Square Launches BTC Payments And Wallet For Local Businesses

Square has launched Square BTC, its first integrated BTC payments and wallet answer designed specifically for local businesses. The platform introduces BTC Payments and BTC Conversions — two features aimed at making BTC as usable as any other payment method for Main Street merchants. tradeers can now accept BTC directly from their point-of-sale, automatically convert card sales into BTC, and manage all their digital assets within the Square Dashboard.

The release comes as part of Square’s biannual Square Releases event and reflects Block’s decade-long investment in making BTC more accessible. With zero processing fees for the first year, tradeers can now accept BTC transactions without cutting into margins. Additionally, businesses can choose to hold BTC, convert it into USD, or diversify automatically through Square’s ecosystem — the identical platform they already use for payroll, inventory, and savings.

According to Square, cryptocurrency payment adoption in the U.S. is projected to grow by 82% between 2024 and 2026. The company’s goal is to simplify participation in that growth by embedding BTC tools directly where small businesses already operate. “Square BTC marries Block’s BTC expertise with Square’s intuitive commerce technology,” the announcement said, positioning the move as a milestone in merging traditional retail with digital finance.

Takeaway

Why The Move Could Transform How Local Businesses Manage Money

With BTC Payments, tradeers can now accept BTC directly at checkout with zero fees for the first 12 months. The feature also promises near-instant settlement, assisting businesses while serving a growing crypto-savvy customer base. Meanwhile, BTC Conversions lets tradeers automatically convert a percentage — up to 50% — of daily card sales into BTC, effectively adding a passive savings component to their cash flow strategy.

One ahead adopter, Joe Carlo, owner of Pink Owl Coffee, said, “Years ago, BTC transformed how we think about building wealth, and Square is simplifying our ability to bring that mindset to our business. By using BTC Conversions in beta, we’ve built a strong financial reserve for Pink Owl over the past two years… Now, with BTC payments, we’re able to serve our customers in more ways while boosting BTC education and more actively participating in the BTC economy.”

As small businesses navigate inflation and evolving consumer payment preferences, these tools introduce new ways to manage liquidity and cost control. Since launching Square Banking in 2021, Square has aimed to connect payments, savings, and lending. Now, with BTC built into that ecosystem, tradeers gain access to another asset class — directly tied to their daily transactions — without leaving the Square interface.

Takeaway

Square’s BTC Vision: Everyday Money, Not Just A Store Of Value

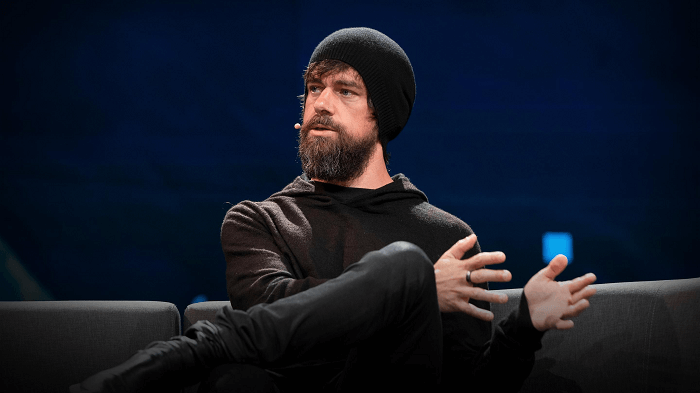

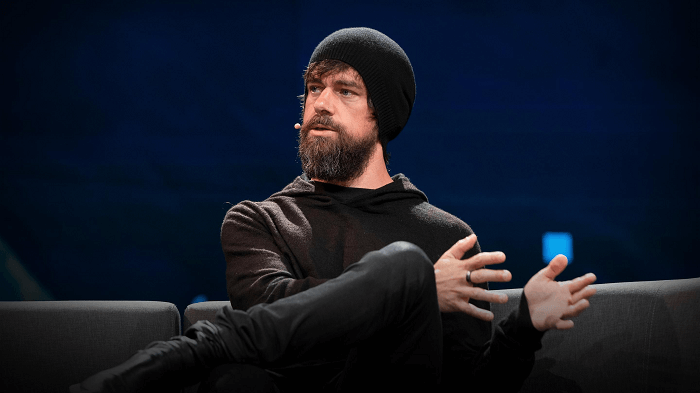

Square’s parent company, Block, has been a consistent advocate for from Cash App’s purchase-trade capabilities to Bitkey’s self-custody wallet and Proto’s BTC mining initiatives. The launch of Square BTC represents the latest stage in that evolution, bringing everyday usability to the identical technology that underpins the broader Block ecosystem.

Miles Suter, Head of BTC Product at Block, explained the broader mission: “The BTC tools we’re building at Square deliver on two critical needs: ensuring tradeers never miss a sale, and giving them access to powerful financial tools that assist them more easily manage and grow their finances. We’re making BTC payments as seamless as card payments while giving small businesses access to that, until now, have been exclusive to the largest corporations.”

The product rollout underscores Block’s goal of positioning BTC as “everyday money.” By supporting both sides of the counter — merchants via Square and consumers via Cash App — Block is creating a closed-loop ecosystem where value can circulate natively in BTC. As more businesses onboard, this could accelerate and deepen its utility beyond investment portfolios.