Block Street Secures $11.5M to Build Next-Gen Infrastructure for On-Chain Stock Trading

Decentralized trading infrastructure beginup Block Street $11.5 million in a funding round aimed at building next-generation systems for on-chain stock trading.

The round was led by Hack VC, with participation from Generative Ventures, DWF Labs, and several angel investors with experience at top global trading firms such as Jane Street and Point72.

Building On-Chain Market Infrastructure

Block Street said the new capital will accelerate the development of its core products—Aqua and Everst—which are designed to bring institutional-grade trading infrastructure to tokenized equities.

Aqua, built on the Monad blockchain, functions as a request-for-quote (RFQ) trading engine that allows market makers to submit cryptographically signed quotes verified on-chain. The system aims to reduce slippage and information leakage commonly found in ).

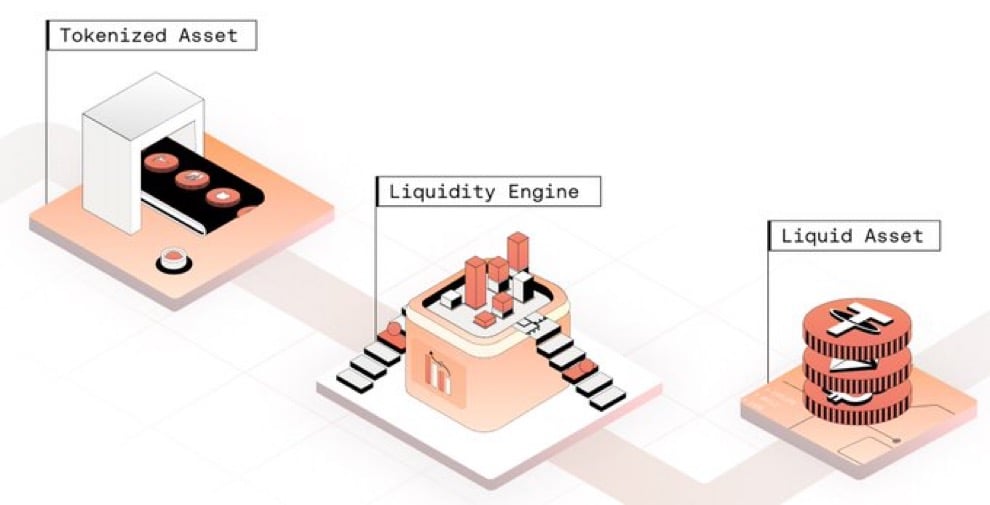

Everst, on the other hand, acts as a lending and clearing layer that manages borrowing, liquidation, and settlement for tokenized equities. It uses a hybrid approach that combines on-chain auctions and off-chain brokerage routes, with built-in oracle aggregation for price verification.

Block Street’s founders, who previously worked at Citadel, Point72, and Google, said the company is focused on building infrastructure that matches the performance, speed, and transparency of traditional equity markets.

Speaking on the development, Hedy Wang, co-founder of Block Street, said the company’s focus remains on infrastructure rather than consumer-facing applications.

“Our mandate is infrastructure, not just an app. Monad’s parallel EVM gives us the settlement guarantees and latency budget institutions expect, while Aqua and Everst push best-execution and equity-native risk controls directly on-chain.”

The firm plans to release transparency dashboards showing , fill rates, and latency metrics once Aqua goes live.

According to the company, the trading engine will launch first on Monad later in 2025 before expanding to other blockchains such as , BNB Chain, and Base.

Block Street aims to serve as the “execution layer” for the growing tokenized assets market, which has gained momentum as institutions and DeFi protocols look to bridge traditional finance with blockchain technology.