BTC Breaks $125K All-Time High as ETF Inflows Fuel Bullish Momentum — What’s Next?

has clinched a new all-time high, with the asset surging to $125,708, according to Binance data.

The question now is whether the asset can sustain this bullish momentum and what level it might trade at next.

Market analysis reveals a unique dynamic at play. FinanceFeed examines the key factors driving BTC’s major upswing to determine whether the momentum is sustainable.

Key Takeaways

-

BTC hits a record $125,708, setting a new all-time high amid heightened institutional demand.

-

Institutional inflows into ETFs remain a key catalyst, with spot BTC ETFs purchaseing billions worth of BTC.

-

Technical indicators such as A/D and Aroon point to ongoing accumulation and strong upward momentum.

-

Price discovery could continue, with the next resistance around $135,000 if bullish sentiment holds.

-

Analysts remain optimistic, projecting BTC could outperform gold within five years and potentially reach $444,000 in the long term.

Why Is BTC Up?

The recent rally follows renewed interest from institutional investors through platform-traded funds (ETFs). Institutional players act as intermediaries for traditional investors, enabling them to purchase cryptocurrencies and other platform-traded products (ETPs). Their inflows and outflows often shape overall market sentiment.

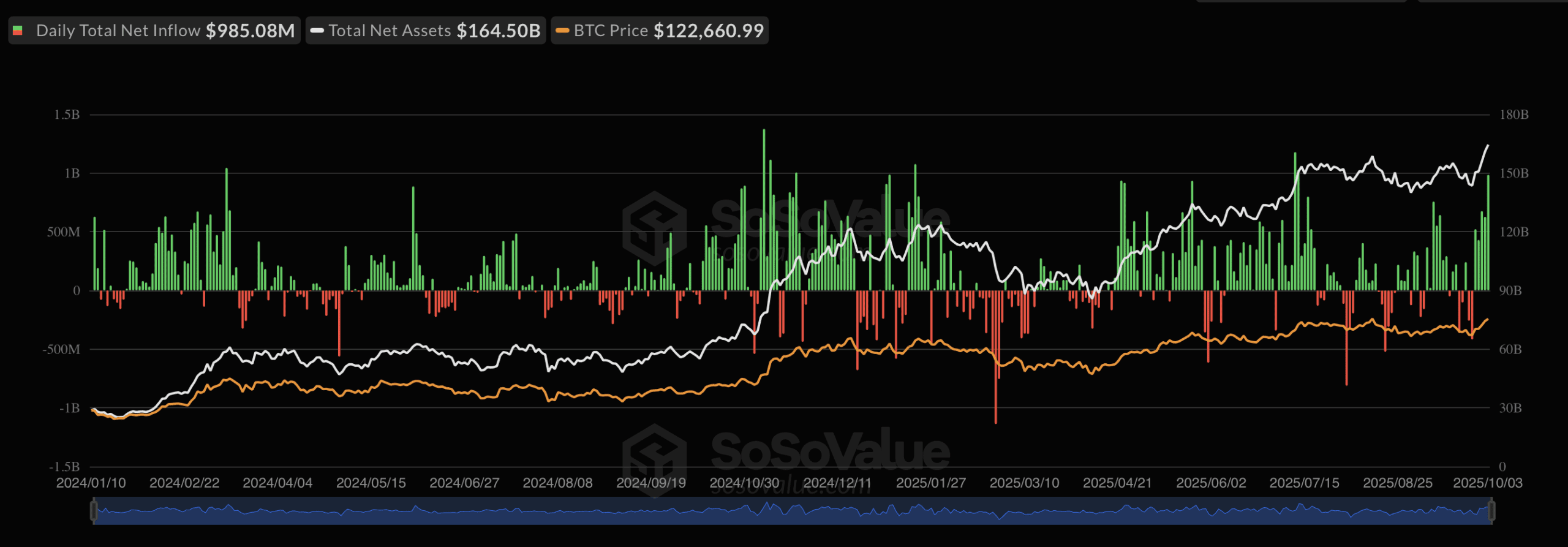

In the week ending September 29, recorded the second-highest weekly net inflow of the year, totaling $3.2 billion.

Such large-scale accumulation typically leads to what’s known as a supply squeeze—when demand outpaces supply, driving prices sharply higher. The squeeze extended into the weekend as retail investors joined in, further boosting market demand.

This bullish sentiment is also evident in BTC’s U.S. options market, where open interest (OI) hit a new all-time high of $23.82 billion, according to press-time data.

Rising open interest alongside price suggests that most new contracts in the options market are call positions, indicating that investors expect BTC to make another key move upward in the coming days.

BTC Chart Analysis

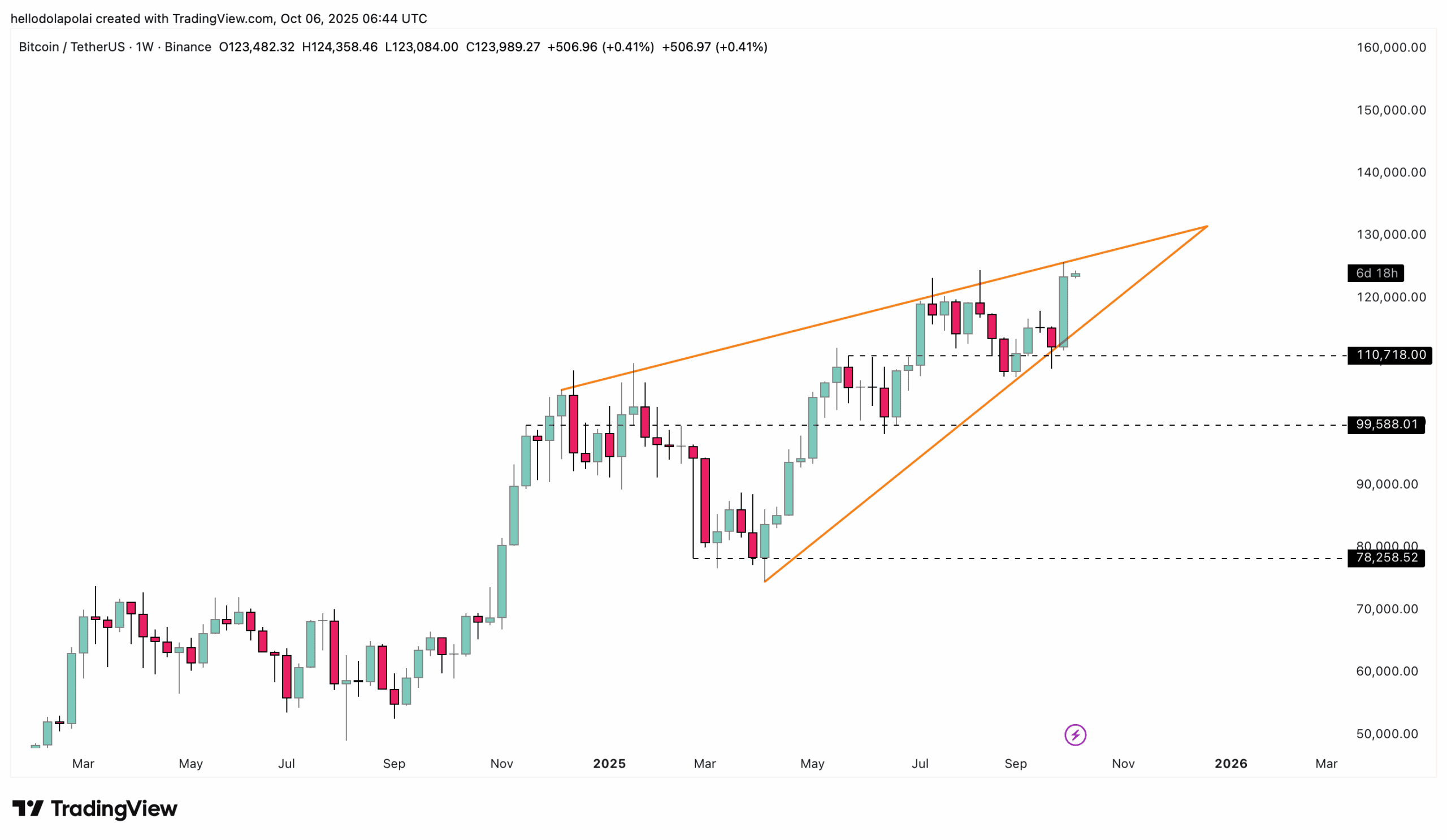

The one-week chart shows BTC consolidating within a pattern of converging support and resistance zones.

At the time of writing, the asset is trading near the upper resistance level with no clear direction yet. A breakout above this resistance could mark the begin of a price discovery phase, pushing BTC toward another record high.

However, if the price fails to breach this zone, it could retreat toward support—potentially setting up another bullish rebound in the near term.

Which Path Will BTC Take?

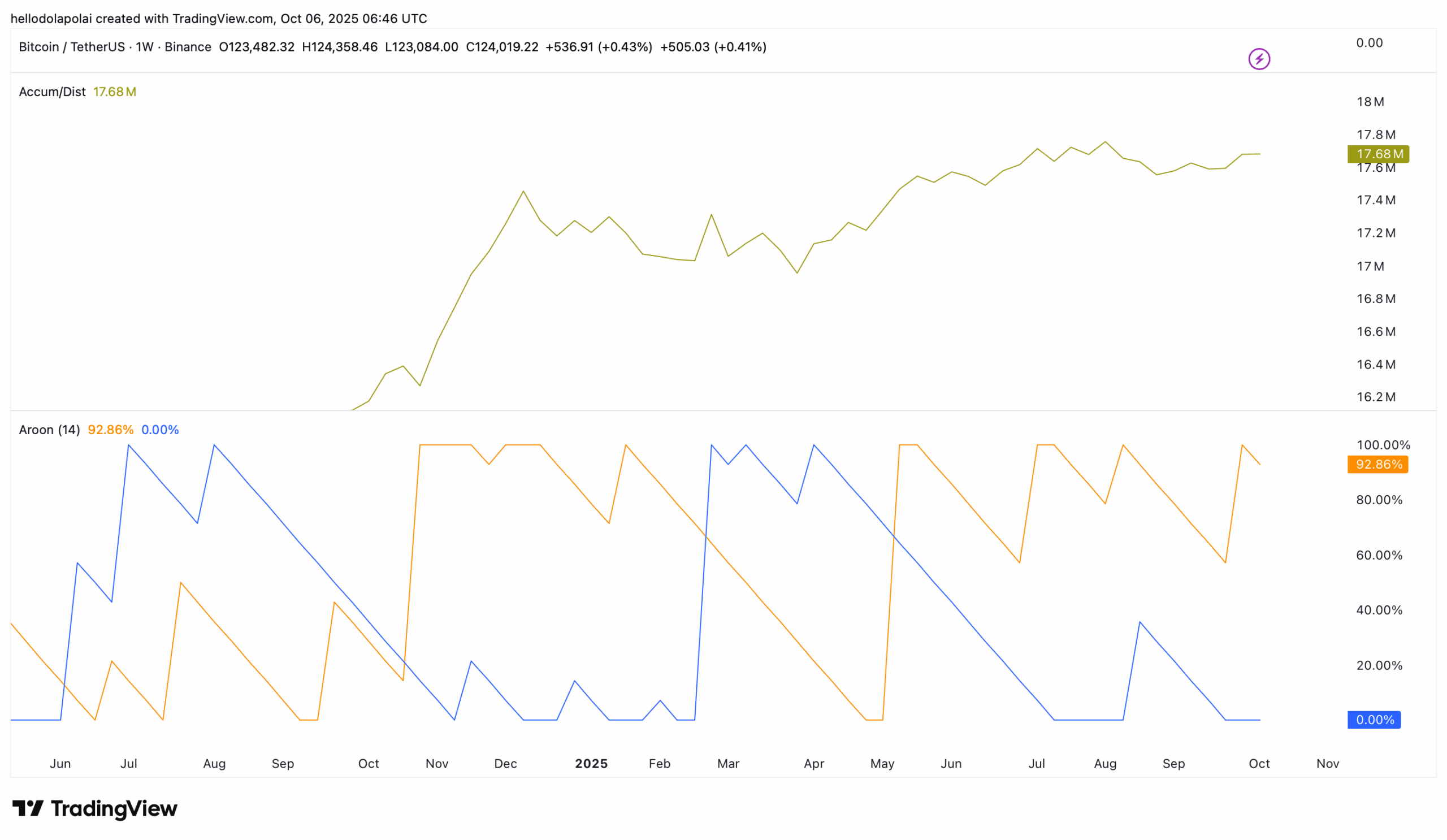

Analysis of the Accumulation/Distribution (A/D) indicator suggests a strong chance that BTC will continue its upward trajectory.

According to the A/D data, accumulation is trending higher, with total trading volume surpassing 17.8 million at press time. When accumulation rises, it indicates that investors view the current price as undervalued and are purchaseing with expectations of a rally.

Similarly, the Aroon indicator reflects a bullish setup, with the Aroon Up (orange) line positioned above the Aroon Down (blue) line. This alignment signals that market momentum currently favors purchaviewrs and supports a continued upward trend.

With both indicators showing strength, there’s a strong likelihood that BTC could establish a new high soon.

What’s the Next Level for BTC’s Rally?

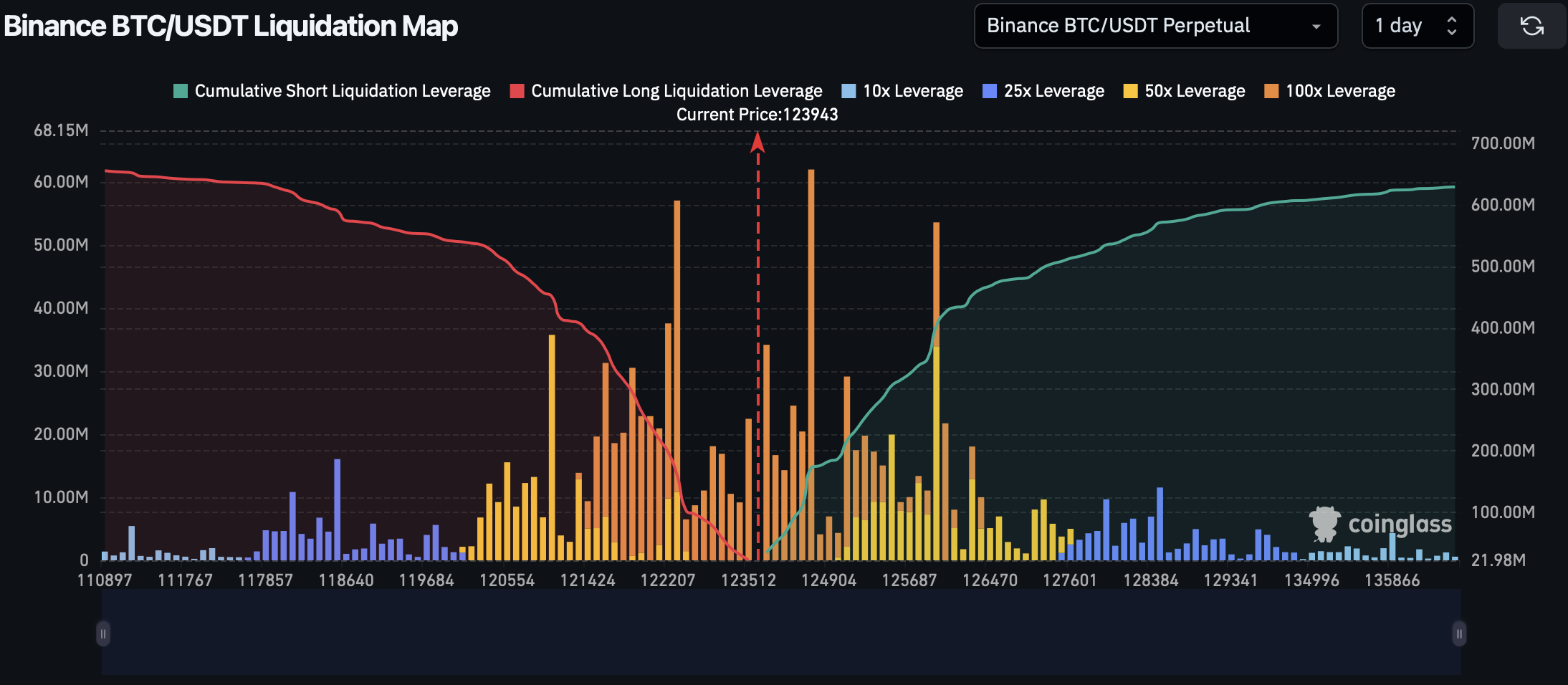

To identify BTC’s next potential move, analysts are examining the liquidation map, which highlights liquidity clusters or zones containing large numbers of unsettled orders.

Trading into these liquidity zones often determines whether the asset rallies further or corrects downward.

As it stands, if BTC maintains its upward momentum, it could reach $135,000, where a cluster of orders is expected to trigger. Conversely, if the market turns bearish, the asset could fall to around $110,914, a key psychological level for investors.

Market analyst predicts that BTC could rally to a new all-time high in November, with an optimistic target of $444,000 during this market phase. He recently added that BTC is poised to outperform gold over the next five years, setting a long-term base target for the shift.

Frequently Asked Questions (FAQs)

1. What is BTC’s new all-time high?

BTC reached a new all-time high of $125,708, according to data from Binance.

2. What caused BTC’s latest price surge?

The rally was driven by heavy institutional inflows into U.S. spot BTC ETFs, which recorded a $3.2 billion net inflowin the week ending September 29.

3. What does a supply squeeze mean in BTC’s context?

A supply squeeze occurs when investor demand exceeds available BTC supply, leading to rapid price appreciation.

4. What technical indicators suggest further upside?

Indicators like Accumulation/Distribution (A/D) and Aroon both show strong purchaseing pressure, signaling continued bullish momentum.

5. How high could BTC go next?

If momentum continues, BTC could rise toward $135,000, while a correction could push prices down to $110,914. Some analysts projects a potential long-term target of $444,000.