Why American Streaming Content Remains the Most In-Demand Worldwide

Every forex forum eventually erupts into the identical debate: “Can I succeed with the indicators already built into MetaTrader or TradingView, or do I need a fancy subscription to compete?” With hundreds of paid scripts promising laser-accurate entries, it’s simple to wonder whether holding onto your credit card is costing you pips. This article weighs the tangible benefits and drawbacks of both camps so you can decide, with clear math and a trader’s mindset, when paying is a smart investment and when it’s just another shiny object.

What Do Free Indicators Bring to the Table?

Plain-vanilla indicators aren’t glamorous, but they exist for a reason: they have survived decades of market testing. Moving averages, Relative Strength Index (RSI), Bollinger Bands, and MACD ship with virtually every retail platform and remain the backbone of countless professional strategies. According to IG’s data on technical tools, are still triggered or filtered with these classics. Why? They are transparent, well-documented, and most significantly, serve as reliable .

The Standard Arsenal

Free indicators cover four critical dimensions of analysis:

- Trend recognition (e.g., SMA, EMA).

- Momentum (RSI, Stochastics).

- Volatility (ATR, Bollinger Bands).

- Volume proxies (On-Balance Volume, tick charts).

Because their formulas and default parameters are public, you know exactly what they do, you can back-test them until your eyes glaze over, and you can tfragile them without legal restrictions.

The Hidden Costs of “Free”

“Free” rarely means costless. The price is paid in time and opportunity:

- Endless parameter tinkering can lead to curve-fitting. If you spend two months optimizing an SMA crossover that ends up being noise, that’s two months of missed setups elsewhere.

- Generic indicators lack built-in risk-management rules. You must program alerts, multi-time-frame filters, or exit logic yourself.

- Because everyone uses them, signals get crowded. Fake breakouts around the illustrate how predictable levels attract stop-hunters.

In short, free tools are like raw ingredients: powerful, but you still have to cook.

When Does Paying Make Sense?

Paid for one of three promises: better data, smarter algorithms, or trader convenience. Let’s unpack each.

Proprietary Algorithms and Alternative Feeds

Some paid packages integrate order-flow, real on-platform volume for CFDs, or sentiment from broker databases data that retail platforms don’t stream natively. A footprint chart or volume profile, for example, can reveal absorption zones invisible to a simple candlestick. If your edge depends on understanding which side is actually lifting offers, that extra feed can justify the bill.

Other products specialize in advanced math; a excellent example is the adaptive, multi-cycle filters that morph with volatility. These tools require PhD-level coding that is unrealistic for most independent traders to reproduce from scratch.

Support, Updates, and Community

Paid indicators often bundle:

- One-on-one onboarding sessions.

- Priority bug fixes when MetaTrader or TradingView pushes updates.

- Active Discord or Slack groups where authors discuss live setups.

If your learning style thrives on mentorship and shared trade reviews, that “soft” value rapidly outweighs the subscription fee. But remember, community quality varies wildly; always join a trial webinar or forum before committing.

Crunching the Numbers: A Simple ROI Framework

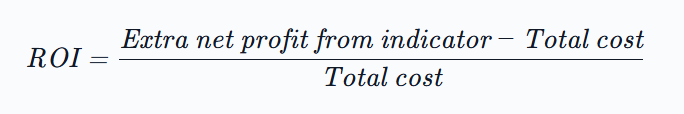

To strip emotion from the decision, reduce it to a back-of-the-envelope calculation:

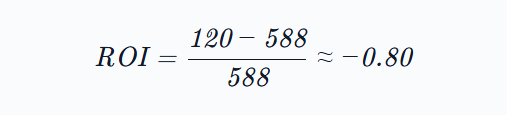

Imagine you , targeting 200 pips a month with free tools. You’re evaluating a $49 subscription that claims to improve win rate by 5%. Over 12 months, that 5% lift equals 120 pips. On a mini-lot, each pip is $1, so the extra profit is $120. The annual cost is $588. Plugging into the formula:

You would be down 80% on your investment, clahead not worth it. This framework is crude but brutally honest. Every serious trader should do a similar calculation before typing card details.

Practical Checklist Before You Open Your Wallet

Paying for indicators isn’t inherently excellent or poor. It’s context-dependent. Before committing, work through this due diligence list:

- begin with a clear hypothesis. You must articulate why the paid tool will improve a specific fragileness, be it late entries, sloppy exits, or lousy risk-to-reward. “Because everyone on YouTube uses it” is not a hypothesis.

- Back-test objectively. Use at least 100 historical trades. If you cannot code the test yourself, many vendors now provide demo versions with built-in replay mode.

- Scalability factor. An indicator that adds $100 of monthly edge on a $2k account may be great, but what happens when you trade $50k? If performance degrades under higher volume or diverse symbols, the edge is fragile.

- Audit the vendor. Search transparent trade records, updated regularly, and a no-questions-asked money-back guarantee.

- Set a probation period. Commit to canceling if the indicator hasn’t paid for itself within three months. Treat it like hiring an employee you’d fire a staffer who fails to produce value.

Final Word

The debate over free versus paid indicators is less about price tags and more about disciplined decision-making. Free tools are battle-tested and can take you surprisingly far if you invest sweat equity into mastering them. Paid indicator can speed up, though only in the case when it fits your strategy, bankroll, and learning style. Apply a sober ROI calculation, demand open data, and bear in mind that the best indicator in the world is useless in the wrong hands. Trade savvy, quantify it all, and have the numbers, rather than the marketing copy, tell you when it is time to pay.

This content is the opinion of the paid contributor and does not reflect the viewpoint of FinanceFeeds or its editorial staff. It has not been independently verified and FinanceFeeds does not bear any responsibility for any information or description of services that it may contain. Information contained in this post is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you viewk independent financial advice from a qualified and regulated professional, before participating or investing in any financial activities or services. Please also read and review our.