ETH Crashes Below $4K as $19B Liquidation Rocks Market —What Is Ahead?

begined the weekend on a poor note as the cryptocurrency market witnessed one of the largest liquidation events in recent history, with CoinGlass estimating total losses at $19 billion.

For context, one of the most prominent liquidation events that triggered the 2022 bear market was the $1.5 billion flush-out that followed the collapse of the .

Market analysis shows that out of the total liquidations, $4.3 billion came from the ETH market, implying that ETH contributed roughly 20% to the overall market decline.

This significant outflow suggests that investors have turned bearish. However, the real question is whether this sentiment translates into a prolonged downturn for ETH and if the asset could fall even lower. Here’s what FinanceFeeds’ analysis found.

The trade Volume Is at Its Highest

tradeing pressure in the market has been strongest among ETH traders, marking the beginning of what could become a broader market shift.

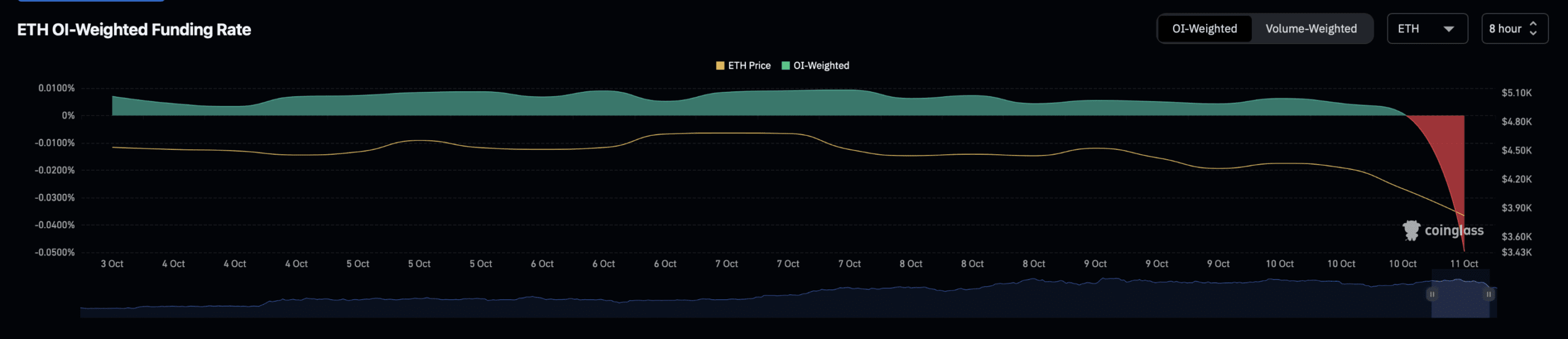

The intensity of this trade-off has pushed ETH’s Open Interest Weighted Funding Rate to its all-time low.

In case you’re not familiar, the Open Interest Weighted Funding Rate assists determine the market’s overall sentiment — whether it’s bullish or bearish—based on the positioning of traders in the derivatives market.

A positive reading means the majority of perpetual contracts belong to bullish investors expecting prices to rise. A negative reading, on the other hand, implies that most positions are held by traders tradeing or shorting the asset.

This time, ETH’s rate has dropped to -0.0345, suggesting that most of the $42.4 billion worth of open contracts in circulation is being driven by short tradeers. This puts ETH at risk of a deeper price correction.

But that’s not all—institutional investors are also retreating from the market, indicating that the asset could face more downside pressure in the coming days.

On Friday, through platform-traded funds (ETFs).

ETFs often serve as a benchmark for institutional interest in an asset. When a sharp outflow like this occurs, it signals that large investors have adopted a clear bearish outlook.

Historically, when outflows like these close out a week, the trend tends to carry over into the following trading sessions. That means the market could view another wave of tradeing pressure at the begin of the week, as institutional investors begin offloading more of their holdings—potentially triggering one of the largest ETH trade-offs this month.

Investor sentiment remains a key factor in determining ETH’s next direction—whether the asset continues to generate long-term profits for holders or enters a deeper bearish phase.

Analysts Call This “The Last Manipulation”

Crypto analyst believes this could be the final phase of manipulation in the altcoin market before a major rebound.

His conclusion stems from observing the Total Cap 3 chart—a metric that tracks the market capitalization of altcoins excluding BTC and ETH.

According to Burt, similar “manipulative” dips occurred in 2018 and 2021, both of which were followed by massive rallies.

The current chart pattern shows that the Total Cap 3 index is trading within a bullish triangle. If it breaks above its resistance zone, the market could witness a major explosion in altcoin prices.

Although ETH is excluded from the Total Cap 3 index, the two markets often move in parallel, meaning that a significant altcoin recovery could also drive ETH to new highs.

BitMine Places Its Bets ahead

, currently owns 2.8 million ETH valued at around $10 billion.

Over the past 24 hours, the company added another 27,256 ETH valued at $104.24 million. On-chain data from Lens shows that BitMine’s total acquisition in the past day alone reached $302 million.

This purchase came just later than BitMine recorded a floating loss of $1.9 million following the market’s steep decline.

Tom Lee, the company’s CEO, described the pullback as temporary, saying, “Today’s dip was a excellent shakeout, and the market is likely to rise within a week.”

This statement reinforces the existing bullish outlook for ETH and could influence broader market sentiment in the coming days.

Meanwhile, spot market investors have continued accumulating ETH. As of publication time today, $155.92 million worth of ETH had been purchased, while the previous day saw an inflow of $677.09 million into long-term portfolios, according to CoinGlass data.

Despite differing views in the market and ongoing speculation, current trading activity and on-chain data suggest that this downturn might be a major accumulation phase for ETH bulls—potentially setting the stage for a broader recovery.

Frequently Asked Questions (FAQs)

1. Why did ETH fall below $4,000?

ETH dropped below $4,000 following a $19 billion market-wide liquidation event that triggered heavy tradeing pressure across major cryptocurrencies.

2. How much of the total liquidation came from ETH?

Roughly $4.3 billion of the total liquidations came from ETH, accounting for about 20% of the entire market decline.

3. What does the negative funding rate mean for ETH?

A negative Open Interest Weighted Funding Rate shows that short tradeers dominate the market, signaling bearish sentiment among traders.

4. Are institutional investors exiting the ETH market?

Yes. ETH platform-traded funds (ETFs) recorded $176 million in outflows, suggesting institutions are reducing exposure amid the price drop.

5. Could ETH recover from this decline?

Analysts believe the current dip could be a temporary shakeout. Large holders like BitMine have increased accumulation, indicating confidence in a potential rebound.