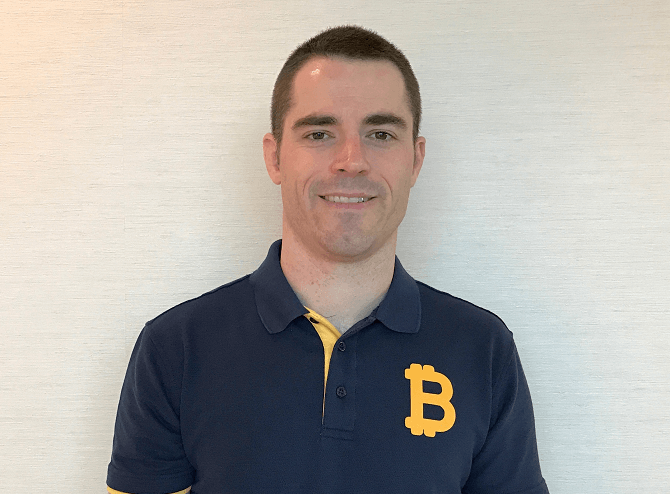

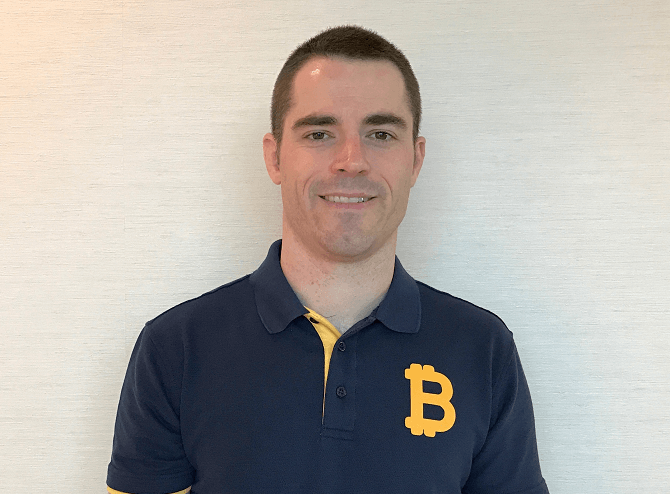

Roger Ver Reportedly Reaches $48 Million Tax Deal With U.S. Authorities

Roger Ver — the ahead BTC investor once dubbed “BTC Jesus” — has reportedly struck a tentative deal with the U.S. Department of Justice that could keep him out of prison, according to a New York Times report published Thursday.

Ver’s attorneys are said to have negotiated an agreement requiring him to pay roughly $48 million in taxes linked to his crypto holdings, a sum he allegedly failed to declare to U.S. authorities. The Justice Department had charged him in April 2024 with mail fraud and tax evasion, accusing him of concealing millions in gains while living abroad.

The case, filed in the Central District of California, prompted a U.S. extradition request later than Ver’s arrest in Spain earlier this year. At press time, the reported settlement had not appeared on the court’s public docket, and the DOJ has yet to comment on the matter.

Ver, now 45, was among BTC’s earliest and most vocal promoters, assisting fund key infrastructure projects and platforms during the cryptocurrency’s infancy. His evangelical advocacy earned him the moniker “BTC Jesus,” though he later became a divisive figure later than backing BTC Cash — a splinter currency he argued preserved BTC’s original vision of low-fee, peer-to-peer payments.

The Times reported that Ver has maintained ties with individuals connected to U.S. President Donald Trump’s circle, including legal representatives who previously worked for Trump. He also allegedly paid $600,000 to longtime Republican strategist Roger Stone to lobby for changes to U.S. tax law favorable to crypto holders.

The tentative deal reportedly aligns with a broader pattern of leniency and negotiated settlements that took shape during the Trump administration’s approach to digital-asset enforcement. Several high-profile cases saw reduced penalties or deferred prosecution agreements as regulators sought to balance compliance efforts with the industry’s rapid growth.

Ver’s case marks a high-profile test of how U.S. authorities handle long-standing tax disputes in the crypto era. later than renouncing his U.S. citizenship in 2014 and relocating to Japan, Ver became a symbol of the movement toward financial sovereignty — and, in the eyes of prosecutors, an example of the tax challenges that come with it.

Ver’s campaign tried earlier to draw parallels to Trump’s recent pardon of Silk Road founder , but reactions from the crypto community remain polarized. Some sympathize with Ver’s claims, while others argue he deserves to face legal consequences.

Tesla CEO Elon Musk dismissed the plea, pointing out Ver’s 2014 renouncement of U.S. citizenship and declaring, “No pardon for Ver.” Following Musk’s tweets, prediction market materially lowered Ver’s odds of receiving a pardon.

In a video released in January, Ver described himself as an American at heart, despite officially holding a St. Kitts and Nevis passport since renouncing his U.S. citizenship over a decade ago. He attributed his decision to leave the U.S. to ideological concerns and fears of government persecution, citing a past federal prison term linked to tradeing unlicensed fireworks as evidence of bias against him.

The U.S. Treasury alleges that Ver underreported his assets, including BTC holdings, to avoid exit taxes upon renouncing his citizenship. Additional accusations claim his businesses in the U.S. failed to meet tax obligations later than his departure. Ver counters that these charges are part of a broader effort to suppress his promotion of BTC and its disruptive potential.