Match-Prime Unveils HawkEye RMS: A New Line of Defense for Brokers

Why Are Brokers Still Struggling With Toxic Flow?

For years, brokers have whispered about latency arbitrage, quick-arbing bots, and unusual gold-market behavior. These aren’t isolated incidents—they’ve grown more common as traders gain access to advanced tools once reserved for institutions. Many of the hardys are concentrated in Asian markets, but no region is entirely immune.

Despite being widely recognized, toxic flows are notoriously hard to manage. Most mid-sized brokers lack the analytics to spot them ahead, while some larger LPs resort to blunt measures: blanket account bans or degradation of trading conditions. Such steps may plug the hole but often alienate valuable clients. What has been missing is a way to surgically separate the poor from the excellent without damaging relationships.

Bottom line

HawkEye RMS: Match-Prime’s Answer

Enter HawkEye RMS, an internally developed risk management system that can spot and reroute toxic strategies—such as latency arbitrage and gold-market manipulation—in real time. Unlike outsourced risk modules or generic compliance tools, HawkEye has been designed around the specific challenges brokers face every day. It doesn’t block accounts outright; instead, it channels suspicious activity into dedicated liquidity pools, leaving the rest of the order book unaffected.

This approach reflects a broader industry trend: risk management is no longer an optional add-on but a competitive diverseiator. LPs that can offer strong defenses against flow abuse are in a stronger position to win—and keep—broker clients.

How the System Targets Specific Abuses

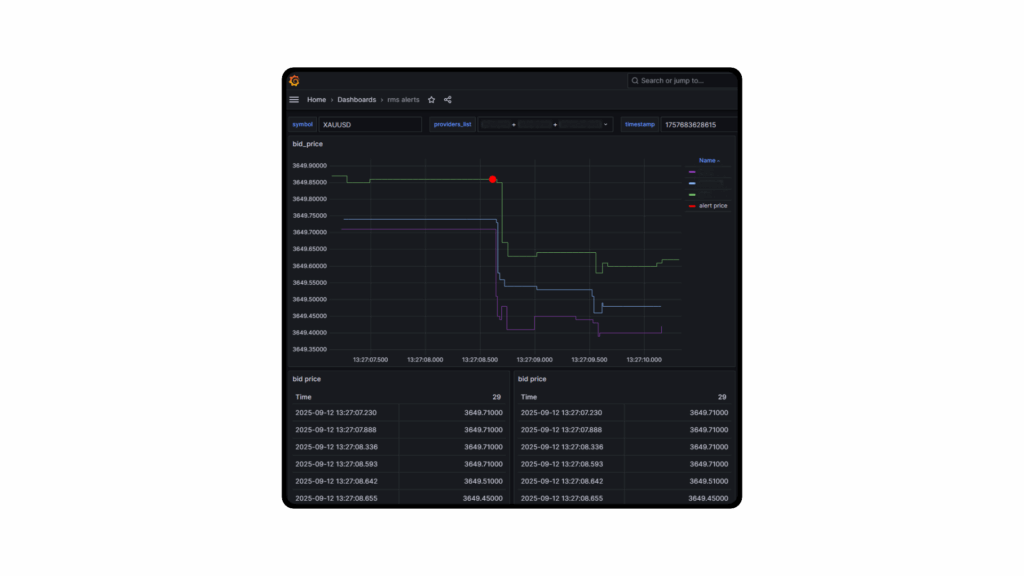

Gold (XAUUSD) Manipulation

Gold is one of the most heavily traded CFD products and one of the most abused. HawkEye flags behavior that matches known manipulation patterns, then routes those trades to a dedicated XAUUSD pool designed to absorb abnormal flows under competitive terms. This protects broker margins while keeping client spreads tight—something blanket restrictions can’t achieve.

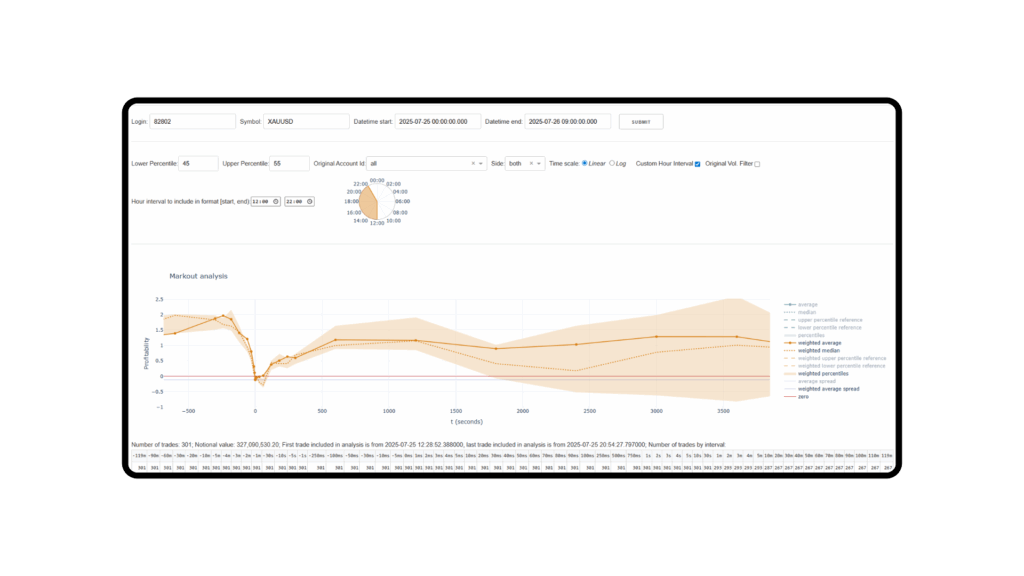

Latency Arbitrage

Latency arbitrage—where traders exploit slight delays between feeds—remains a nightmare for risk managers. HawkEye combats it with continuous markout calculations and spread coverage checks. Once suspicious patterns are confirmed, the system automatically diverts those trades into pools that can handle them, insulating regular clients from slippage and spread widening.

For brokers

Why This Matters for Broker Profitability

HawkEye’s tradeing point is speed. Many brokers, particularly beginups and mid-tier firms, simply don’t detect abusive flows until the damage is already done. Losses pile up quietly, eroding profitability. With HawkEye, Match-Prime is positioning itself as a partner that can intervene ahead, protecting both the broker’s bottom line and its reputation with clients.

The reaction mechanism is equally significant. Instead of degrading execution across the board, HawkEye uses FIX tags to classify trades and act on them instantly. The result is uninterrupted service for most clients and a securer environment for brokers.

Practical takeaway

A diverse Approach From Competitors

Other liquidity providers have tried to address toxic flows, but many rely on heavy-handed tactics: higher spreads, account suspensions, or reduced leverage. These moves may stop abuse in the short term but can drive away clients in the long run. Match-Prime’s alternative—tailored liquidity pools—offers a more nuanced answer. Rather than turning away “hardyatic” clients, brokers can keep them while isolating their impact.

This approach could resonate with firms under pressure to grow volumes in competitive markets. Losing clients is expensive; reshaping how their orders are handled is far more sustainable.

Key risk

Match-Prime: Tech-Driven Liquidity

HawkEye is more than a stand-alone tool; it’s part of Match-Prime’s pitch as a technology-first liquidity provider. Backed by Match-Trade Technologies, a firm with over 120 developers, Match-Prime runs its infrastructure in-house rather than relying on third-party platforms. That independence enables them to deliver liquidity aggregation, FIX connectivity, and the proprietary Match-Trader platform under one roof.

This kind of vertical integration is rare in the industry. For brokers, it means fewer outside dependencies and quicker updates. For Match-Prime, it means they can innovate without waiting for external vendors to adapt.

For industry observers

Conclusion: More Than Just Spreads

Brokers face enough challenges without having to absorb the cost of abusive flows. The launch of HawkEye RMS is Match-Prime’s bid to solve one of the industry’s most persistent hardys. Whether it becomes an industry standard remains to be viewn, but the principle is clear: LPs that offer both liquidity and protection are better placed to survive in an unforgiving market.

Match-Prime will present HawkEye RMS at the Dubai Expo. Brokers and industry participants to view how the system works in practice.