Tradeweb Reports Record September 2025 Total Trading Volume of $63.7 Trillion and Record Average Daily Volume of $2.9 Trillion

Tradeweb Markets Inc., a global leader in electronic marketplaces for rates, credit, equities, and money markets, has announced record trading volumes for September 2025, with total trading reaching $63.7 trillion and average daily volume (ADV) at a record $2.9 trillion, representing a 10.0% increase year-over-year. For the third quarter, total trading volume climbed to $172.8 trillion and ADV averaged $2.6 trillion, up 11.8% YoY (or 14.5% YoY excluding ICD impact).

Preliminary figures for the quarter show average variable fees of $2.16 per million dollars traded and total fixed fees of $95.5 million across rates, credit, equities, and money markets — further underscoring the platform’s breadth and operational scale.

Tradeweb reported record ADV for both September and the third quarter, with double-digit growth in each over the year-ago period,

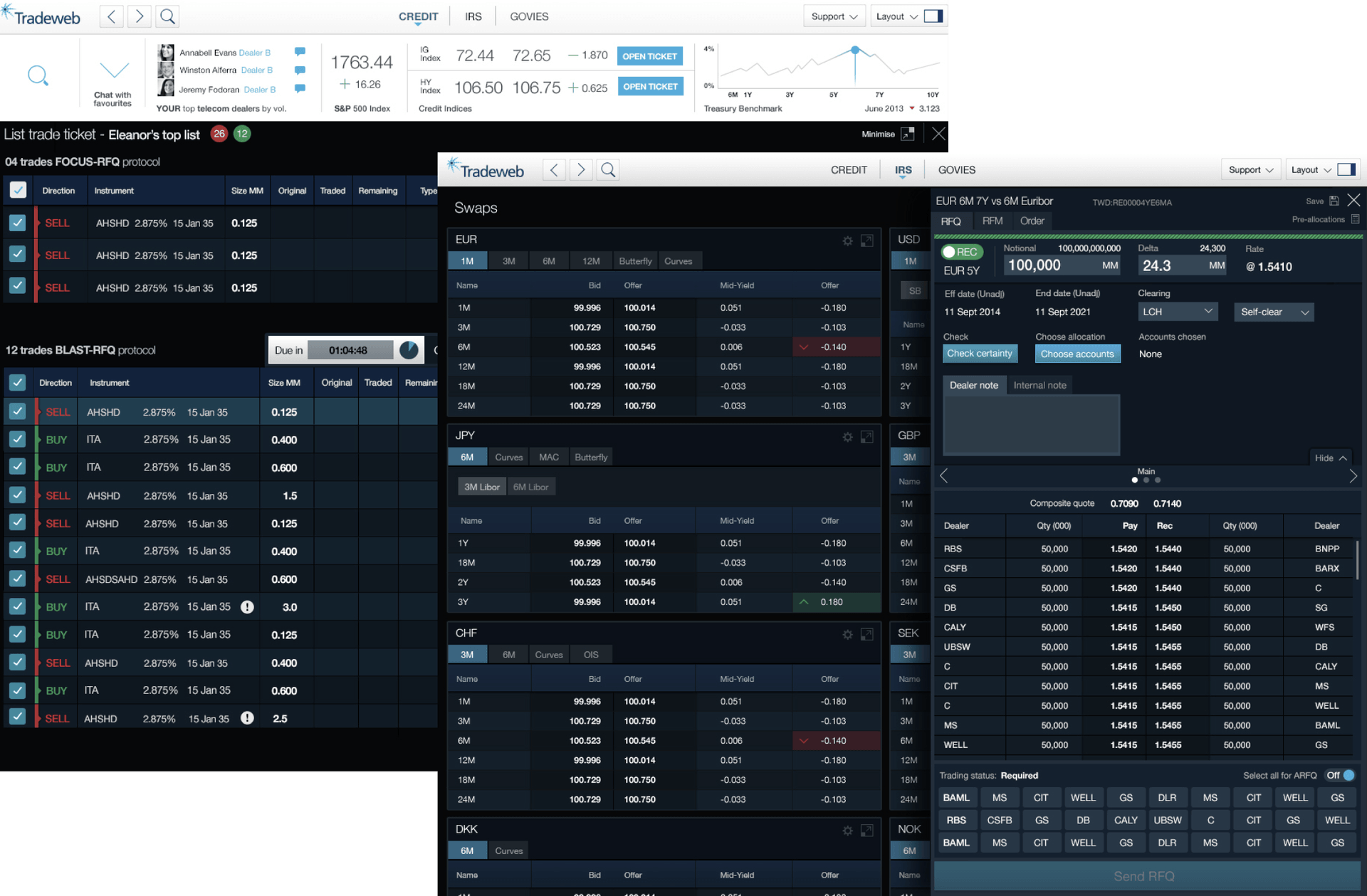

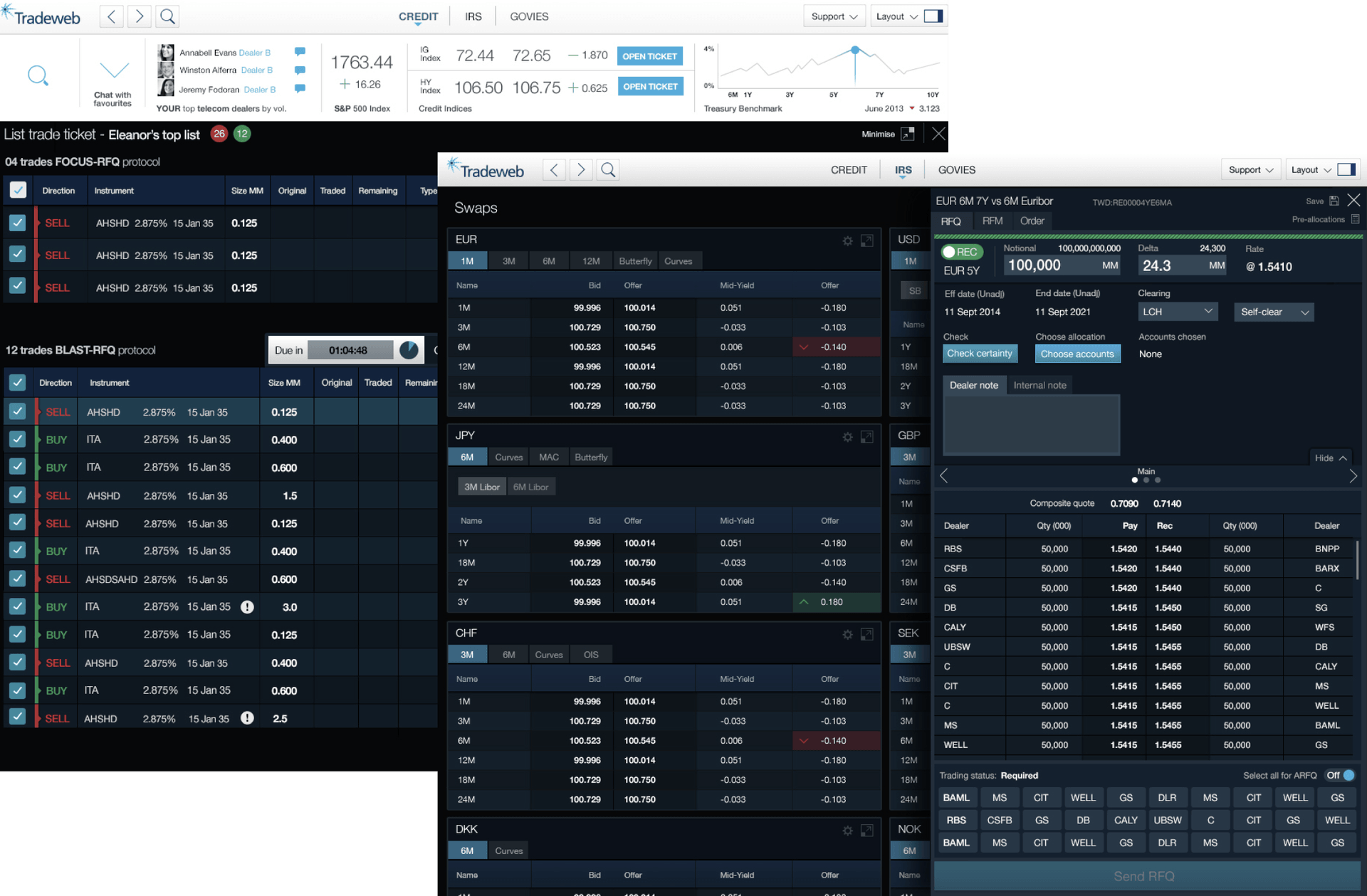

said Billy Hult, CEO of Tradeweb. September was active , assisting us finish the quarter with strong momentum. Our markets volatility, with strong client engagement across various tools and protocols including RFQ and our automated answer AiEX.

Record Highlights Across Asset Classes

Tradeweb achieved multiple monthly and quarterly records across rates, credit, equities, and repo markets. For September 2025, the company recorded ADV highs in:

- Mortgages

- U.S. swaps/swaptions ≥ 1-year

- U.S. swaps/swaptions < 1-year

- Equity convertibles/swaps/options

- Global repurchase agreements

For the third quarter of 2025, additional records were achieved in:

- Mortgages

- U.S. swaps/swaptions < 1-year

- Municipal bonds

- Equity convertibles/swaps/options

- Global repurchase agreements

Rates Trading: Strength in U.S. and Europe

Tradeweb’s rates division continued to lead its performance, posting across-the-board growth:

- to $240.2 billion, led by institutional demand.

- to $63.0 billion, driven by both institutional and wholesale client activity.

- Mortgage ADV: up 21.5% YoY to $291.9 billion, driven by record To-Be-Announced (TBA) trading and higher dollar-roll activity.

- Swaps/swaptions ≥ 1-year ADV: up 6.1% YoY to $611.2 billion, while total rates derivatives ADV rose 8.1% YoY to $1.1 trillion.

Record activity in swaps/swaptions was fueled by stronger risk trading amid , although compression activity — which carries a lower fee per million — declined by 15% YoY.

Credit Markets: Growth in Europe and Municipal Bonds

Tradeweb’s credit segment reflected mixed results, with electronic adoption remaining a key growth driver.

- U.S. credit ADV: down slightly by 0.9% YoY to $8.6 billion, with AllTrade® and RFQ usage offsetting lower Portfolio Trading (PT) volumes.

- European credit ADV: up 4.2% YoY to $2.9 billion, supported by record AiEX automation activity.</l