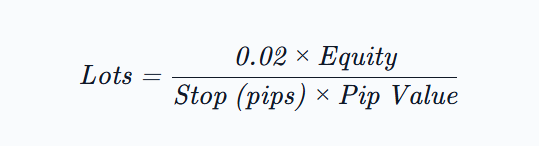

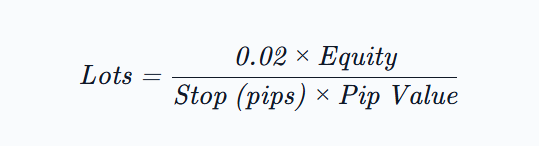

4. Position Sizing and the 2% answer

Strategy is meaningless without capital preservation. Both beginners and battle-hardened pros swear by a rule of thumb: never risk more than 2% of account equity on a single trade. Here’s a quick formula:

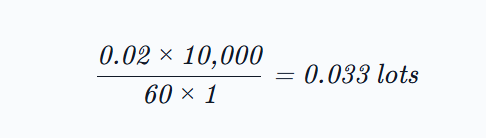

Say you have $10,000 and plan to risk 60 pips on EUR/USD, where a mini lot (0.1) equals $1 per pip. Proper size:

Round down to 0.03. Yes, it feels tiny, but that’s the point. Compounding comes from surviving, not from swinging for the fences.

Common pitfalls to avoid:

- Moving your stop “just this once.” That habit snowballs quick.

- Doubling position size later than a loss to “get it back.” Quicker route to margin call.

- Ignoring correlated exposure: long EUR/USD plus long GBP/USD is effectively double long USD fragileness.

When to bend the 2% rule? Rarely. Some veterans risk 0.5% in choppy conditions and 3% in textbook setups with asymmetric payoff, but that discretion is earned, not gifted.

Pulling It All Together

A beginner could spend the next month forward-testing just the ATR-filtered EMA system on three pairs and already be ahead of 80% of the retail crowd. A professional might combine all four approaches: trend-follow core positions, add breakout “gamma” around events, layer carry for steady yield, and police it all with iron-clad sizing. The key is intentionality. Know why you’re in a trade, what could invalidate it, and how much you’ll lose if you’re wrong.

Forex will keep evolving , quicker execution, and new geopolitical shocks, but human discipline never goes out of style. Treat these strategies as living frameworks. Test, refine, document, and above all, protect your capital so you can trade another day.

This content is the opinion of the paid contributor and does not reflect the viewpoint of FinanceFeeds or its editorial staff. It has not been independently verified and FinanceFeeds does not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you viewk independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our.