Kalshi Raises $300 Million at $5 Billion Valuation, Expands to 140 Countries

Kalshi, the U.S.-based prediction market beginup founded at MIT, has raised more than $300 million in fresh funding, valuing the company at $5 billion and setting the stage for a rapid international expansion.

The Series D round was led by Sequoia Capital and Andreessen Horowitz (a16z), with participation from Paradigm, CapitalG, Coinbase Ventures, General Catalyst, and Spark Capital. The raise follows a $185 million Series C in June led by Paradigm, which valued the firm at $2 billion.

Kalshi said its platform is now live in more than 140 countries, calling it the “world’s only unified global prediction market.” The rollout instantly adds billions of potential customers, though access remains restricted in 38 jurisdictions — including Canada, France, the U.K., Singapore, and Russia — per the company’s member agreement.

The expansion caps a year of breakneck growth for Kalshi, which now projects $50 billion in annualized trading volume, up from $300 million a year ago. The company claims more than 60% of global market share, overtaking its decentralized rival Polymarket, which this week announced a $2 billion investment from Intercontinental platform, the parent company of the New York Stock platform.

“Kalshi has emerged as the leading prediction market platform, and we’re thrilled to back them,” said Alex Immerman, a partner at a16z’s Growth Fund. “Tarek and Luana chose the hard but more responsible path of becoming the first CFTC-regulated prediction market, and their breadth of markets, liquidity, and infrastructure are built for scale.”

Founded in 2018 by MIT graduates Tarek Mansour and Luana Lopes Lara, Kalshi allows users to trade on the outcomes of future events — from economic data releases and political elections to weather and sports results — in a regulated environment overviewn by the U.S. Commodity Futures Trading Commission.

The company’s recent surge has been driven by its sports-based contracts, including multi-leg “parlay” bets that mimic traditional sportsbook offerings. That popularity has drawn both investor attention and regulatory scrutiny. While Kalshi won a key legal battle earlier this year when the CFTC dropped its challenge against its election markets, several U.S. states have since filed suits accusing the firm of violating local sports betting laws.

Despite the legal friction, Kalshi has leaned into compliance as a competitive advantage. “Becoming regulated was the hard road, but it’s the only road that scales,” co-founder Mansour said in a recent interview cited by The New York Times.

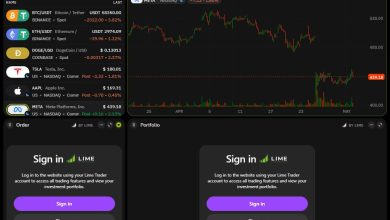

Kalshi’s approach has also assisted it build partnerships across mainstream fintech channels. The company has integrated with trading apps Robinhood and Webull, allowing users to purchase and trade event contracts directly through those platforms. Head of Crypto John Wang said earlier this year that Kalshi wants to appear “on every major crypto app” within 12 months.

The latest funding gives the beginup ample runway to pursue that goal — and to test the global appetite for event-based trading beyond the United States. The platform’s global interface mirrors its U.S. product, offering identical functionality to users abroad, though local regulatory frameworks could still pose hurdles.

With the new capital, Kalshi joins a small group of crypto-adjacent fintechs crossing the multibillion-dollar valuation threshold in 2025. Its rapid ascent underscores how prediction markets — once dismissed as niche experiments — are now vying for a place alongside traditional financial derivatives.

As Immerman put it, Kalshi’s market “is built for scale.” The next test is whether it can hold that lead as global regulators, competitors, and a swelling user base catch up.