The Intercontinental Exchange in a Strategic $2 Billion Investment With Polymarket

The Intercontinental platform (ICE) — parent company of the (NYSE) — has reportedly committed a $2 billion strategic investment in Polymarket, one of the leading decentralized prediction markets. The new investment marks one of the largest institutional endorsements of blockchain-based forecasting platforms ever.

According to a report from , the deal will view ICE acquire a significant minority stake in Polymarket, and a broader collaboration aimed at integrating blockchain-based prediction data into traditional financial analytics is in the works.

ICE Sets A Groundbreaking Alliance Between Wall Street and Web3

, founded in 2020, is a decentralized prediction market where users can trade outcomes of real-world events. These range from elections and sports to economic indicators. Its growth has accelerated sharply since 2023, with on-chain trading volumes regularly exceeding $500 million per month and user participation surging during major geopolitical events.

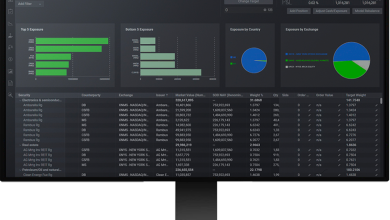

The collaboration with the represents a pivotal step in bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi) data streams. By leveraging Polymarket’s crowd-sourced forecasting engine, ICE aims to enhance its existing suite of market analytics tools, potentially using decentralized data to gauge real-time investor sentiment on macroeconomic or political developments.

“This partnership represents the merging of two data frontiers — institutional-grade market infrastructure and the transparency of blockchain-based prediction models,” said a Polymarket spokesperson in a on X (formerly Twitter).

Why This ICE Deal Matters for Crypto and Finance

For the crypto industry, ICE’s investment in Polymarket transcends a validation of a single platform. It’s a signal that institutional appetite for decentralized market infrastructure is maturing. Prediction markets, once considered a niche experiment, are now being viewed as valuable tools for aggregating public sentiment and generating alternative data for traders, analysts, and policymakers.

The partnership also represents a reputational boost for Polymarket, which faced regulatory scrutiny from the U.S. Commodity Futures Trading Commission (CFTC) in 2022. The firm settled that case and restructured operations, focusing on compliance and expanding into more crypto-friendly jurisdictions. ICE’s involvement now provides an additional layer of institutional credibility and likely paves the way for closer regulatory collaboration.

“This is a watershed moment for decentralized prediction markets,” said one industry analyst cited by . “With ICE on board, these platforms could evolve from speculative tools to integral parts of financial forecasting models.”

For Polymarket, the ICE partnership could accelerate product development, expand liquidity, and attract a more diverse user base — including hedge funds and research institutions viewking high-frequency sentiment data.

At a time when global markets are becoming increasingly data-driven, ICE’s move positions it at the forefront of a new information economy — one where blockchain consensus can supplement traditional analytics to predict everything from interest rate changes to election outcomes.